It was just your average week with another set of random trade war announcements from President Donald Trump. Among the strategically important kitchen cabinets and so on, the eye-catching one was his threat of 100 per cent tariffs on pharmaceuticals. The aim is clear — to encourage drugmakers to set up in the US rather than export there.

Older readers may recall that I have counted seven separate and often conflicting motives for Trump’s tariffs. On top of the familiar three Rs of revenue, restriction (protectionism) and reciprocity, I added four Cs: coercion, current account, clientelism and confusion. Now I’ll add another R — reshoring.

One mildly positive thing is that partners with bilateral trade agreements, notably Japan and the EU, will face the 15 per cent drugs tariff, not the higher one. So it turns out those deals aren’t totally pointless, which is something. Today’s newsletter is on China’s neat but largely symbolic diplomatic footwork at the World Trade Organization. Charted Waters, where I look at the data behind world trade, is on the euro rising against the dollar.

Get in touch. Email me at alan.beattie@ft.com

Feeling special

Some exciting news, at least if you’re a trade bureaucrat: China announced it was giving up “special and differential treatment” (SDT) at the WTO (the claim that gave it more leeway on tariffs and subsidies and so on). This has been a long-standing US demand, echoed (with slightly less obsessive enthusiasm) by the EU and others. Low- and middle-income countries also quietly support the move, being somewhat cheesed off with China muscling their exporters aside while claiming trade privileges it doesn’t need.

WTO director-general Ngozi Okonjo-Iweala said it was a “pivotal moment” for the institution. Hmmm. For one, we can safely say it’s not going to make much difference to actual trade in practice. China has already given up SDT for big recent and current negotiations (Covid-19 vaccine patents and fisheries subsidies). The one where it might matter is agriculture, but since there aren’t going to be any substantive WTO ag agreements in my lifetime that’s a bit of a moot point. Also, let’s face it: China became an export powerhouse in the 1990s before joining the WTO. A few preferences here and there really aren’t the point.

Does the symbolism matter? Specifically, if China is prepared to give this up, will other countries (India, even the US) also be flexible on their demands at the WTO? My answers are 1) yes, but only a bit, and 2) nope.

I say “only a bit” because the move mainly shows China is committed to the WTO as an institution. But we already knew that. China loves, and I mean loves, the WTO. The country is very active, turns up, makes lots of suggestions, briefs the press, and has built a nice Chinese garden in front of the Geneva headquarters. Beijing particularly appreciates that a lot of Chinese state capitalism is unconstrained by WTO rules. China gets to look multilateralist on the cheap and shame the US for not showing up, a diplomatic open goal with which Trump has presented it.

I recently did an FT podcast with Michael Froman, president of the Council on Foreign Relations and former US trade representative. He argues the WTO has ceased to function because the US and China ignore it. I say, although you can argue China ignores WTO rules, that’s not a basis to create a new system. Since Beijing is absolutely not prepared to abandon the institution, it doesn’t think there’s a WTO-shaped hole to fill.

On the question of spurring other countries to agree to WTO reform, I’m sceptical. The US is not suddenly going to re-engage because of China’s largely performative gesture, and wouldn’t have done so under former president Joe Biden either. India doesn’t kill WTO deals because it has genuine principled concerns about the way the institution is run, it kills them because doing so plays well at home. India sabotaged the aforementioned fisheries deal at the last minute of last year’s meeting of WTO ministers, despite having watered the agreement down considerably and China having given up SDT for those talks.

So the Chinese SDT move is a good bit of optics and a smart diplomatic gambit. At the margin it restores a little credibility to the WTO, and will please advanced and lower-income countries. But a game-changer? No. The struggle of finding the institution a role remains substantially unchanged.

Brussels caught in a thicket

The less cheering and surprising news from last week is that the EU deferred the deforestation regulation again. I say “less cheering” not because the EUDR was a brilliant idea doing well, but because the deferral is evidence of how the EU, which is supposed to be leading the world trading system in the US’s absence, is tying itself in knots with poor execution.

The principle of unilaterally imposing deforestation standards on the rest of the world, which particularly affected developing countries and former European colonies, was always a tricky one (especially since EU countries seem to underestimate the symbolism of their imperial past). Creating a wildly complicated compliance programme that implied literally millions of in-person farm inspections made sure injury was added to insult.

I wouldn’t be surprised if the EUDR never gets implemented. The EU is in retreat from greenery in general. And once it was clear the regulation would hurt European forestry and paper companies, it acquired domestic enemies. The EUDR is also yet another irritant in EU-US relations. Instead the bloc will negotiate deforestation issues agreement by agreement, as it has in the Mercosur and Indonesia deals.

If the EUDR does die, we’ll put its demise down to two habitual EU problems. First, a failure to assess bureaucratic burdens accurately. Second, the European Commission in particular believing so strongly in its rhetoric about being progressive that it fails to notice others disagree.

Charted waters

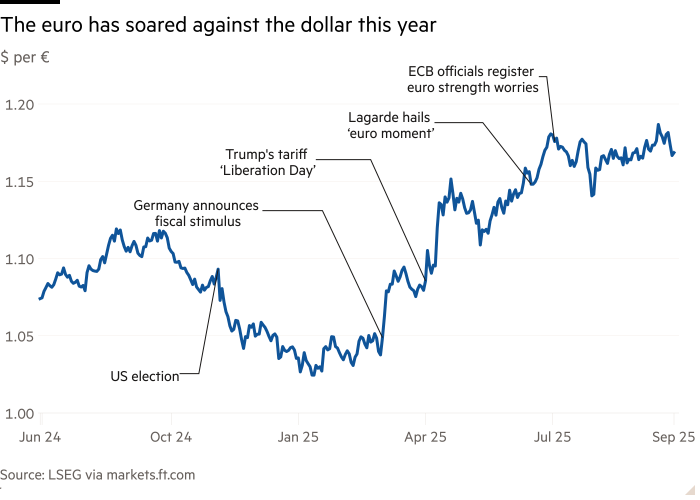

The US equity and bond markets have been surprisingly cheery about the future despite Trump’s tariff craziness. But one market price that continues to show marked weakness is the dollar. Naturally, the rise of the euro against the dollar is producing complaints from European businesses and policymakers who want the euro to be a global currency but moan when it appreciates like one.

Trade links

Sabine Weyand, head of the EU’s trade directorate, unleashed a home truth in a European parliament hearing last week, saying Brussels’ pact with Washington was unlikely to be compliant with WTO rules on preferential trade agreements. (The EU is generally insistent it will only sign WTO-consistent deals.)

The Trump administration is apparently considering tariffs on imported electronics according to the number of microchips they contain.

The continued grip of the German car industry over its government and the EU trade debate remains clear. Chancellor Friedrich Merz last week strengthened his opposition to the EU ban on conventional internal combustion engine cars after 2035 because of the impact on auto part suppliers, a move with implications for the transition to electric vehicles and trade with China.

Here’s a nice story from a couple of weeks ago I just spotted: uncertainty over Trump’s tariffs is playing havoc with the supply of merchandise for next year’s football World Cup in the US, Canada and Mexico.

The Toronto Globe and Mail looks at Canada’s attempts to diversify away from US trade.

Trade Secrets is edited by Harvey Nriapia