Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Zijin Gold shares soared by as much as 68 per cent in their Hong Kong trading debut on Tuesday, after the spin-off company of one of China’s largest miners raised $3.2bn in an initial public offering.

The listing comes as the price of the gold is trading at a record high of above $3,800 a troy ounce, driven higher by macroeconomic uncertainty and geopolitical risk, including a potential US government shutdown.

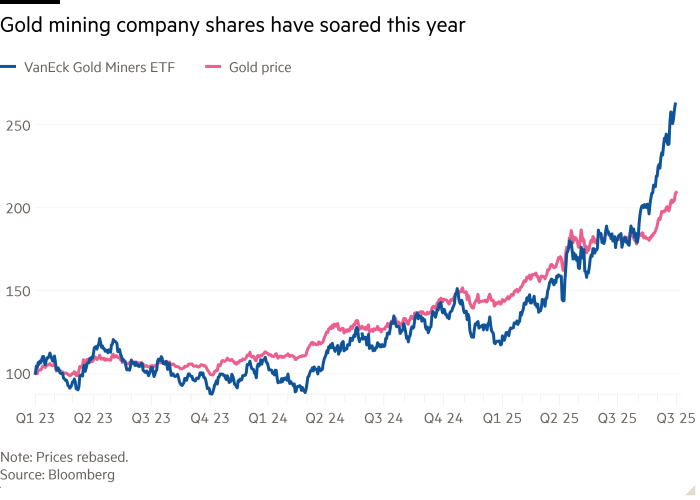

The rise of Zijin Gold’s shares gave the company a market value of HK$300bn ($40.1bn). The stocks of gold mining companies have rallied sharply this year as higher bullion prices boost their revenues.

The company is a spin-off of Zijin Mining’s overseas gold assets, which includes mines spanning central Asia, Europe, Africa, South America and Australia. Zijin Mining subsidiaries have an 87 per cent stake in the gold unit.

“Every element of uncertainty that is traditionally supportive for gold is happening at the same time,” said David Wilson, a director of commodities strategy at BNP Paribas.

Tavi Costa, macro strategist at Crescat Capital, said there had been “explosive” moves in the mining industry from depressed levels. “The big change here has been the fact that metal prices are substantially higher than the structure of cost for most of these miners.”

Zijin Mining’s management has a strong reputation, said Jack Shang, co-head of Asia mining and metals at Citi, noting their disciplined approach to capital expenditure and mine acquisition.

He added that by spinning off the company’s overseas gold assets the company would be able to better finance future acquisitions. “I do think the management is doing this deal in a smart way,” Shang said.

Lisa Liu, managing director of Gold Mountains Asset Management, a Zijin Mining subsidiary that is a controlling shareholder of Zijin Gold, said the debut “validates investor confidence in quality mining investments and reinforces our long-term bullish outlook on gold”.

The company said proceeds from the share sale would be used to settle the acquisition of a gold mine in Kazakhstan, develop a project in Ghana and invest in another prospect in Suriname.

The Zijin Gold IPO is the largest listing in the world since a $5bn share offering in May from Chinese battery maker CATL, which also took place in Hong Kong, and comes during a revival of the territory’s capital markets.

Singapore’s sovereign wealth fund GIC, BlackRock, Schroders and Oaktree are among more than two dozen cornerstone investors that have subscribed about $1.6bn to the IPO. Morgan Stanley and Citic Securities are joint sponsors of the offering.

Gold has more than doubled in value since the start of 2023, driven by increased central bank buying as well as from demand from investors.