In recent years, a quiet yet profound competition has been unfolding among the countries of the Persian Gulf – this time over data, not oil. China has been quietly yet systematically sowing the seeds of its technological influence in the Gulf.

The key countries that Beijing has targeted for technological influence are Saudi Arabia, the United Arab Emirates and Qatar. These countries, aiming for economic diversification and developmental goals, have turned to new technologies, including AI, from China.

How have Chinese AI companies in the Persian Gulf changed the nature of China’s influence in these three key countries? And what are the implications for Arab technological security, independence, and regional balance?

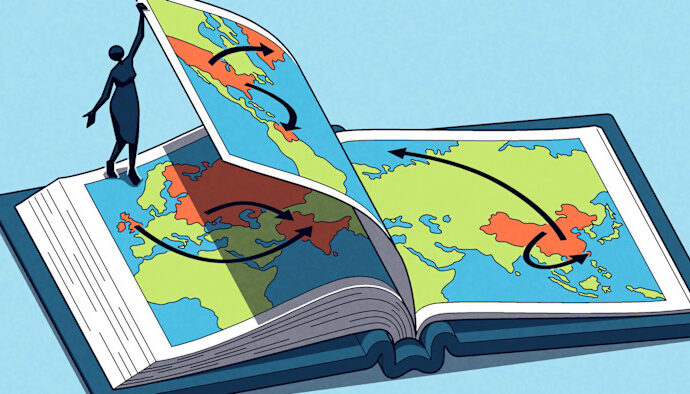

For decades, power in the region was defined by energy. Every barrel of oil was a geopolitical card in the game between East and West. Today, however, drilling rigs are gradually being replaced by data centers, cloud servers, and machine learning algorithms. Recognizing this shift early, Beijing has transformed its policy from securing energy supplies to seizing algorithmic infrastructure. Digital-focused agreements and the presence of companies like Huawei, Alibaba Cloud, and SenseTime in AI projects indicate that China is establishing a form of technological dependency in the Gulf.

Saudi Arabia, the UAE, and Qatar, in their quest for post-oil economic transformation, are moving toward digital and innovative economies. While this convergence of interests provides a suitable platform for technological collaboration with China, it also enables the transition from energy power to “algorithmic power,” shaped by Beijing. This form of power reflects an actor’s ability to leverage data, computation, algorithms, and networks as instruments of power in international and regional arenas. Naturally, it can complement or even replace traditional power.

Saudi Arabia

In September 2022, SenseTime, one of China’s AI giants, signed a memorandum of understanding worth $206 million with the Saudi National Center for Artificial Intelligence. The goal was to develop machine vision systems for energy, urban security, and public services.

This collaboration is only one example of a larger Chinese effort to penetrate Saudi Arabia’s data infrastructure – the key to the post-oil economic vision. In another example, the Saudi investment company Prosperity7 Ventures, affiliated with Aramco, participated in a new funding round for Zhipu AI, which is valued at around $3 billion.

In the massive NEOM project, Saudi Arabia is not only aiming to build a futuristic city but also a model of “digital governance.” Chinese companies such as SenseTime and Huawei are at the heart of this project, with their algorithms applied in urban data management, video surveillance, and behavioral analytics.

On the surface, this collaboration appears merely economic; yet, at its core, it involves sharing Saudi Arabia’s national data with Chinese algorithms. In exchange for transferring these technologies, Beijing gains access to data flowing from Saudi smart cities to its oil industries – data that constitutes 21st century raw gold for China. This could pose a major risk to Saudi Arabia in the long term and reduce its digital independence.

United Arab Emirates

The UAE has consistently aimed to transition from oil to AI as a national brand. The UAE seems to have grasped earlier than its neighbors that the “future” depends on sovereign technology.

The Chinese company UBTech Robotics, backed by Tencent Holdings, signed a $362 million contract in 2019 to develop AI laboratories in the UAE. In 2020, Chinese companies, including Huawei and G42, initiated joint cooperation with Abu Dhabi to localize Chinese algorithms in facial recognition, urban security, and digital healthcare systems.

With its ambitious AI 2031 program, Abu Dhabi has become the AI hub of the Persian Gulf region. The collaboration of the Emirati Company G42 with Chinese labs has created a network of regional big data that blurs the line between commercial cooperation and informational influence. Recently, the Chinese company TRUNK, specializing in autonomous transport, announced that it will establish its regional headquarters in the UAE as part of the FDI NextGen initiative.

Clearly, these initiatives generate a reverse data dependency: the Gulf countries use Chinese technology, but the algorithms are fed by local data. This results in enhanced Chinese algorithmic power through global access to diverse datasets.

Qatar

Qatar has taken a different path: investing in education, technological diplomacy, and academic cooperation with China. Beijing consolidates its soft influence through participation in Qatari universities and the establishment of data-driven research centers. Yet, this form of soft power creates a paradox for Qatar: symbolic soft power infrastructure, such as media, education, diplomacy, and the Lusail smart city, all operate based on Chinese algorithmic standards.

In 2025, the Qatari government signed an agreement with Huawei and Cloud for cloud systems and data infrastructure. This deal is part of China’s Digital Belt and Road Initiative and solidifies Qatar’s role as a central hub for data in the region. Qatar seeks to position itself as a center for digital innovation in the Persian Gulf, transitioning its cultural soft power into technological soft power.

According to Invest Qatar and Accenture, Qatar has invested $2.5 billion in data and AI. The presence of Huawei and Kingdee in Qatar allows China to access regional data and infrastructure, further strengthening China’s algorithmic power.

Doha has become a key piece in Beijing’s digital geopolitical puzzle. For China, all these agreements form links in a data-transfer chain extending from East Asia to the Gulf.

The Geopolitics of Data

In the oil era, Gulf countries controlled resources; in the data era, control is exerted through foreign codes and infrastructure. The Persian Gulf may enjoy energy independence today, but it is gradually becoming an importer of algorithms and data infrastructure.

Beijing is building a new reality – one in which influence is exercised through cloud infrastructure, AI networks, and citizen data. The United States, which has a security-oriented perspective on China, views this development with concern. The China-U.S. competition in the Gulf is no longer about ports or military bases but about cloud space and data centers. This network allows China to play a decisive role in shaping future data policy, AI ethics, and cybersecurity standards. There is a potential for these computational infrastructures to create technological dependency for the Arab countries as well.

To conclude, in a world where AI is reshaping the nature of power, algorithmic power is a key instrument for redefining the balance of power. Through its algorithmic strength, Beijing seeks to redefine the regional geopolitical order, gain different levers of power vis-à-vis Washington, and export its governance model to the Persian Gulf.

At a higher level, technological engagement between China and the Gulf countries can be seen as a form of technological power balancing, carrying profound implications for the region’s future geopolitics.