China’s Communist party leaders are expected to prioritise increased investment in advanced manufacturing, as they meet this week to hammer out the next five-year plan in the shadow of tensions with the US over technology and trade.

The party’s elite Central Committee, which will begin mapping out the country’s 15th five-year plan at the four-day “fourth plenum” meeting on Monday, is also expected to highlight the importance of consumption in an economy threatened by persistent deflation.

“The meat of the 15th five-year plan probably will be to show determined support for technology, innovation and security,” said Hui Shan, chief China economist at Goldman Sachs.

Once vital to China’s former command economy, Beijing today uses the five-year plans to convey its political and economic priorities to society, making them keenly watched by foreign governments and investors.

During the 14th five-year plan that ends this year, China’s industrial policies and subsidies contributed to breakthroughs in green technologies, such as electric vehicles, that have threatened core industries in Europe and the US and sparked trade tensions.

Beijing is signalling it will follow the same blueprint in the next five-year plan, which will be formally released in March, with heavy state-led investment in cutting-edge technologies as President Xi Jinping pursues industrial and technological “self reliance” from the US-led advanced economies.

“The pursuit of greater self-reliance and strength in science and technology is indispensable for securing critical technological advantages,” the Communist party mouthpiece People’s Daily said in July.

The next five-year plan will “continue channelling resources towards strategic emerging industries such as AI, new energy, new materials, advanced manufacturing, and ‘future industries’ like brain-computer interfaces”, according to Yuhan Zhang, principal economist of the China Center at the Conference Board.

China saw investment as a means to continue upgrading its infrastructure and industries, to provide countercyclical support for economic growth and to strengthen its global position in emerging technologies, such as AI, he said.

“State-directed investments in new productive forces and infrastructure aim to expand ‘the means of production’, create jobs, attract private capital, and strengthen economic and technological autonomy while asserting China’s global influence,” Zhang said.

He said the expected focus on industry had been made clear by research this year commissioned by China’s chief planning body, the National Development and Reform Commission.

Of the 32 topics, 14 were focused exclusively on investment, eight on consumption, three on trade and the remainder on a mix of these areas.

Topics range from “the creation and cultivation of an innovative and entrepreneurial ecosystem for unicorn enterprises” to “policy measures for developing new R&D institutions and new research universities” during the five-year period.

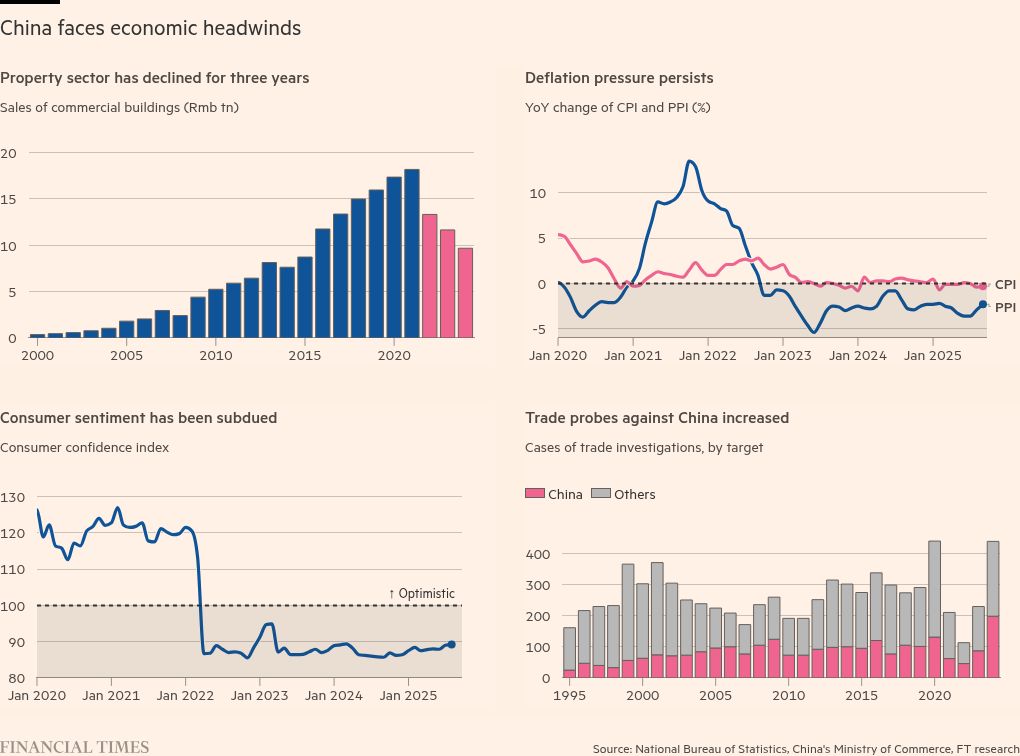

But, while China’s tech prowess and exports surged during the past five years, policymakers struggled with rising youth unemployment, deep deflation, a prolonged real estate slump and sagging household confidence.

