Some economists fear that raising interest rates at this point would be a blunder.

It would tighten monetary policy at a time when households and businesses are already being squeezed by higher energy costs, and as government Covid-19 support measures, such as the universal credit uplift, are withdrawn, hurting vulnerable families.

A rate hike might calm inflation expectations; policymakers worry that workers will seek higher wages to match rising prices in the shops (although not every employee has as much leverage as, say, a qualified HGV lorry driver).

But it wouldn’t do anything to address the supply-side problems driving up inflation — such as record gas prices, delays at the ports, or the global chip shortages.

Jo Michell, associate professor in economics at Bristol Business School, fears the UK could be heading towards a policy error.

Jo Michell (@JoMicheII)

Without a rapid change in direction we are heading towards a 2010-style macro policy error. https://t.co/1WP68bvkVO

AndreasStenoLarsen (@AndreasSteno)

The swiftest repricing of the GBP front-end in 10-12 years.. pic.twitter.com/6UsMM1teEh

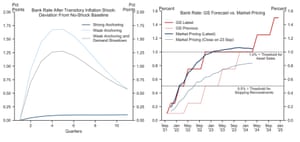

Goldman Sachs have raised their forecasts for UK interest rate rises, following the hawkish comments from some Bank of England policymakers including governor Bailey.

The Wall Street bank now expect three hikes at alternate MPC meetings – first in November, then in February and May 2022 – which would lift Bank Rate to 0.75%.

Previously, Goldman had expected a slower tightening – with hikes in intervals of six months following lift-off.

But with the UK labour market looking strong, vacancies at record highs, and inflation expectations rising, they believe the Bank will act faster to ‘nip inflation in the bud’.

Goldman told clients:

- Recent BoE commentary combined with a shrinking activity shortfall, a resilient labour market and a likely further rise in long-term inflation expectations, suggests that the BoE will start hiking this year. While we view it as a close call between a November and December lift-off, we think the November meeting is slightly more likely given it comes with a press conference and updated projections within the Monetary Policy Report.

- Macroeconomic modelling suggests that the BoE should act pre-emptively and decisively to concerns about knock-on effects from high inflation. As such, we have significantly steepened our expected path for Bank Rate in the near term. We now expect three hikes at alternate MPC meetings, with Bank Rate reaching 0.75% by May 2022.

With inflationary pressures likely to soften, Goldman expects hikes to be “more limited from the middle of next year”, with Bank Rate reaching 1.0% by the last quarter of 2022.

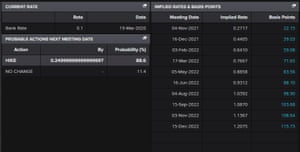

Traders are anticipating that the Bank of England will increase interest rates from record lows of 0.1% to 0.25% as soon as the MPC’s next meeting, on November 4th.

And they see further rises ahead — current market pricing shows rates hitting 0.5% by February 2022, and 1% by next August.

That would take borrowing costs back to their highest levels since the financial crisis (back in 2008 they were 5%, before they were slashed after the collapse of Lehman Brothers).

However, some experts do argue that the markets have got ahead of themselves (ING, remember, only expect two rate rises by the end of next year).

Joe Weisenthal (@TheStalwart)

Wow, 2-year yields in the UK are actually above pre-crisis levels now.

By comparison, US moving up sharply, but nowhere close to where we were. pic.twitter.com/WYc3WuWK2S

An increase in UK interest rates would be a shock to many borrowers, says Laith Khalaf, head of investment analysis, AJ Bell:

“Even if we don’t get a rate hike this side of Christmas, tighter monetary policy is firmly on the agenda in financial markets. Savers and investors should therefore take stock of their finances, because an environment of rising interest rates is going to be a shock to many. Indeed a whole generation of young adults won’t even remember a time when bank rate started with anything other than a zero.

Around 10 million people in the UK haven’t seen interest rates above 1% in their adult lives, seeing as the last time base rate was at this level was in February 2009.

