Biden and Xi try direct diplomacy The mood music was upbeat but pragmatic after the first face-to-face meeting in a year between President Biden and his Chinese counterpart, Xi Jinping. There was no joint communiqué after Wednesday’s talks, but both sides issued positive statements trumpeting where they found common ground, including on tackling climate change and improving communications. The San Francisco summit, and Xi’s banquet with American business leaders afterward, were signs of how entwined the economies remain despite years of rising tensions — and why both sides and many…

Tag: BlackRock Inc

What China Isn’t Telling the World About Its Economy

China’s answer to bad news: skip it China released more bad economic news on Tuesday, but it was the number that wasn’t included in the official data dump that stood out: Beijing said it would stop publishing figures for youth unemployment, weeks after it hit a record high of 21.3 percent in June. The decision may be temporary, but it will only make it harder for investors to know what’s happening in the country — and that may be the point. Shares in Hong Kong and Shanghai closed lower again,…

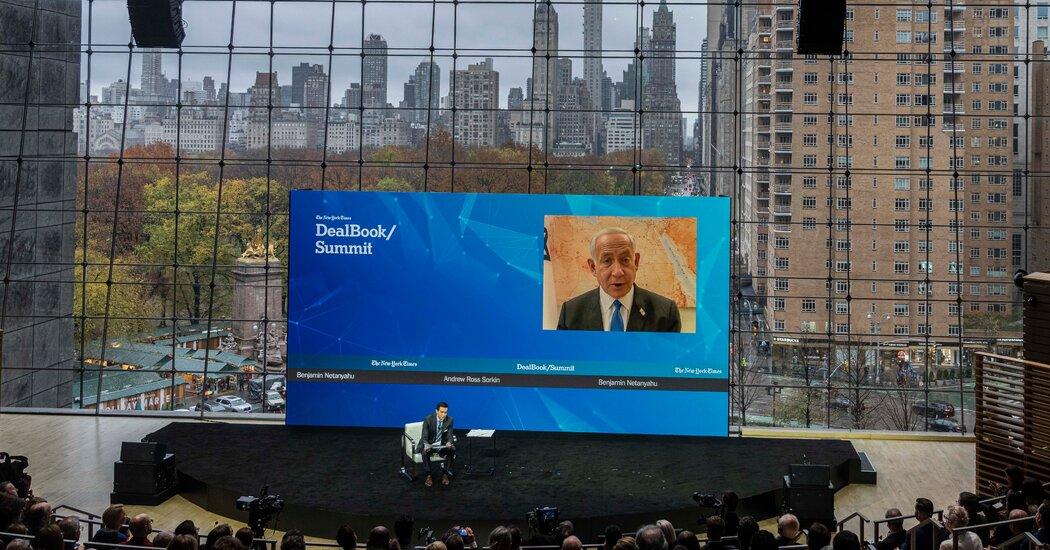

At the DealBook Summit, Untangling the Now — and the Future

This article is part of our special section on the DealBook Summit that included business and policy leaders from around the world. Last week at the DealBook Summit, I interviewed some of the world’s most influential leaders, among them Janet Yellen, the Treasury secretary of the United States; President Volodymyr Zelensky of Ukraine; Mark Zuckerberg, chief executive of Meta; and Andy Jassy, the chief executive of Amazon. One common theme came up in just about every conversation. It was that every decision — big and small — is ultimately a…

Wall Street Is Finally Getting Access to China. But for How Long?

For decades, American banks have been eager to expand their business in China, the world’s second-largest economy. They’re finally getting their way — just as a spiraling corporate debt crisis threatens to rock the country’s financial system and China’s central government takes a stronger hand with big businesses. In July, Citigroup became the first foreign bank to win approval to open a custody business in China, essentially acting as a bank for Chinese investment funds. In August, JPMorgan Chase got permission from the Chinese authorities to take full ownership of…

Why Wall Street Backs China Despite Beijing’s Tighter Grip

This year has been unsettling for Chinese business. The ruling Communist Party has gone after the private sector industry by industry. The stock markets have taken a huge hit. The country’s biggest property developer is on the verge of collapse. But for some of the biggest names on Wall Street, China’s economic prospects look rosier than ever. BlackRock, the world’s biggest asset manager, urged investors to increase their exposure to China by as much as three times. “Is China investable?” asked J.P. Morgan, before answering, “We think so.” Goldman Sachs…