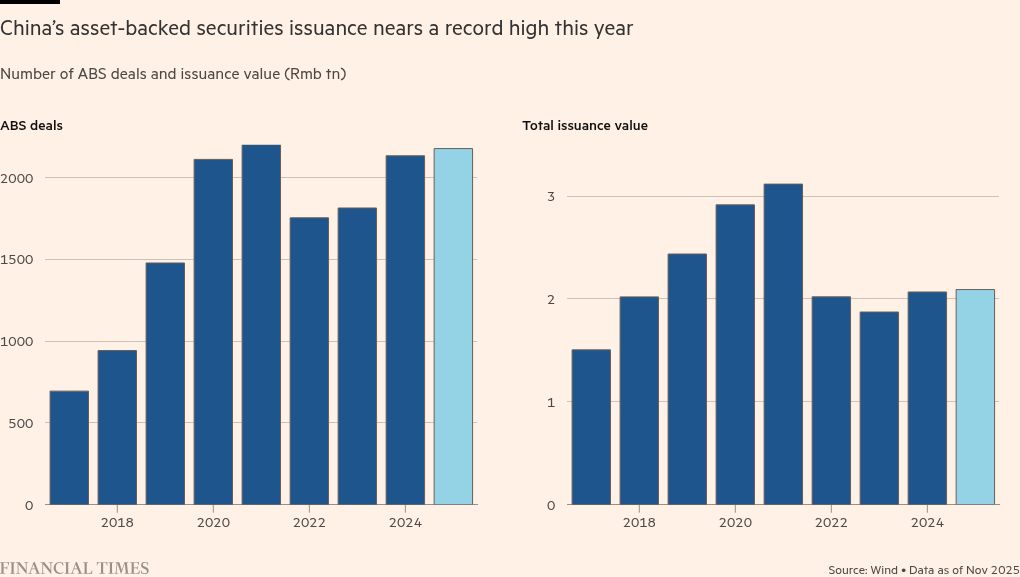

Chinese offerings of asset-backed securities have hit a record high this year as cash-strapped local governments struggle to plug fiscal holes.

The number of deals in China involving sales of ABS — financial instruments based on the revenue streams of an underlying pool of assets such as property rentals or leases — reached 2,386 as of December 24, surpassing the previous record set in 2021, according to data provider Wind.

The rise in deals this year was driven by authorities at the provincial level and below, said a Chinese broker who advises companies on ABS issuance.

The value of new ABS deals in the country has totalled $2.3tn, the highest in four years, the Wind data shows.

Highly indebted local governments hope the sales will help solve liquidity problems stemming from a weakened economy and property market crisis and raise money for new investments to help them meet central government growth targets.

But the rush to securitise assets — some of which appear to have highly uncertain underlying value — is itself fuelling questions about the long-term sustainability of Chinese local government finances.

Such is the need for liquidity that one local leader, Li Dianxun, governor of central Hubei province, has coined the slogan: “Turn every possible state-owned resource into an asset, every possible state-owned asset into a security, and leverage all possible state-owned funds.”

“This emerging campaign reflects the surging need for local governments to address mounting debt and fiscal pressures,” said Yubin Fu, vice-president and senior analyst at Moody’s Ratings.

China’s local governments have been under pressure since the Covid-19 pandemic, which devastated their finances. A crackdown by the central government in Beijing on property developer leverage has also hit land sales that were previously a crucial source of revenue for provincial and city authorities.

