This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

Beijing’s war games around Taiwan

US stocks eclipsed by global markets in 2025

How Abu Dhabi rose as a sovereign wealth power

The rise of the side hustle

China has launched a new round of military drills around Taiwan, a move it said was a warning to “independence” forces and which follows Taipei’s largest-ever weapons procurement deal with the US.

What to know: The Chinese exercises involve army, navy, air and rocket forces operating in the Taiwan Strait and around the island and will include live-fire drills today, according to a statement issued by the People’s Liberation Army. The “Justice Mission 2025” exercises, China’s second round of big drills around Taiwan this year, would include blockades of ports and strategic areas, establishing battlefield control and deterring external forces, the statement said.

Taiwan’s defence ministry said that the Chinese military manoeuvres had entered Taiwan’s air response area. The ministry added that the PLA’s designated areas for the drills overlapped with international air and shipping routes.

Testing Trump: A PLA spokesperson said the drills serve “as a serious warning to Taiwan independence separatist forces and external interference forces”. Earlier this month, the US approved an $11.1bn arms sale to Taiwan, the largest package of its kind. William Yang, an analyst at the International Crisis Group, said the exercises would “test” the Trump administration’s response. Read the full story.

Here’s what else we’re keeping tabs on today:

Five more top stories

1. SoftBank Group has agreed to acquire DigitalBridge, a US-based investor in data centres and telecoms infrastructure, for about $4bn, marking the latest move in Masayoshi Son’s artificial intelligence-fuelled dealmaking spree. Read more about the Japanese conglomerate’s AI ambitions.

2. China has fixed the renminbi at its strongest level against the dollar in 15 months, a move that analysts say signals its tolerance of a gradual appreciation as its soaring exports stoke tensions with trading partners. American and European leaders have seen the renminbi’s weakness as unfairly advantaging Chinese exporters and contributing to China’s enormous trade surplus.

3. US stocks have been eclipsed by market gains in the rest of the world in 2025, as worries about high valuations, a Chinese AI breakthrough and Donald Trump’s radical economic policies contributed to a rare year of underperformance for Wall Street. Asian stock markets have been among the strongest performers.

4. The US has offered Ukraine a 15-year security guarantee, but Kyiv wants a period three times as long to deter future Russian aggression, Volodymyr Zelenskyy said yesterday. The Ukrainian president’s comments came the day after a Florida summit with Trump that both leaders said was significant but that failed to make a decisive breakthrough.

5. Trump has said the US carried out an attack on a “dock area” in Venezuela, confirming that Washington had struck inside the country. The US president told a radio interviewer last Friday that the US had earlier that week destroyed “a big [drug] facility . . . where the ships come from”. Here’s what he said to reporters yesterday.

The Big Read

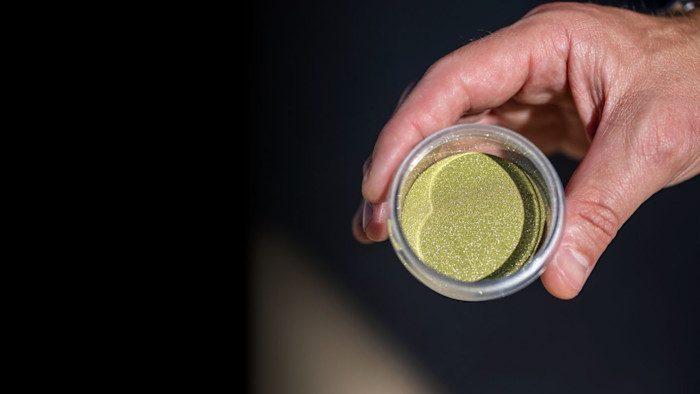

Synthetic diamonds are powering a new quantum revolution. By inserting tiny imperfections, the precious stones can be turned into extraordinarily sensitive detectors that can be used in computing, encryption and sensors. Read more on their potential applications, from navigation to medicine.

We’re also reading . . .

Chart of the day

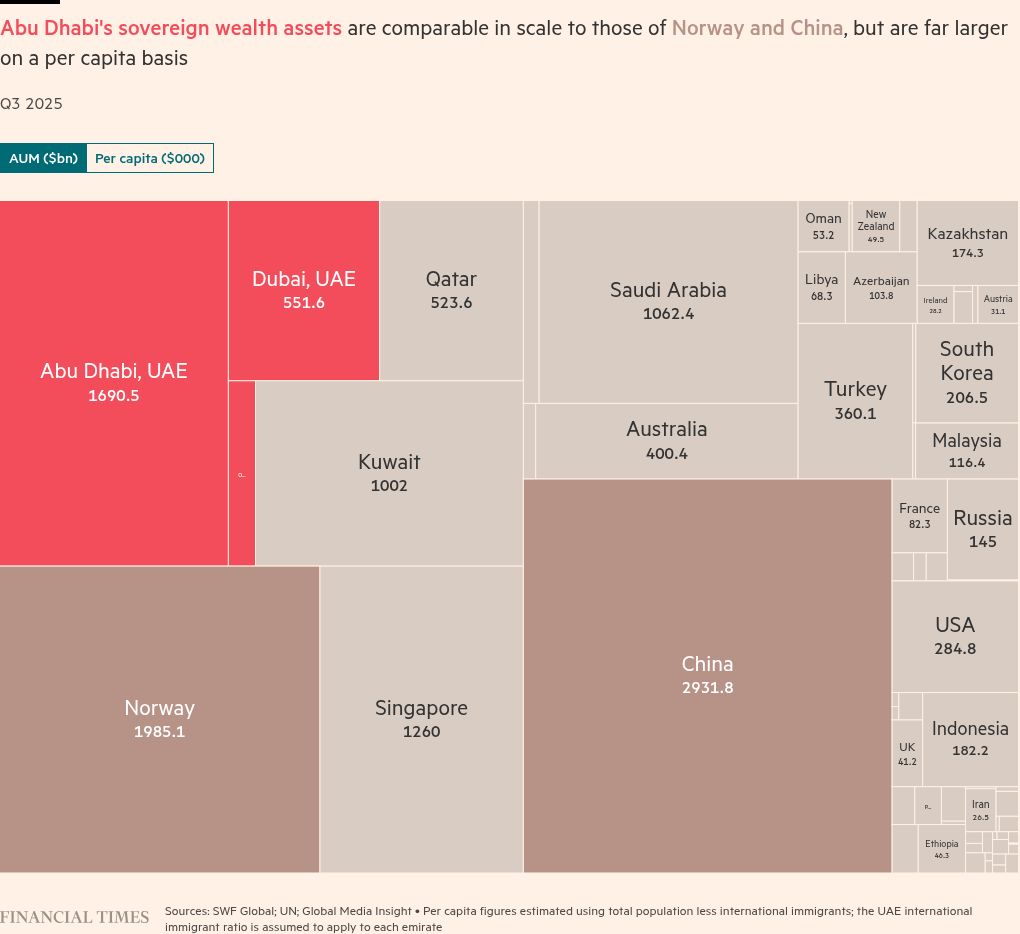

Abu Dhabi has some of the highest levels of sovereign wealth in the world, having channelled its petrodollars into international investment and domestic development. Here are the people, funds and institutions behind the emirate’s staggering rise to riches.

Take a break from the news . . .

Economists might be underestimating the impact of side hustles. Jobs such as “social media influencer” don’t appear in labour force surveys, while how to tax gig work is a growing problem for fiscal agencies. Yet the trend is set to endure.