China Evergrande Group exaggerated its revenue by more than $78 billion and committed securities fraud over two years before its spectacular collapse in 2021, a top Chinese regulator said. The China Securities Regulatory Commission accused Hui Ka Yan, the founder of Evergrande, of “making decisions and organizing fraud,” the company reported in a filing to the Shanghai and Shenzhen stock exchanges on Monday night. Mr. Hui was fined $6.5 million and banned from China’s financial markets for life. Xia Haijun, a former chief executive, was fined $2 million and also…

Tag: China Evergrande Group

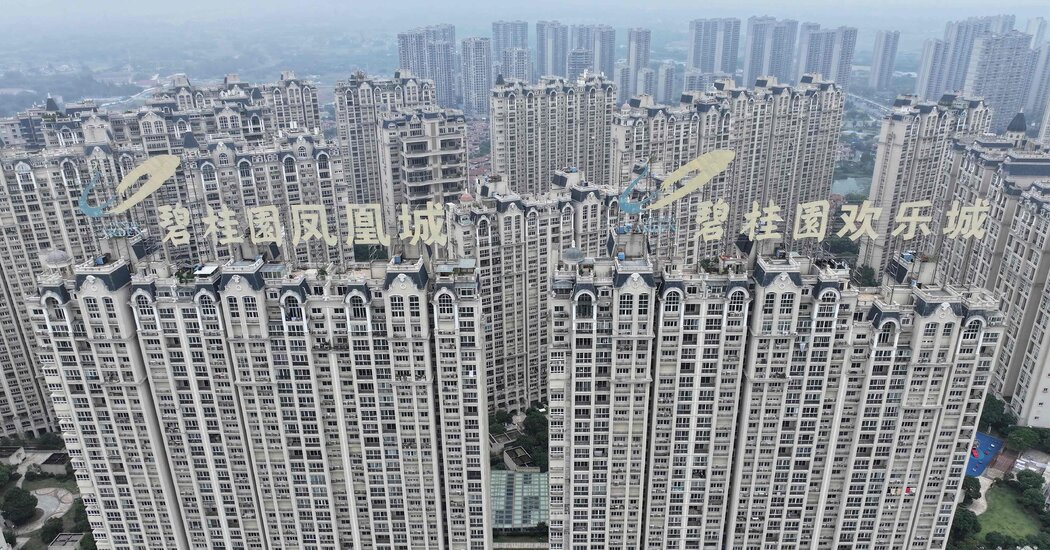

China’s Country Garden Faces Winding Up Petition In Hong Kong

Country Garden, China’s largest real estate developer as recently as 2022, said on Wednesday that a creditor had asked a Hong Kong court to liquidate its operations and pay off lenders, in the latest sign that China’s housing crisis continues unabated. Ever Credit Ltd., a Hong Kong lender, is petitioning the city’s High Court to shut down Country Garden. The court filing involves Country Garden’s failure to repay a loan of $204 million plus interest owed to Ever Credit, the real estate developer told the Hong Kong stock market. Ever…

After China Evergrande, Real Estate Crisis ‘Has Not Touched Bottom’

The unwavering belief of Chinese home buyers that real estate was a can’t-lose investment propelled the country’s property sector to become the backbone of its economy. But over the last two years, as firms crumbled under the weight of massive debts and sales of new homes plunged, Chinese consumers have demonstrated an equally unshakable belief: Real estate has become a losing investment. This sharp loss of faith in property, the main store of wealth for many Chinese families, is a growing problem for Chinese policymakers who are pulling out all…

What Evergrande’s Collapse Might Mean for the Global Economy

What next for Evergrande’s creditors? A Hong Kong court on Monday ordered the liquidation of Evergrande, the heavily indebted Chinese property giant. The decision comes two years after the company defaulted, setting off a financial crisis at other developers and adding to the challenges facing the world’s second-largest economy. The company’s dissolution raises questions about fairness for overseas creditors — which could have wider implications for foreign businesses operating in China. How Evergrande fell: The company was once deemed too big to fail, racking up debt to expand during a…

China Evergrande Must Be Liquidated, a Judge Said. What Happens Next?

After nearly two years of false starts, last-ditch proposals and pleas for more time, China Evergrande, a massive property company, has been ordered to dismantle itself. It’s a big moment. Evergrande’s collapse in 2021 sent China’s housing market into a tailspin. The worries in real estate, where most households put their savings, helped tip the economy into a downturn. The scale of Evergrande’s empire is enormous: Its developments cover hundreds of cities. It controls dozens of business and is more than $300 billion in debt — a sum far greater…

Real Estate Giant China Evergrande Will Be Liquidated

Months after China Evergrande ran out of cash and defaulted in 2021, investors around the world scooped up the property developer’s discounted I.O.U.’s, betting that the Chinese government would eventually step in to bail it out. On Monday it became clear just how misguided that bet was. After two years in limbo, Evergrande was ordered by a court in Hong Kong to liquidate, a move that will set off a race by lawyers to find and grab anything belonging to Evergrande that can be sold. The order is also likely…

China Evergrande Soared on the Property Boom. Here’s Why It Crashed.

In January, more than 100 financial sleuths were dispatched to the Guangzhou headquarters of China Evergrande Group, a real estate giant that had defaulted a year earlier under $300 billion of debt. Its longtime auditor had just resigned, and a nation of home buyers had directed its ire at Evergrande. Police on watch for protesters stood guard outside the building, and the new team of auditors were issued permits to get in. After six months of work, the auditors reported that Evergrande had lost $81 billion over the prior two…

China Evergrande Gets Reprieve in Talks With Foreign Investors

Once China’s most prolific property developer, China Evergrande has narrowly averted liquidation. A Hong Kong bankruptcy judge on Monday gave Evergrande another two months to work out a deal with foreign investors who lost money when the company defaulted two years ago with hundreds of billions of dollars in debt. The judge set another court hearing for Jan. 29. It was an unexpected development in a bankruptcy lawsuit filed 18 months ago by one investor trying to get paid by forcing the dismantling of Evergrande. The judge, Linda Chan, had…

China Evergrande May Finally Meet Its End in Hong Kong Court

Once China’s most prolific property developer, China Evergrande may soon be its biggest and messiest corporate breakup. In a Hong Kong courtroom on Monday, a bankruptcy judge could force Evergrande to liquidate and pay back creditors who are owed tens of billions of dollars. It would mark an end to two years of limbo for investors who lent Evergrande money in Hong Kong and have tried to negotiate for a piece of the debt-saddled corporate behemoth that defaulted in early December 2021. A liquidation of Evergrande was once unimaginable. For…

China Wants to Bulldoze ‘Urban Villages’ to Revive the Economy

In Shenzhen, a metropolis born of China’s economic prosperity, Paibang Village is a reminder of the city’s modest past and the challenges ahead for reviving the country’s property sector. Paibang is what China calls an urban village, a labyrinth of low-slung apartment buildings and mom-and-pop storefronts connected by a maze of alleyways and narrow roads. There are hundreds of them in Shenzhen, a municipality of 18 million people next to Hong Kong, and thousands of such villages across China. Now with China mired in an unyielding property crisis, policymakers want…