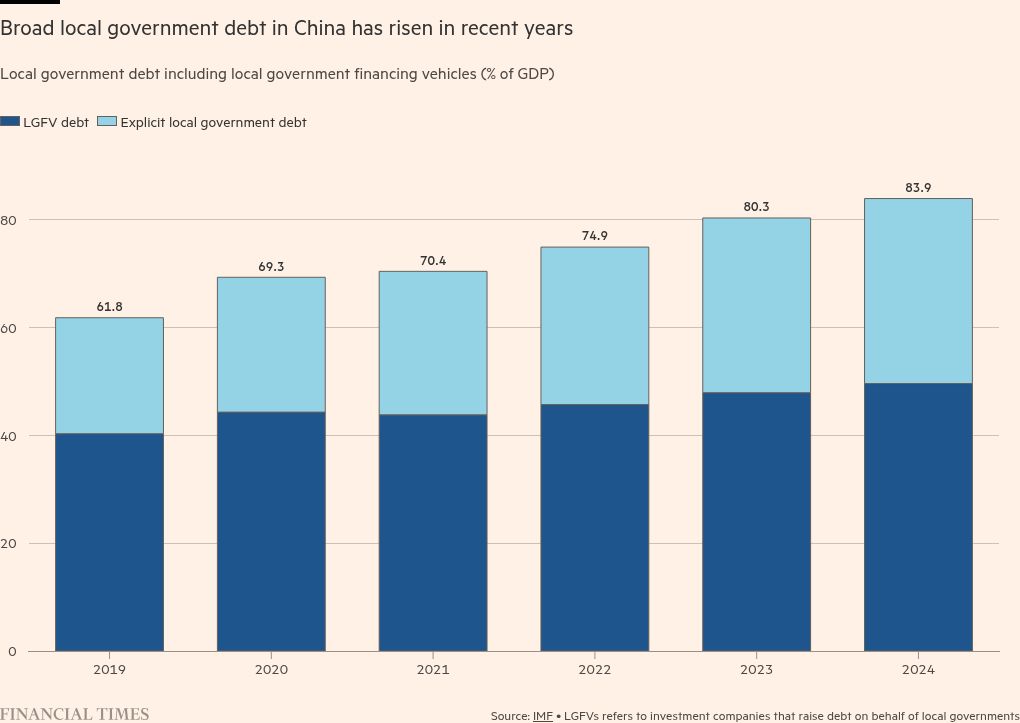

Local governments’ official debt plus borrowings by their off-balance sheet financing vehicles — which raise money and build infrastructure on their behalf — soared to about 84 per cent of GDP in 2024 from 62 per cent in 2019, according to IMF figures released last year.

Beijing has helped settle local government financing vehicles’ maturing debt and improve liquidity conditions through a $1.4tn debt swap scheme, but liabilities associated with these vehicles remain vast at about $10tn, analysts say.

“Beijing wants to press the local governments to monetise their state assets to make them more efficient,” said Robin Xing, chief China economist with Morgan Stanley. “A lot of local governments do have state assets, but many of these are not running in the most efficient way to make money.”

Repackaging these holdings as asset-backed securities is attractive to local authorities, since it can bring forward the income they are expected to generate in the future while retaining state ownership.

Hubei’s Li spearheaded efforts to convert idle assets into cash in his previous role as deputy governor of neighbouring Hunan province. Under his leadership, Hunan began repurposing spaces under bridges and other unused properties as public amenities such as parking areas and sports grounds.

From 2022 to 2024, Li’s programme contributed nearly 11 per cent of Hunan’s total fiscal revenues, according to official data.

By the end of last year, Hubei had compiled an inventory of state assets that could possibly be securitised worth Rmb21.5tn ($3.06tn). Southern Guangdong province and central Anhui have also compiled inventories.

While local authority ABSs offer investors — mainly government-backed institutions such as banks, wealth management funds and securities traders — an implicit state guarantee, analysts have raised concerns about the quality of the underlying assets.

“All the high-quality assets were largely sold or securitised early on, leaving mostly lower-quality assets. With local government finances under pressure, authorities are exploring every possible avenue to reduce debt,” said the Chinese broker.

The government-owned public transport group in Hubei’s capital Wuhan, for instance, early this year sold a first Rmb600mn tranche of a planned total of Rmb4bn in securities backed by assets of the company that operates all regular bus routes in the city.

But the bus company is making a net loss, which deepened to Rmb821mn in the first half of 2025 from Rmb13mn for all of last year. The 10-year notes are already trading 5 per cent below their face value.