Khalaf adds that the expectation of higher rates has driven government bond yields higher:

Guessing how nine people in a room are going to vote on interest rate policy isn’t based on any science, but a rate hike in November would give the impression of a pretty panicked knee-jerk reaction to events unfolding in the energy market. A December hike therefore looks more likely, but there’s still a lot of data to enter on the Bank’s spreadsheet before then.

When the time comes, the central bank will want to take a slow and low approach to tightening policy, so as not to cause any frogs to leap out of the simmering pan. Market prices will move ahead of the Bank of England however, which goes some way to explaining why gilt yields have more than doubled in the last two months.”

PiQ (@PriapusIQ)

🇬🇧🏦 The latest signal from BoE that tighter monetary policy is on the way sparked a sell-off on Monday in short-dated UK government debt, sending yields jumping higher. The 2-year gilt yield climbed 0.15 percentage point to 0.72%, the highest level in two-and-a-half years. pic.twitter.com/Mrc9hux5ZQ

Last week, though, Monetary Policy Committee members Catherine Mann and Silvana Tenreyro argued for waiting and seeing how surging gas prices and shortages of raw materials affect inflation before lifting borrowing costs.

Those higher energy prices will slow economic growth and hit household disposable income – doing a similar job to an interest rate hike.

That could be a good reason to leave rates on hold for longer, especially if current inflation pressures are transitory.

“There’s also the human element to consider, Khalaf adds:

The Bank’s interest rate committee voted unanimously to keep interest rates on hold less than a month ago, so a 2021 rate rise would require a pretty humbling collective shuffle across the aisle.

[There are nine members of the MPC, including the hawkish Michael Saunders who has said markets are correct to price in rate rises].

Rising interest rates could take some of the heat out of the UK housing market… which remained pumped up this month.

New figures from Rightmove today show that asking prices jumped by 1.8% this month, the biggest rise at this time of year since October 2015.

Price records were hit in all regions of Great Britain and in all property market sectors.

Rightmove says that some movers are keen to buy and sell in a ‘window of opportunity’ before a likely interest rate rise from the Bank of England, which would lift mortgage costs.

Tim Bannister, Rightmove’s director of property data, says:

New price records have been set across the board, with every region of Great Britain and all of the three market sectors of first-time buyer, second-stepper and top of the ladder hitting all-time highs. This ‘full house’ is an extremely rare event, happening for the first time since March 2007.

The stock shortages started after the first lockdown, and they look set to continue with the underlying housing market fundamentals remaining strong, and an additional incentive to buy and fix your mortgage interest rate before a widely expected rate rise.

Mortgage interest rates are lower than they have ever been before and lenders are keen to lend in a competitive market, with employment and wage growth also robust. The number of sales agreed continue to be strong despite the end of the stamp duty incentives.”

With homes being snapped up quickly, buyers who have already sold their own property subject to contract or have nothing to sell have the most powerful negotiating hand, Rightmove adds.

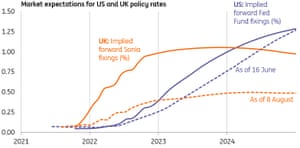

Bank of England governor Andrew Bailey’s hawkish comments this weekend suggest a November UK rate hike is increasingly likely, says ING Developed Markets Economist James Smith.

But, Smith argues that the rapid succession of rate hikes being priced by investors looks too extreme. At most, ING expect two rate hikes by the end of 2022.

Smith says:

It’s a close call between a November and February move, but we suggest the former is more consistent with the Governor’s latest hints.

Still, we don’t share the markets’ conviction that this will be followed by a series of rate hikes. More likely, the most we’ll see next year is a further 25bp hike, taking the Bank rate to 0.5%, followed by the start of balance sheet reduction.

We may even see the BoE hint at this in its November forecasts. Policymakers plug in market-rate expectations into the forecasts, and if the steeper yield curve means inflation is projected to be below target in 2-3 years, it would be an implicit hint that investors are jumping the gun.”

