Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Autonomous driving might be a race, but the world’s biggest automotive markets are speeding in different directions. In the US, self-driving cars are viewed as a software platform opportunity. Meanwhile, in China they are mostly being seen as a hardware-intensive mobility service.

The recent listings of Pony.ai and WeRide in Hong Kong and the optimistic expectations and valuations attached to Waymo’s and Uber’s ambitions illustrate the divide. Undoubtedly, a large chunk of Tesla’s $1.4tn valuation is accounted for by investors’ faith in Elon Musk’s autonomous driving and robotaxi ambitions. The company continues to trade at more than 200 times forward earnings.

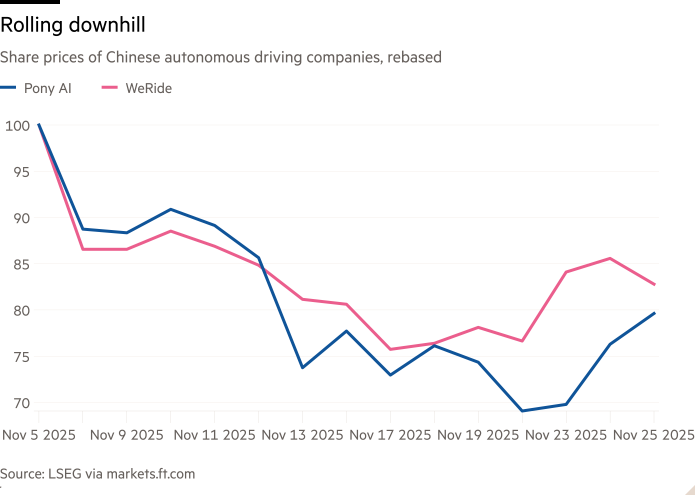

No such exuberance among investors of Pony.ai and WeRide. Shares in both have fallen since their November debuts, even as they pledged to use the funds towards scaling their fleets and advancing Level 4 autonomous driving — technology capable of operating without human monitoring or intervention.

That is surprising given the businesses are already showing signs of viability. They have deployed more than 2,000 autonomous vehicles across 10 cities in China and have recorded millions of paid user rides. Many cities now allow fully driverless service.

One explanation is that for Chinese investors, autonomous driving is still seen as a more costly hardware race than a software breakthrough. There is good reason for that level of caution. China’s bike-sharing boom and early delivery robot start-ups failed to generate recurring revenue, and left behind mountains of stranded rental bicycles and unpaid debts.

Indeed, hardware remains a significant cost driver. Lidars, radars and cameras can cost tens of thousands of dollars per vehicle. These sensors, along with high-performance compute clusters to train complex Level 4 models and remote operations centres for customer support, all contribute to high operating expenses. That has meant local operators remain lossmaking despite a growing number of users.

Supporters of the more bullish US view point to industries that looked structurally unprofitable for years before they made it big, from chips and cloud infrastructure to ecommerce. It’s not unusual for a long period of cash burn to flip into the black when companies reach scale. The market potential is significant. The total addressable market for the robotaxi sector in China alone is projected to reach about $47bn by 2035, according to Goldman Sachs.

Yet for all the promise, the near-term outlook for robotaxis remains bleak. Sharply cutting down hardware costs, improving vehicle utilisation to commercially viable levels and securing regulatory clearance across more cities, not just limited pilot zones, will be neither easy nor quick.

Without those, robotaxis will resemble a low-return fleet business rather than the high-margin software platform US markets are betting on. Until then, China’s cautious approach looks like the more rational one.