Another Wuhan state-owned group sold asset-backed securities based on a previously struggling property development, the Hongshan AI Building, for Rmb300mn last year. The group claimed that by adding unspecified artificial intelligence features it had changed the tower from a building with 30 per cent occupancy to an AI centre with three times as many tenants — including 60 AI companies.

When the Financial Times visited the address, office workers in the building said they could not identify new features that made it particularly suited to AI.

The tenants included several state-owned companies that had been relocated to the Hongshan building from other parts of a surrounding industrial park. There was also a tech company whose staff were mostly engaged in censoring posts on Kuaishou, a short-video online platform, work that is generally regarded as low-skilled.

In another case, the Wuhan city government-owned Bishui Group turned a former underground flood chamber into a wedding centre — the kind of move that fits Li’s programme of “turning every possible state-owned resource into an asset”.

The facility includes a “Monet Park” by the riverside for banquets and a Tang Dynasty-style reception hall underground.

Analysts said that for local governments, tapping the ABS market offers a new funding channel as China’s slow domestic economy makes it ever more difficult to raise money.

But there is also a risk that if low-quality projects are securitised, they could become another source of financial vulnerability for local governments that Beijing has spent huge sums bailing out.

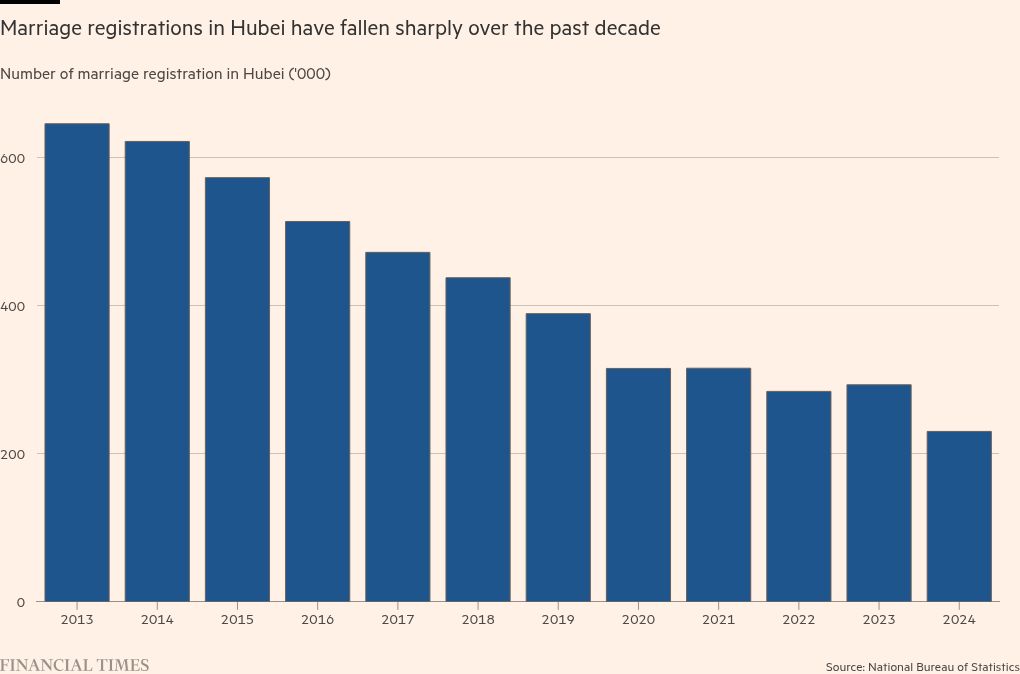

At the Hubei marriage facility, for instance, there were no customers in sight in the vast facility during a recent visit. Marriages in Hubei are falling, reflecting a broader demographic decline across the country.

“The peak time was before 2022,” said a photographer from the wedding photo studio. “Now after Covid and weak consumption, people are less inclined to spend lavishly on weddings.”

Data visualisation by Haohsiang Ko in Hong Kong. With additional contributions from Cheng Leng and Tina Hu in Beijing