Andy Bruce (@BruceReuters)

Massacre going on in 2022 short sterling contracts this morning – people doubling down on BoE rate hike bets.

Here’s the March 2022 contract pic.twitter.com/bCAewKeyQM

Michael Brown, senior market analyst at CaxtonFX, argues that the Bank of England has backed itself into a corner over whether to raise interest rates:

Michael Brown (@MrMBrown)

Biggest 1-day jump in the 2yr gilt yield since 2015 pic.twitter.com/WUbtrK6kn9

Michael Brown (@MrMBrown)

BoE have backed themselves into a corner now https://t.co/rnAzLGkntN

Michael Brown (@MrMBrown)

Bailey’s either gonna make a policy mistake by hiking to try (in vain) to curb supply-driven inflation, or fail to hike and become the unreliable boyfriend mk 2

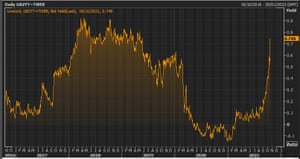

Britain’s short-term cost of borrowing has surged to its highest level in nearly two and a half years, as the City prices in a UK interest rate rise soon.

The yield, or interest rate, on two-year UK gilts has jumped to its highest since May 2019 this morning.

Two-year gilt yields hit 0.75%, up from just 0.57% on Friday night.

Rising gilt yields are a sign that traders are expecting UK interest rates to rise soon, in an attempt to combat inflation.

The yield on 10-year gilt yields have also risen (from 1.1% to 1.15%), close to the two and a half-year highs seen last week.

The moves comes after the governor of the Bank of England warned it will “have to act” to curb rising inflation, sending a new signal that it is gearing up to raise interest rates.

Andrew Bailey said he continued to believe the recent jump in inflation would be temporary, but he predicted a surge in energy prices would push it higher and make its climb last longer, increasing the risk of higher inflation expectations.

“Monetary policy cannot solve supply-side problems – but it will have to act and must do so if we see a risk, particularly to medium-term inflation and to medium-term inflation expectations,” Bailey said on Sunday.

During an online panel discussion organised by the Group of 30 consultative group Bailey explained:

“And that’s why we at the Bank of England have signalled, and this is another such signal, that we will have to act.

But of course that action comes in our monetary policy meetings.”

The Bank has two more MPC meetings this year, on 4th November and then 16th December.

The Bank recently predicted that inflation will rise over 4% early next year, or more than double its 2% target. The surge in energy prices are adding to inflationary pressures, bolstering rate rise expectations.

Jeremy Thomson-Cook, chief economist at international business payments specialist Equals Money, points out that investors are now pricing in several rate hikes by the end of next year….

…even though UK growth isn’t exactly sparkling.

With markets already fully pricing in a rate hike of 0.15% this year and three more next year, taking the base rate up to 1%, Bailey’s comments are unlikely to push GBP [the pound] significantly higher.

But despite the upbeat rhetoric, Johnson’s government faces an unfortunate fact: the UK’s economy isn’t growing at the rate they desire. August’s GDP figures only rose by 0.4%, which means Q3 growth will likely come in at only half of the Bank of England’s 3% forecast. The economy is still 5% smaller than it would have been if growth had continued on its 2010 to 2019 pre-pandemic trajectory; in contrast, the U.S. achieved this by Q2 2021.

British businesses have grown more nervous about supply chain issues and skills shortages in recent weeks, according to NatWest Group Plc Chief Executive Officer Alison Rose.

“Clearly there are challenges they are facing as a result of coming out of lockdown and the supply chain issues,” Rose said in an interview on Bloomberg TV on Monday.

For now at least, firms are repaying the loans they took out during the pandemic, with about 92% of companies owing debts under the government-backed programs paying on time, Rose said.