That means that, while domestic demand would not be the main priority of the next five-year plan, the government is expected to announce more efforts to boost consumption. It has already begun announcing new subsidies for households, including for raising children and for consumer loans.

Some economists speculate that in the next plan, Beijing could try to incentivise government officials at all levels to increase household spending by setting numerical targets.

“The government may consider setting an explicit official target for the consumption share of GDP,” said Ning Zhang, senior China economist at UBS.

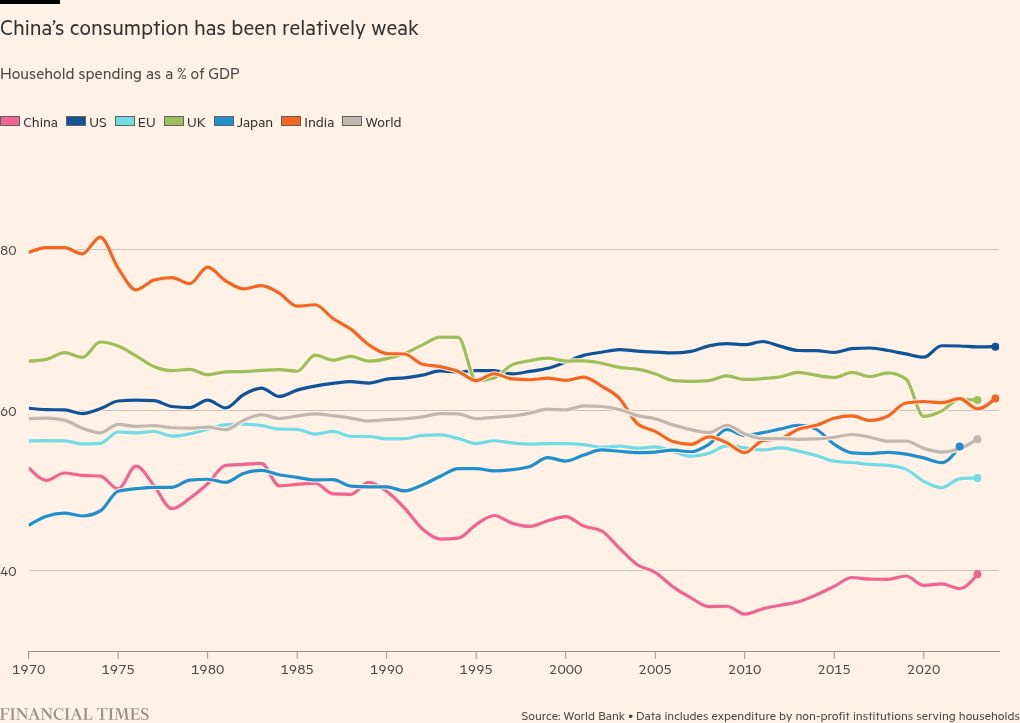

China’s household consumption to GDP is about 40 per cent compared with about 68 per cent in the US.

Fred Neumann, chief Asia economist at HSBC, said if the government were to set a target of increasing the ratio of consumption to GDP by, for instance, 5 percentage points, that would send a “very strong signal to local governments, to state-owned enterprises, to central government ministries and to the investment community that the government is really serious about rebalancing the economy”.

For headline economic growth, most economists believe the next five-year plan will not have a specific target but Xi’s previous call to double GDP between 2020 and 2035 would make implicit a growth rate of between 4.7-4.8 per cent a year. Many economists believe the actual growth rate will be lower given weak domestic demand.

“We estimate that China’s potential growth could average 4.3 per cent in the next five years,” said Standard Chartered economists Shuang Ding and Hunter Chan in a recent note.

Overall, the next five-year plan would show that Xi was more focused on security and self-reliance than before, said Neil Thomas, fellow on Chinese Politics at the Center for China Analysis at the Asia Society.

“Perceptions in Beijing of the external environment have darkened, with US politics intensifying global uncertainty and economic risk,” Thomas said in a report. Hence Xi’s emphasis on investment in new technologies, which not only gave China a technological edge but also aimed to lift productivity — the key to future economic growth.

“Boosting productivity is Xi’s best hope of advancing his project of national rejuvenation amid demographic decline, slowing growth, and potential technological isolation from the west,” Thomas wrote.

The fourth plenum could also give analysts rare insights into the political state of the party under Xi’s rule, Thomas said. His increasing purges of party officials, mostly on corruption charges, should mean that fewer cadres will show up for Monday’s meeting.

Late on Friday, China purged the number two general in the People’s Liberation Army and eight other senior commanders, in a big military shake-up.

Of the Central Committee’s original 205 members and 171 non-voting members, the future of dozens was under a cloud following confirmed and rumoured investigations for corruption, Thomas said.

“Xi has shown he is willing to remove those he once promoted if it strengthens cadre integrity and bureaucratic capability,” said Thomas.