Hi, this is Kenji from Tokyo, your host for this edition of the #techAsia newsletter.

It has been a disastrous and tragic week for the region. Severe floods across south-east Asia have already claimed over 1,000 lives in Indonesia, Malaysia and Thailand. Meanwhile, Hong Kong has been mourning the deaths of at least 159 people in a blaze in the Wang Fuk Court residential complex. The death tolls in both incidents are, unfortunately, expected to rise.

Having lived in Hong Kong until April, I have been following the disaster closely. What has been happening is a stark reminder of how the city has changed after five-plus years since the imposition of a national security law by Beijing. President Xi Jinping’s message of condolences and his directive to minimise casualties was published by state-owned media Xinhua before Hong Kong chief executive John Lee spoke at his first press conference. And on that occasion, Lee thanked Xi before anyone else, not even the firefighters or others working on the ground, arousing local anger.

Hong Kong is supposed to operate under the “one country, two systems” governance formula until at least 2047, as promised by China and the UK under the legally binding Sino-British Joint Declaration of 1984. A “high degree of autonomy” is a crucial part of that agreement, in which the only exceptions are defence and diplomacy.

A major difference between Hong Kong and the mainland is that in the former, the internet remains relatively free, even though surveillance by the authorities has been elevated. For example, a university student was detained after seeking to collect signatures both off and online for a petition to demand that the government conduct a thorough and independent investigation of the cause of the fire.

Toru Kurata, a veteran Hong Kong watcher, told Nikkei Asia that “there could be a possibility” of some sort of internet control going forward, if the government deems the online debate has got out of hand. Kurata believes the chance of that actually happening is not high, as the authorities hope to maintain Hong Kong’s business-friendly reputation, and online freedom is a big part of that.

While the internet remains in official crosshairs, another question at the intersection of tech and politics is emerging: Who will control the future of AI? Nvidia CEO Jensen Huang warned the US on Wednesday that abandoning the Chinese market to domestic players will leave room for China to export its advanced technologies to other countries.

Just as Xi’s Belt and Road Initiative has helped Huawei export 5G technology to countries, he said, “now there’s an AI belt and road.”

Please contribute to our New Year’s survey: We want to know your thoughts on what’s ahead for Asia in 2026 for an upcoming “Big in Asia” feature. The survey will be open until Monday, December 8.

In the fast lane

As growth in China’s electric vehicle market shows signs of decelerating, demand in south-east Asia is picking up, especially in Vietnam. While the country’s total auto sales jumped 18 per cent during the first nine months of the year, EV sales rose by 84 per cent, according to data compiled by consultancy PwC.

Nikkei Asia’s Lien Hoang reports that the rapid electrification is led by the country’s homegrown, Nasdaq-listed VinFast. It is Asean’s top EV brand, selling 110,362 vehicles through September, outpacing Chinese rival BYD’s more than 70,000 in the region, though 94 per cent of VinFast’s sales came from its home market.

Turning to Malaysia, the country’s largest automaker Perodua rolled out its first homegrown EV model, the QV-E, on Monday. According to Nikkei Asia’s Norman Goh, Malaysia’s first “battery as a service” programme, which separates the ownership of the car and the battery, was also introduced. While Prime Minister Anwar Ibrahim praised the localisation of EV development as a national milestone, the lithium-iron phosphate battery is manufactured by China’s CATL.

Overseas training

Top Chinese companies are training their artificial intelligence models overseas to access Nvidia’s chips and bypass US efforts to prevent their development of the powerful technology, write the Financial Times’ Zijing Wu and Ryan McMorrow.

Alibaba and ByteDance are among the tech groups training their latest large language models in data centres across south-east Asia, according to two people with direct knowledge of the matter.

These people said there had been a steady increase in training in offshore locations after the US in April moved to restrict sales of the H20, Nvidia’s China-only semiconductors.

“It’s an obvious choice to come here,” said one Singapore-based data centre operator. “You need the best chips to train the most cutting-edge models and it’s all legally compliant.”

