Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

One of the world’s hottest initial public offering markets this year is showing signs of weakness after a number of disappointing debuts.

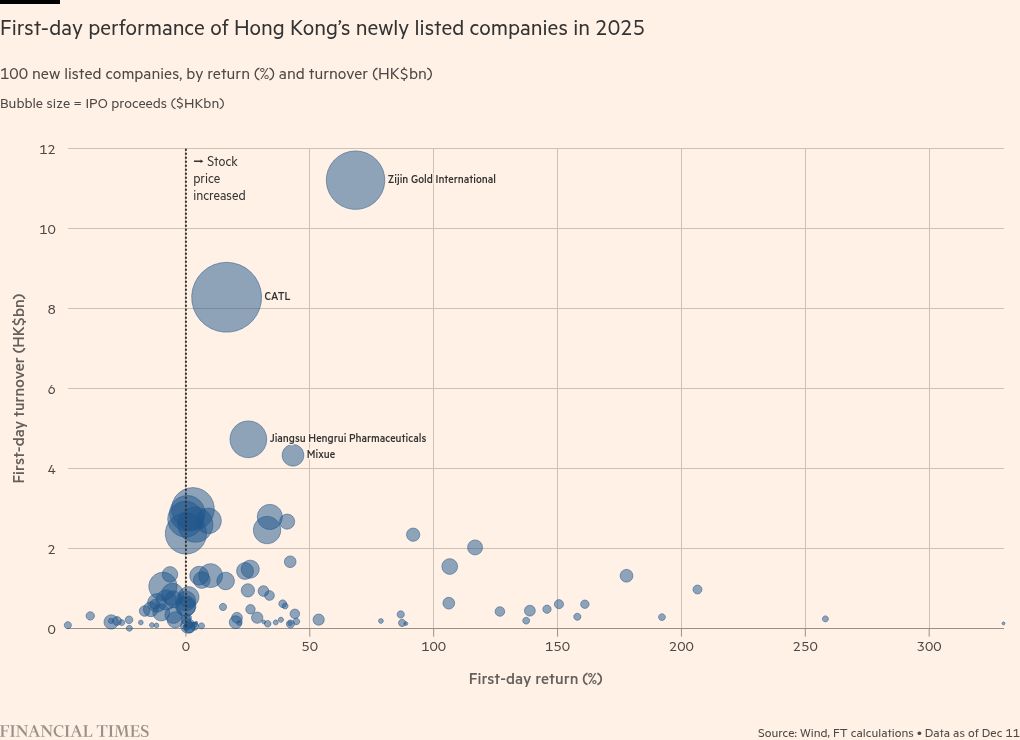

Roughly half of Hong Kong’s listings since the start of November have failed to rise on the first day, with signs that sponsors of IPOs have stepped in to buy shares, according to a Financial Times analysis of first-day performance.

The poor listings come at the end of a record year for the Asian financial hub, with $35bn raised in IPOs and secondary listings as of December making Hong Kong Exchanges and Clearing the top global listings venue.

Of 102 Hong Kong listings this year to mid-December, 31 had shares that closed flat or lower than their listing price. Of those, 11 were in the fourth quarter.

“The market has indigestion,” said one Hong Kong-based fund manager. “There are too many companies coming to market.”

The pipeline remains crowded going into 2026, with more than 300 companies planning to float, according to figures from the territory’s exchange. Many of the companies listing in Hong Kong are from mainland China and are using the venue to raise offshore funds for international expansion.

In a sign of the frenetic pace of IPO applications, Hong Kong financial regulators recently scolded investment bankers over the quality of the paperwork they were submitting on behalf of companies.

Banks appeared to have been purchasing stocks of newly listed companies in Hong Kong to stabilise falling share prices.

In November, Morgan Stanley stepped in to buy 15 per cent of the total Hong Kong float of CNGR, a Chinese supplier of lithium battery materials, to stabilise the share price following its IPO, according to disclosures with the territory’s exchange.

Morgan Stanley declined to comment on its role in stabilising the listing and CNGR also declined to comment.

In December, shares of Jingdong Industrials, a subsidiary of Chinese online retailer JD.com, fell as much as 10 per cent on its first day of trading before rapidly recovering to its listing price minutes before the close. The recovery is likely to be a result of a bank intervening to boost the price, said experts.

“A lead bank will intervene to support an IPO . . . if the share price is falling,” said Craig Coben, former global head of equity capital markets at Bank of America.

“More often than not, a stock trades below its issue price because issuers pushed the bankers hard on valuation and wouldn’t accept their recommendation to price at a lower level,” he added.

Jingdong Industrials and Bank of America — the company’s stabilisation agent, according to its IPO prospectus — declined to comment on the share price recovery on Jingdong’s first day of trading.

Hillhouse-backed Guangzhou Xiao Noodles, a Chinese fast-food chain, and Tianyu Semiconductor, a Chinese silicon wafer manufacturer, both fell as much as 30 per cent after listing in December.

“It’s not really cooling, it’s just a correction [from] overheating,” said Fang Liu, a partner at law firm Clifford Chance who advises on securities offerings.

Some listings suffered as a result of sector-specific issues. Shares of Chinese automaker Seres Group and robotaxi rivals Pony.ai and WeRide fell on their first day of trading in November, as concern mounts over fierce competition in the crowded Chinese automobile sector.

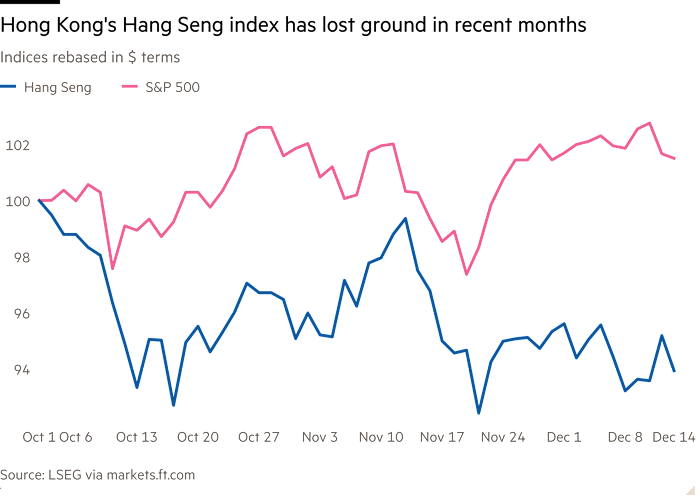

The Hang Seng index is down almost 6 per cent since October 2, mirroring a fall in mainland stocks caused in part by weak economic data. Its turnover, a measure of investor participation, has also fallen since the summer.

This led analysts at Citi last week to revise down their earnings estimates for the Hong Kong exchange due to reduced trading revenues.

“No one wants to take too much risk at the end of the year,” said Alicia García-Herrero, chief Asia-Pacific economist at Natixis.

She added that the recent hawkish comments from the US Federal Reserve were “bad news for Hong Kong . . . as that implies a stronger dollar and less liquidity, which is essential for a good IPO market”.