Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

China’s textile exports into the EU have surged as manufacturers hit by heavy US tariffs redirect goods to Europe, the European textile industry body has said.

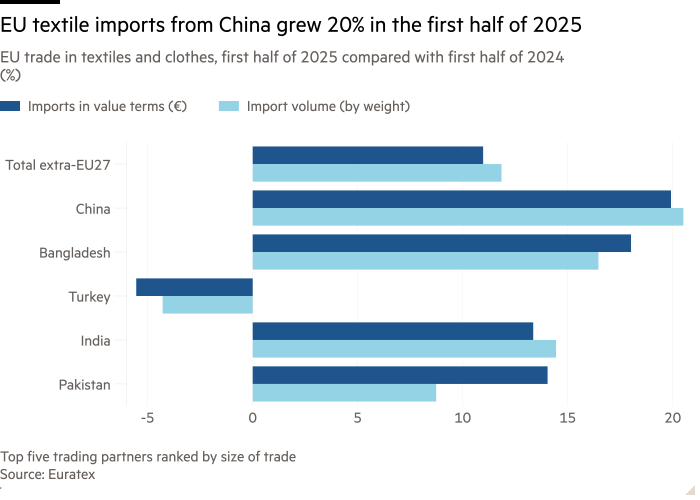

EU imports of Chinese clothing and textiles increased by 20 per cent in value and volume in the first half of 2025, compared with last year, according to Euratex data shared with the Financial Times. The majority of the value increase came from an approximately €2bn rise in cheap clothing imports.

“We are talking about this tariff war and we see that China is exporting less to the USA,’’ said Mario Jorge Machado, president of Euratex. ‘‘We see a significant amount of it exported to Europe but [it] also connects with a decrease in price in the articles we are importing.”

“The Chinese companies, because they cannot sell in the United States, are behaving in a very aggressive way to sell in Europe.”

The knock-on impact of US tariffs has been coupled with the EU’s slow progress to cut the number of packages flooding into the bloc from online sellers such as Temu and Shein. The European Commission has proposed scrapping its €150 de minimis threshold, below which parcels can be sent to the EU duty-free, and charging a flat €2 fee on packages with a value under €150 instead. Member states must agree on the change before it becomes law.

The US scrapped its own de minimis regime in August. Shippers face a minimum $80 fee on packages into the US.

“We are comparing for the same package €2 to $80,” Machado said, describing the EU’s effort as “ridiculous”.

“European politicians have not been defending European industry for many years . . . we are watching our industry being destroyed,” as China and the US acted in their own industrial interests, he added.

At the same time, the value of exports from the EU to China fell 19 per cent, driven by a fall in the prices of clothing in Europe due to competitive pressure and a weaker yuan against the euro.

Léa Marie, director-general of Le Slip Français, a French underwear company, said the company was in “direct competition” with imports from Asia and had invested extra in communicating to consumers “that purchasing our products helps accelerate job growth in the French textile industry” in order to persuade them to buy French.

Policymakers have been on high alert for signs of Chinese dumping of goods in the EU, which could push down inflation. Europe has also been hit by a surge in steel imports diverted from the US because of high tariffs.

The US administration’s tariff regime has caused huge ructions in long-established supply chains, particularly from China, as Chinese companies turn to Europe as an outlet for their production, as opposed to sending it to the US. Additional tariffs imposed on China since Donald Trump took office are 30 per cent at present, following extensive talks between the two sides.

That has left European companies facing even tougher competition against cheap imports from China at the same time that they are struggling with a heavy administrative burden and higher energy costs than in most other markets.

Textile companies, like much of the EU industry, are also struggling with higher tariff rates to sell to the US. Before the bloc’s trade deal with the US in July, which sets a standard 15 per cent tariff rate across most products, the majority of clothing and textile products had tariffs of less than 15 per cent.

Only 11 per cent of textile products had tariffs above 15 per cent, said Euratex.

The EU textile industry accounts for €170bn in annual turnover and 1.3mn jobs.

Marie said that contrary to many businesses that argue that EU regulation is stifling their growth, “we do not have any particular difficulties with EU regulations; on the contrary, these rules protect us”.

Data visualisation by Keith Fray