One exception is DeepSeek, maker of high-quality and low-cost AI models, which is being trained domestically, said people with knowledge of the matter.

Data centre clusters have boomed in Singapore and Malaysia, fuelled by Chinese demand. Many of these data centres are equipped with high-end Nvidia products, similar to those used by US Big Tech groups to train LLMs.

Crunch time

Japan is among the region’s most sought-after locations for setting up data centres, but serious bottlenecks in the construction industry are hindering efforts to build them. Nikkei Asia’s Tsubasa Suruga took a deep dive into the matter and found out that there are two major sources of strain: the country’s chronic labour shortage and slow uptake of digital construction methods.

Another factor that has emerged more recently is Chinese tech companies looking to secure computing power in Japan in response to US restrictions on cutting-edge chips, which limit their access to servers needed to build data centres at home.

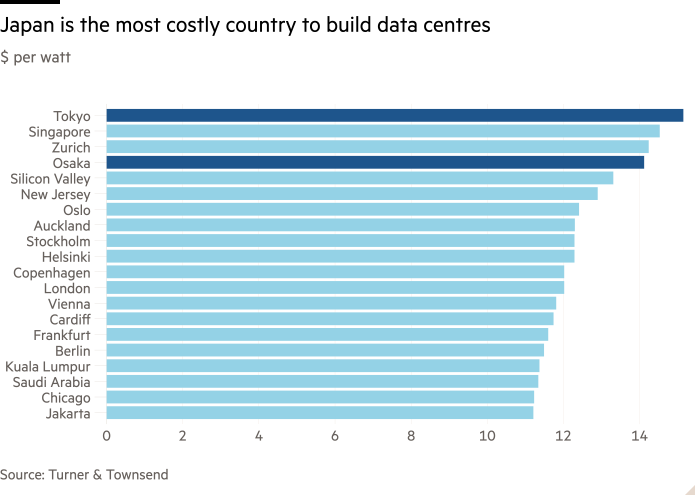

A combination of robust demand and restricted supply is a recipe for higher price tags. According to a Turner & Townsend report, Tokyo has been the most expensive place in the world to build data centres for two years in a row, with general construction costs projected to rise 38 per cent between 2020 and 2025.

But despite the rising costs and delays, global operators still see Japan as too important to ignore. “Nobody’s walking away from Japan,” said one overseas consultant. “It’s a gold mine.”

Strategy on the stock market

China National Uranium, a key state-owned miner of the mineral indispensable for nuclear technologies, made a splash in its debut on the Shenzhen stock market on Wednesday. The company raised Rmb4.43bn ($628mn) in its initial public offering, adding to its war chest for boosting domestic production capabilities and competitiveness in the race for global resources, writes Nikkei Asia’s Kenji Kawase.

Nuclear technology is among the non-traditional areas President Xi Jinping designated as a core priority under his “holistic approach to national security” in 2015 — a policy that linked many new sectors and technologies to national security.

China Uranium is a unit of China National Nuclear Corporation (CNNC), one of the most strategically important state-owned conglomerates. Its recent listing is part of Beijing’s broader efforts to strengthen its domestic players in strategic industries through the use of local capital markets. Chair Yuan Xu articulated this point in a speech during the listing ceremony where he described the IPO as a “starting point” to accelerate the company’s global push.

Suggested reads

US defence tech start-up Anduril eyes manufacturing in Japan (Nikkei Asia)

New tensions flare up between Nexperia’s Dutch and Chinese units (FT)

Taiwan prosecutors charge Tokyo Electron unit over alleged TSMC data breach (Nikkei Asia)

SoftBank all in on supporting OpenAI, not investing in rivals, CFO says (Nikkei Asia)

India’s move to force government app on to new smartphones stirs up furore (Nikkei Asia)

Nvidia and Fanuc team on ‘physical AI’ push for industrial robots (Nikkei Asia)

TSMC supplier Merck opens 500mn euro AI chip materials plant in Taiwan (Nikkei Asia)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp