This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Today’s agenda: US-China trade truce; New York shooting; Revolut’s US plans; FT investigation on Haitian gangs; and turmoil at Novo Nordisk

Good morning. We start in Wall Street, where analysts are calling the next few days the year’s “most pivotal” for US markets. Here’s why.

What’s happening: A flurry of key economic and corporate data will come out over the next three days, starting with second-quarter US GDP today. This will be followed hours later by a Federal Reserve decision, with the central bank expected to keep rates on hold despite pressure from President Donald Trump. Earnings season is also reaching its peak, with tech heavyweights Meta and Microsoft reporting today and Apple and Amazon tomorrow. The working week ends with US labour data, expected to show slower jobs growth, and the president’s tariff deadline.

Why it matters: Any one of these events would be market-moving in their own right, analysts note. Some investors have grown uneasy about the scale of gains in US equities, and others will be looking to see if there is a widening schism between Fed chair Jay Powell and his rate-setting committee over the pace of rate cuts. In terms of tariffs, benign economic readings have helped investors “move past the subject”, while recent trade deals have prompted economists to reduce the odds of a potential recession. But risks remain, with uncertainty over whether Trump will go ahead on Friday with levies on countries that are yet to strike deals.

Here’s more on the tone-setting rush of news and data for the rest of the week, and we have more related analysis below:

Stockpicking funds: So-called equity long-short hedge funds have made a comeback during this year’s market turbulence, attracting $10bn from investors.

US companies: Groups are taking advantage of blistering conditions in the debt market to re-price loans and slash borrowing costs.

Meta’s AI spree: Will Mark Zuckerberg’s multibillion-dollar hiring and infrastructure plan win over Wall Street?

And here’s what else we’re keeping tabs on today.

Pacific earthquake: The US and Japan have issued tsunami warnings after an 8.8 magnitude quake struck Russia’s Far Eastern region.

Economic data: The EU and Germany both report second-quarter GDP.

Results: Apart from the two tech giants, others reporting today include Aberdeen, Adidas, Airbus, Hermès, HSBC, Mercedes-Benz, Porsche, Prada, Santander and UBS. See the full list in our Week Ahead newsletter.

Five more top stories

1. An extension to a truce in the US-China trade war will hinge on Trump’s approval, his Treasury secretary has said, calling the talks “very constructive”. After two days of negotiations in Stockholm, Scott Bessent will head back to Washington to brief the president on the proposal today.

More on US-China: Amid tensions with Washington, Beijing is increasing its use of “exit bans”, deepening concerns about business travel to the country.

2. Companies are tightening security after the fatal shooting in New York on Monday. Before taking his own life, the shooter killed four people including Blackstone executive Wesley LePatner, prompting corporate leaders to rethink how to keep their employees safe after the second such killing in the city in less than a year.

3. Exclusive: Revolut is weighing buying a US lender in a bid to get an American banking licence rapidly, as the UK’s biggest fintech continues its wait to clinch a similar accreditation in its home country. People familiar with the matter said it would potentially target a cheap bank that already holds a national licence.

4. Exclusive: Evercore has agreed to buy elite UK advisory firm Robey Warshaw for $196mn, as the US investment bank steps up its challenge to the likes of Goldman Sachs, Morgan Stanley and JPMorgan Chase in Europe with the addition of some of London’s best-known dealmakers. Read the full story.

5. Ghislaine Maxwell has requested clemency in exchange for congressional testimony about Jeffrey Epstein. Lawyers for the late paedophile financier’s co-conspirator and former girlfriend were responding to a congressional subpoena, posing a dilemma for Trump as he seeks to quash controversy around the case.

News in-depth

Until a year ago, Novo Nordisk was riding high. The Danish drugmaker had been first to market with an injectable diabetes treatment and the name Ozempic quickly became shorthand for a new class of blockbuster weight loss drugs. But shares and growth fell, its chief executive departed in May and yesterday a major profit warning knocked more than €60bn off its value. What happened?

We’re also reading . . .