“This is really an issue around the speed of recovery and then confidence going into next year and the decisions businesses may be making around investing.”

More here: U.K. Firms Getting More Nervous Over Supply Chains, Says NatWest CEO

Zoe Schneeweiss (@ZSchneeweiss)

Supply chains, skills are worrying UK firms more, says NatWest CEO https://t.co/8qrjm5O1ke via @mvdakers @flacqua pic.twitter.com/ZNlTMESV01

Dutch manufacturing giant Philips has joined the swelling ranks of companies hit by supply chain woes.

Royal Philips NV cuts its forecasts for growth and earnings growth this morning, following problems obtaining parts and materials, and shipping delays.

Frans van Houten, chief executive, told Bloomberg that Philips was sitting on a “massive order book” in the last quarter. But the supply chain crunch meant it wasn’t able to fully deliver on its strong order growth.

It’s really a matter of both chips and ships.

We have a shortage of e-components and we see the delays in the shipping industry and the congestion in the ports.

Bloomberg TV (@BloombergTV)

“It’s really a matter of both chips and ships,” says Philips CEO Frans van Houten. He spoke to @daniburgz & @ManusCranny about the supply chain crunch that has led the company to cut its growth and earnings guidance https://t.co/mLoUzgTQ6Y pic.twitter.com/EJ7kQ0UJLs

Group sales fell by 7.6% in the last quarter, due to “headwinds caused by global supply chain challenges” and the recall of ventilation devices used to treat sleep apnea. Those devices have a faulty sound abatement foam that can degrade and become toxic.

Philips now only expects to deliver low single-digit sales growth for 2021, down from the low-to-mid-single digit increase it forecast previously, with profit margins only expected to rise modestly.

Shares in European luxury goods makers have fallen today, on concerns that demand from Chinese consumers could falter.

LVMH Moët Hennessy Louis Vuitton (-2.9%), Pernod Ricard (-1.9%), Hermes (-2.2%) and Burberry (-1.85%) have all benefitted from demand for expensive items like clothes, drinks and handbags from China’s wealthier citizens.

This morning’s disappointing GDP report could be a sign that this boom is fading, if supply chain problems, energy shortages and property sector problems continue.

China’s President Xi Jinping call for progress on a long-awaited property tax that could help reduce wealth gaps could also threaten spending on luxury goods.

In an essay in the ruling Communist Party journal Qiushi, published on Friday, Xi called for China to “vigorously and steadily advance” legislation for a property tax to help reduce wealth gaps, alongside a push for “common prosperity” by mid-century.

Matthew Moulding, the founder and chief executive of The Hut Group, is giving up his “golden” share of the company in an attempt to regain the confidence of the City after a sharp fall share in recent weeks.

The online retailer and tech services company said the cancellation of Moulding’s controlling share would promote “good corporate governance”, after a turbulent few weeks for the retailer’s stock price sparked by questions over its profitability, share structure and valuation.

The Manchester-based group – which owns the online retail sites Lookfantastic, Glossybox, Zavvi and Coggles, as well as beauty brands including ESPA and Illamasqua – said the move would also help it apply for a premium listing in London, which it hopes to secure in 2022. Under current rules, Moulding’s golden share prevents a premium listing and therefore THG cannot be included in the FTSE.

Moulding said:

“After the anniversary of our 2020 listing we feel that the time is right to make this next step and apply to the premium segment in 2022, thereby continuing the development of THG as we endeavour to deliver our strategy for the benefit of our shareholders, key stakeholders and employees,”

Moulding’s controlling share was originally meant to give him ultimate control of the THG for up to three years, after it first floated on the London Stock Exchange in September 2020 with a £5.4bn valuation. The removal of the dual-class share structure is likely to appeal to investors whose holdings have significantly dropped in value in recent weeks.

Shares in THG jumped 8% to 312p on Monday morning after the announcement, giving it a market value of £3.5bn. Despite the rise, shares were still more than 50% lower than in early September.