Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The heads of Indonesia’s financial regulator and stock exchange have resigned following two days of market turmoil that was sparked by warnings of a possible downgrade by index compiler MSCI.

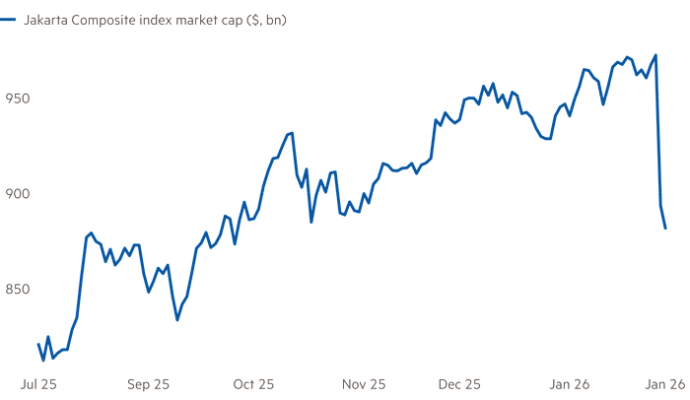

Mahendra Siregar, chair of the Financial Services Authority, and Iman Rachman, president-director of the Indonesia Stock Exchange, stepped down on Friday. Their resignations came after the country’s main stock index tumbled as much as 16 per cent in two days this week on a report from MSCI citing “fundamental investability issues” in the market.

The regulator said Siregar’s resignation was a “form of moral responsibility to support the creation of the necessary recovery steps”, while the exchange said Rachman would step down “as a form of accountability over the condition of the Indonesian capital market in the past few days”.

Three other senior officials at the regulator, including the head of capital markets supervision, also resigned.

Their departures came as the government said it would raise the limit on investment by pension funds and insurers in the stock market to 20 per cent of their assets from 8 per cent, part of a series of measures aimed at improving liquidity and addressing MSCI’s concerns.

Shares rose 1.2 per cent on Friday after the announcements. They were down 7 per cent since the start of the week.

The market turmoil began after MSCI said it had found issues in the exchange’s data feed of publicly traded shares and warned that Indonesia could be reclassified from an emerging to a frontier market if no resolution was made by May.

That statement caused shares to fall more than 7 per cent on Wednesday and triggered a 30-minute trading halt.

The index then fell as much as 10 per cent on Thursday after Goldman Sachs cut its ratings on Indonesian stocks, saying the threat of losing emerging market status was “likely to prompt significant selling”.

In response to the rout, the chair of Indonesia’s Financial Services Authority on Thursday said it would raise the free-float requirement for listed companies to 15 per cent.

Indonesia has long faced questions around concentrated ownership of publicly listed companies, especially for conglomerates controlled by billionaires.

In its announcement, MSCI said many investors “expressed significant concerns” about the way shareholders were categorised by an Indonesian data provider, during a consultation over Indonesian securities’ free float.

MSCI cited opacity in shareholding structures and “concerns about possible co-ordinated trading behaviour”.

The turmoil in Indonesian stocks comes amid broader uncertainty over the country’s economic outlook and fiscal situation under President Prabowo Subianto, who has pledged to increase social spending even as government revenues have dropped.

The rupiah, which weakened as much as 0.4 per cent against the dollar on Friday, has been trading close to all-time lows, fuelled by concerns over central bank independence after Prabowo nominated his nephew as its deputy governor. The nomination was confirmed by parliament this week.