<gu-island name="KeyEventsCarousel" priority="feature" deferuntil="visible" props="{"keyEvents":[{"id":"682c18208f08d37c78c1d264","elements":[{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":" Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy. ","elementId":"23b79db8-98e7-4fa4-a88c-ff2c0221bb75"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":" China’s and Australia’s central banks have both cut interest rates to stimulate their economies and cushion the impact of US trade tariffs. ","elementId":"652d1f9c-abc2-427e-b10d-3503711900a8"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":" China cut its benchmark lending rates for the first time since October, following Beijing’s sweeping monetary easing measures. The People’s Bank of China reduced the one-year loan prime rate by 10 basis points to 3.0%, and the five-year loan prime rate was cut by…

Tag: Interest Rates

China to cut interest rates in response to trade war with US

China will cut interest rates and inject some much-needed liquidity into the domestic economy, as the country steels itself for a bruising trade war with the US. The People’s Bank of China said on Wednesday it would make a half-point cut to the banks’ reserve requirement ratio, its benchmark interest rate, and release 1tn yuan (£103.6bn) into the banking system. Pan Gongsheng, the governor of the People’s Bank of China, said China would also cut a key interest rate by 0.1 percentage point. Pan said the “moderately loose” measures were…

The global economy is poised for another tumultuous year in 2024 | Kenneth Rogoff

The global economy was full of surprises in 2023. Despite the sharp rise in interest rates, the US successfully avoided a recession, and major emerging markets did not spiral into a debt crisis. Even Japan’s geriatric economy exhibited stunning vitality. By contrast, the EU fell behind, as its German growth engine sputtered after China’s four-decade era of hypergrowth abruptly ended. Looking ahead to 2024, several questions loom large. What will happen to long-term inflation-adjusted interest rates? Can China avoid a more dramatic slowdown, given the turmoil in its real estate…

The Debt Problem Is Enormous, and the System for Fixing It Is Broken

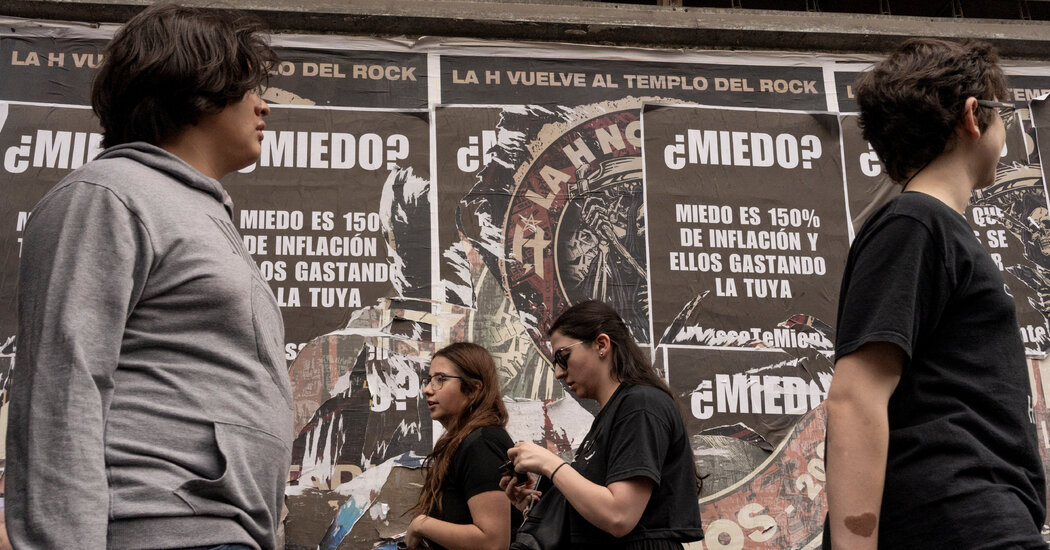

Martin Guzman was a college freshman at La Universidad Nacional de La Plata, Argentina, in 2001 when a debt crisis prompted default, riots and a devastating depression. A dazed middle class suffered ruin, as the International Monetary Fund insisted that the government make misery-inducing budget cuts in exchange for a bailout. Watching Argentina unravel inspired Mr. Guzman to switch majors and study economics. Nearly two decades later, when the government was again bankrupt, it was Mr. Guzman as finance minister who negotiated with I.M.F. officials to restructure a $44 billion…

Global Markets Cheer on Better Than Expected Inflation Data

Good news for global markets Yesterday’s impressive rally in U.S. stocks and bonds has gone worldwide this morning, as investors see central banks making gains in their fight against inflation. Adding to the good news was a breakthrough in the House last night that could avert a government shutdown. S&P 500 futures signal further gains at the opening bell. The question now is whether this represents a false dawn on inflation, or the start of a durable decline in rising costs — and interest rates. Here’s what’s exciting investors: Yesterday’s…

Australia news live: Shorten labels Greens’ Senate walkout ‘political grandstanding’; Birmingham says Gaza child deaths a ‘terrible function of war’

From 39m ago Shorten labels Greens’ Senate walkout ‘political grandstanding’ Government services minister Bill Shorten has labelled the Greens decision to walk out of Senate question time yesterday as “political grandstanding”. Yesterday, the Greens stormed out of Senate question time to protest what they say is Albanese government inaction over the conflict in Gaza. You can read more from my colleague Paul Karp here: Speaking to the ABC just earlier, Shorten argued the Greens’ walk out doesn’t help “a single soul anywhere”: I think that is just political grand standing.…

High interest rates help double HSBC profits

HSBC will hand more than $3bn (£2.5bn) to shareholders, after higher interest rates helped to more than double quarterly profits, despite taking a financial hit on China’s property crisis. The London-headquartered bank said it was launching the share buyback, and pay a dividend worth 10 cents a share, after what its chief executive, Noel Quinn, hailed as “three consecutive quarters of strong financial performance”. The move came as HSBC revealed it had made $7.7bn in pre-tax profits between July and September. While it fell short of average analyst forecasts for…

Fragile Global Economy Faces New Crisis in Israel-Gaza War

The International Monetary Fund said on Tuesday that the pace of the global economic recovery is slowing, a warning that came as a new war in the Middle East threatened to upend a world economy already reeling from several years of overlapping crises. The eruption of fighting between Israel and Hamas over the weekend, which could sow disruption across the region, reflects how challenging it has become to shield economies from increasingly frequent and unpredictable global shocks. The conflict has cast a cloud over a gathering of top economic policymakers…

$100 Oil Could Scramble the Fed’s Efforts to Ease Inflation

What rising oil prices mean for the Fed Crude oil has slipped below the 10-month high it hit on Tuesday. But analysts say the monthslong rally that has sent prices close to $100 a barrel isn’t over, posing a big risk for global growth and complicating central bankers’ efforts to tame inflation. Expect Jay Powell to field plenty of questions about oil prices at his news conference on Wednesday. The crude rally has become a wild card for the Fed chair and other policymakers grappling with high inflation. The Fed…

A US growth-inflation ‘soft landing’ is vital to solving the global economy puzzle | Mohamed El-Erian

The global economy this year is full of puzzling surprises. Japan’s GDP growth is currently surpassing that of China, and July retail sales in the US were double the consensus forecast, despite the US Federal Reserve pursuing one of the most concentrated rate-hiking cycles in decades. In the UK, wage growth has risen to an annualised rate of 7.8% and core inflation has remained high, even after 14 consecutive rate increases by the Bank of England (with more to come). Meanwhile, Brazil and Chile have cut interest rates, diverging from…