Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

“Here be dragons” was ancient mapmaker code for the unknown. Something similar applies to China’s latest group of so-called dragons — AI chipmakers seeking to profit from Nvidia’s geopolitical tangles. They have been buoyed by investor optimism, but their path ahead is unclear.

Last week, shares in Biren Technology surged 76 per cent on its initial public offering in Hong Kong after the chipmaker raised just over $700mn. Last month in Shanghai, Moore Threads and MetaX leapt 425 per cent and almost 700 per cent, respectively, on their debuts, having raised a combined $1.7bn. Anticipation is fevered: search engine giant Baidu rose 15 per cent last week after it said it will spin off its chips unit in Hong Kong.

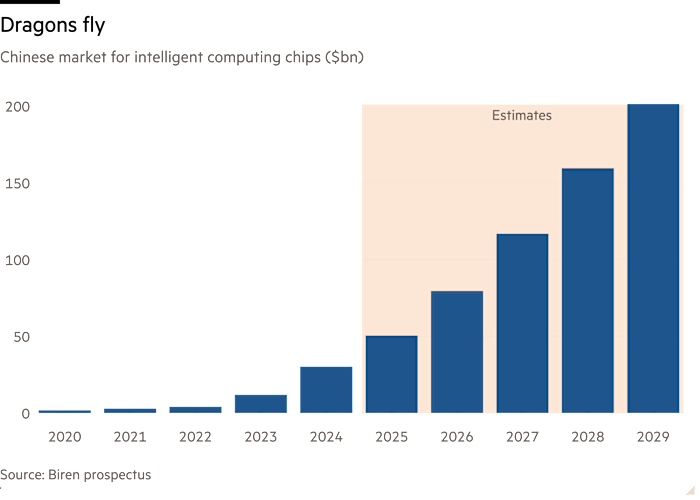

As elsewhere, excitement is pinned on ever-rising forecasts for AI use. But local chipmakers also have another tailwind. Last year’s decision by US President Donald Trump to halt Nvidia’s exports of H20 chips to China prompted Beijing to increase support for local players by boosting funding for production facilities and encouraging users to buy local.

The US may have since backtracked, but China’s resolve should propel the share of its chip market held by domestic producers to 53 per cent this year, reckon Bernstein analysts, up from 29 per cent in 2024, prior to Nvidia’s muzzling. Market expansion implies revenue almost quintupling to $29bn.

That’s good for Biren and rivals collectively, but they must still fight it out for market share. None of the three newly public chipmakers, all lossmaking, has sales worth more than a tenth of their bigger listed rival, Cambricon. More are sprouting, such as Hygon and Enflame. The towering Huawei had a whopping one-fifth share of the market in 2024, according to Biren’s prospectus. No other Chinese chipmaker managed even 1 per cent.

The recent excitement has left Cambricon and Biren with enterprise values worth a stunning 40-plus times 2026 sales — assuming both roughly double last year’s revenue. Nvidia, for comparison, peaked at a forward multiple of 24 last year. AMD, a distant number two and thus probably the best role model for Huawei’s local rivals, managed a high of 12.

Of course, the future of AI is filled with dragon-sized unknowables. Sub-scale chipmakers might prove surprisingly durable in a market with a habit of state-sponsored favouritism. That doesn’t make them wise investments. Think of China’s 130-odd electric-vehicle makers, or its myriad solar-panel makers before that. Today’s dragon may turn out to be tomorrow’s newt.