Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A Chinese rival to DeepSeek soared 87 per cent in its trading debut on Friday, as the country’s AI hopefuls rush to tap public markets to fund model development and global expansion.

MiniMax, a Shanghai-based large language model company, raised $619mn in its Hong Kong IPO, buoyed by investor enthusiasm over China’s advances in artificial intelligence. MiniMax’s stock was trading at HK$310 ($40) after pricing its shares at HK$165 each, to bring its market capitalisation to more than $12bn.

Chinese LLM companies have turned to stock markets earlier than their US counterparts, which have raised tens of billions of dollars in private funding. Zhipu, a Beijing-based competitor, became the first LLM start-up to list globally on Thursday, raising $558mn in Hong Kong. Shares of Zhipu are up 29 per cent since its IPO.

“Chinese companies have more urgent funding needs than their US counterparts,” said Tilly Zhang, a technology and industrial policy analyst at Gavekal Dragonomics. “Zhipu AI has gone through eight rounds of financing in just six years. Without the kind of massive financial backing that US hyperscalers enjoy, going public becomes a practical way to raise more capital.”

Founded by former SenseTime executive Yan Junjie, MiniMax is one of China’s leading LLM developers and best known for its multimodal models, which are popular for their image and video generation capabilities.

Backed by investors including technology groups Alibaba and Tencent, as well as investors HongShan Capital Group, Hillhouse Capital and Future Capital, MiniMax has focused on building consumer AI products. The company has pushed aggressively into international markets, particularly the US, where there is a potentially larger pool of high-spending users than in China.

Both MiniMax and Zhipu could use the IPO revenues to expand their overseas operations.

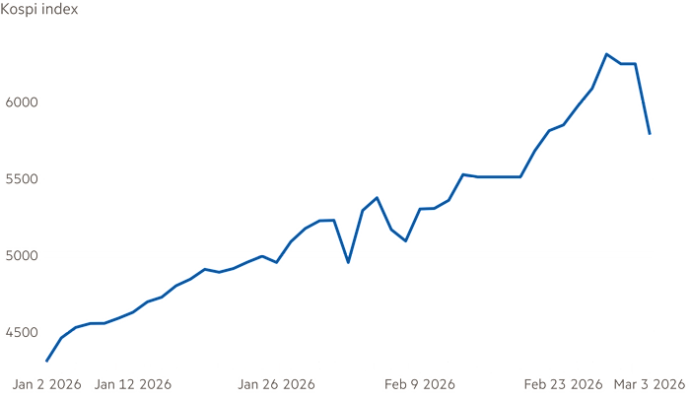

“Finally there is enough confidence to bring these companies to IPO,” said Wee Khoon Chong, a senior strategist at BNY.

“It’s quite important that this first wave is going through successfully.” “The AI and tech-related optimism is going to continue and that should be fairly positive for the region”

MiniMax generates most of its revenue from consumer applications rather than by selling access to its models or tailored solutions to enterprises. These include the character chatbot app Talkie, which is gaining traction with American teenagers, and video-generation platform Hailuo AI. In the first nine months of 2025, the company generated $100mn in revenue, more than $70mn of which came from its applications business, according to its IPO application paperwork.

While MiniMax generates more revenue than Zhipu, both companies are burning cash as they invest heavily in research and development, costly AI infrastructure and overseas expansion.

The two listings follow a wave of recent IPOs by Chinese AI chipmakers, including Biren, Shanghai Iluvatar CoreX Semiconductor and Moore Threads, whose share prices have surged as investors bet Beijing’s push for domestic AI hardware will reduce reliance on Nvidia.