From the top of the government, China is heavily promoting a plan to fix the country’s stagnant economy and offset the harm from a decades-long housing bubble. The program has a fresh slogan, presented foremost by Xi Jinping, the country’s top leader, as “new, quality productive forces.” But it has features that are familiar from China’s economic playbook: The idea is to spur innovation and growth through massive investments in manufacturing, particularly in high-tech and clean energy, as well as robust spending on research and development. And there have been…

Tag: Real Estate and Housing (Residential)

China Sets Economic Growth Target of About 5%

China’s top leaders on Tuesday set an ambitious target for growth as its economy is laboring under a steep slide in the housing market, consumer malaise and investor wariness. Premier Li Qiang, the country’s No. 2 official after Xi Jinping, said in his report to the annual session of the legislature that the government would seek economic growth of around 5 percent. That is the same target that China’s leadership set for last year, when official statistics ended up showing that the country’s gross domestic product grew 5.2 percent. Some…

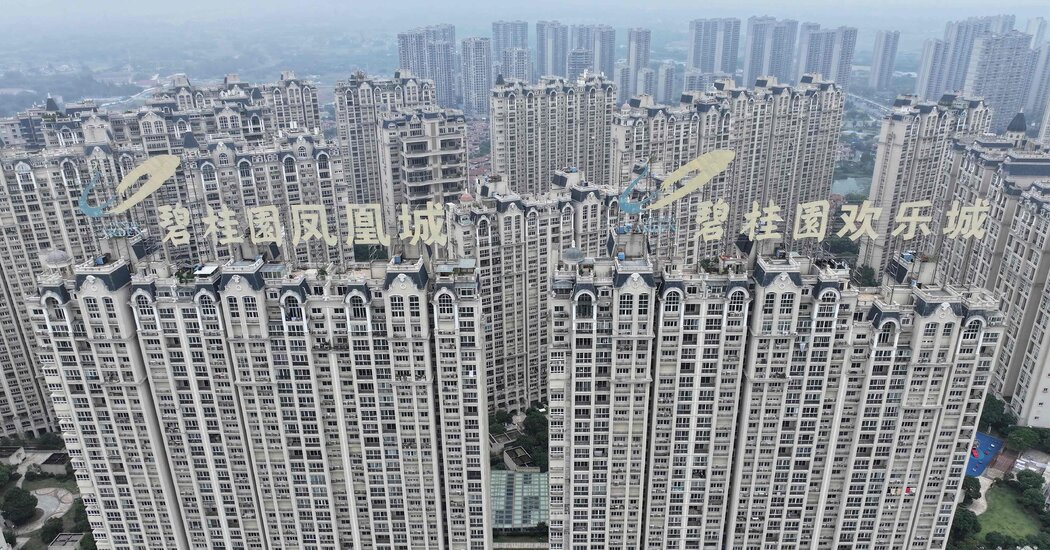

China’s Country Garden Faces Winding Up Petition In Hong Kong

Country Garden, China’s largest real estate developer as recently as 2022, said on Wednesday that a creditor had asked a Hong Kong court to liquidate its operations and pay off lenders, in the latest sign that China’s housing crisis continues unabated. Ever Credit Ltd., a Hong Kong lender, is petitioning the city’s High Court to shut down Country Garden. The court filing involves Country Garden’s failure to repay a loan of $204 million plus interest owed to Ever Credit, the real estate developer told the Hong Kong stock market. Ever…

After China Evergrande, Real Estate Crisis ‘Has Not Touched Bottom’

The unwavering belief of Chinese home buyers that real estate was a can’t-lose investment propelled the country’s property sector to become the backbone of its economy. But over the last two years, as firms crumbled under the weight of massive debts and sales of new homes plunged, Chinese consumers have demonstrated an equally unshakable belief: Real estate has become a losing investment. This sharp loss of faith in property, the main store of wealth for many Chinese families, is a growing problem for Chinese policymakers who are pulling out all…

China Evergrande Must Be Liquidated, a Judge Said. What Happens Next?

After nearly two years of false starts, last-ditch proposals and pleas for more time, China Evergrande, a massive property company, has been ordered to dismantle itself. It’s a big moment. Evergrande’s collapse in 2021 sent China’s housing market into a tailspin. The worries in real estate, where most households put their savings, helped tip the economy into a downturn. The scale of Evergrande’s empire is enormous: Its developments cover hundreds of cities. It controls dozens of business and is more than $300 billion in debt — a sum far greater…

Real Estate Giant China Evergrande Will Be Liquidated

Months after China Evergrande ran out of cash and defaulted in 2021, investors around the world scooped up the property developer’s discounted I.O.U.’s, betting that the Chinese government would eventually step in to bail it out. On Monday it became clear just how misguided that bet was. After two years in limbo, Evergrande was ordered by a court in Hong Kong to liquidate, a move that will set off a race by lawyers to find and grab anything belonging to Evergrande that can be sold. The order is also likely…

What Hefei, China’s EV City, Says About the State of the Economy

Ultramodern factories churn out electric cars and solar panels in Hefei, an industrial center in the heart of central China. Broad avenues link office towers and landscaped parks. Subway lines open at a brisk pace. Yet at Hefei’s market for construction materials, which fills 10 city blocks, local merchants are gloomy. Wu Junlin, a vendor of doors, has closed two of his three stores and laid off all but one of his dozen employees. “I have been doing this for 20 years — after all these years, this year is…

China’s GDP Grew in 2023, but Economic Strains Lurk

Car production set records in China last year. Restaurants and hotels were increasingly full. Construction of new factories surged. Yet China’s economic strengths conceal weaknesses. Deep discounts helped drive car sales, particularly for electric cars. Diners and travelers chose cheaper dishes and less expensive hotels. Many factories ran at half capacity or less because of weak demand inside China, and are working to export more to make up for it. China’s economy grew 5.2 percent last year as it rebounded from nearly three years of stringent “zero Covid” pandemic control…

Hong Kong Stocks Plunge to Losses for 4th Straight Year

This summer, when Hong Kong’s stock market rout seemed to have no end in sight, the city’s financial chief, Paul Chan, jumped into action, creating a task force to inject confidence into a market that was being pummeled by global investors wary of China. Hong Kong cut taxes on trading and Mr. Chan went on a roadshow to Europe and the United States, promising measures to “let investors feel optimistic about the outlook.” Investors were anything but sanguine, however, and the city’s Hang Seng Exchange is among the world’s worst-performing…

China’s Property Crisis Blew Up Investments That Couldn’t Lose

One of China’s largest investment firms, Citic Trust, had a clear pitch to investors when it was aiming to raise $1.7 billion to fund property development in 2020: There is no safer Chinese investment than real estate. The trust, the investment arm of the state-owned financial conglomerate Citic, called housing “China’s economic ballast” and “an indispensable value investment.” The money it raised would be put toward four projects from Sunac China Holdings, a major developer. Three years later, investors who put their money in the Citic fund have recouped only…