Trump on Gaza: Harrowing images of starvation and unease among parts of his Maga base may be testing the limits of his support for Benjamin Netanyahu.

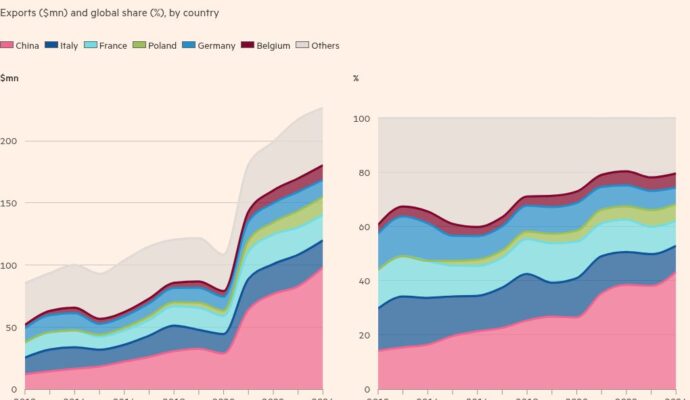

Haiti gangs: Our latest visual investigation shows how guns smuggled from Florida are empowering militias in the Caribbean country.

‘Technology’: It’s time to retire a word that spans too much and clarifies too little, writes engineer and author Guru Madhavan.

Japanese debt: The return of inflation has brought public finances back under control, writes Asia editor Robin Harding.

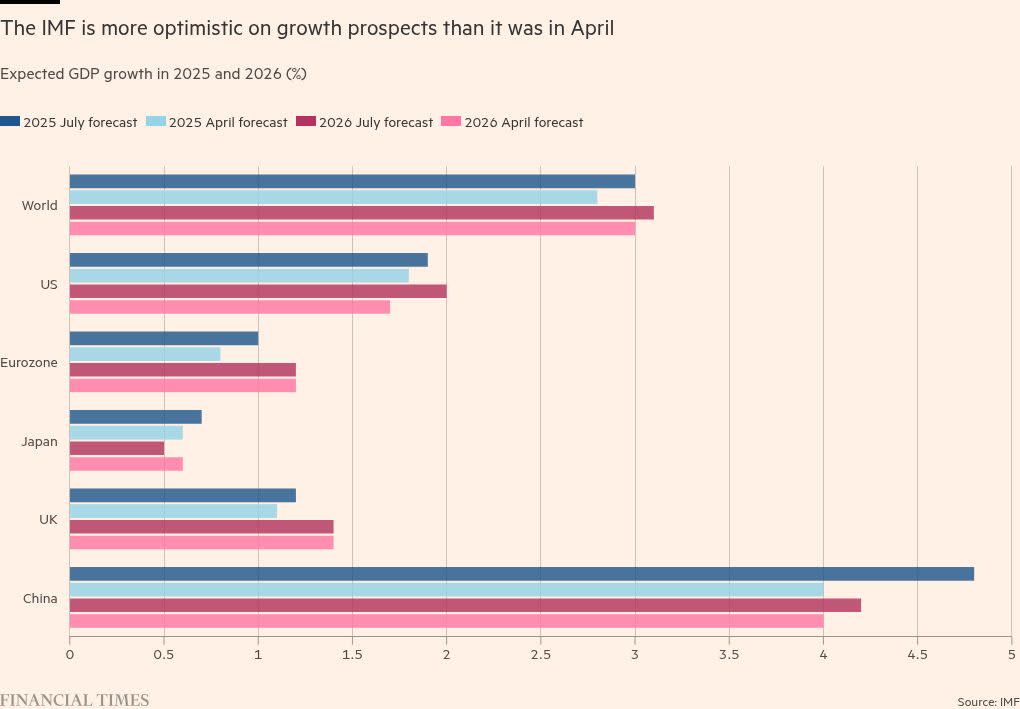

Chart of the day

The IMF has upgraded its global growth forecast amid signs that Trump’s trade war will do less damage to the world economy than initially feared.

Take a break from the news . . .

The art world’s age of empires might be over, writes Tim Schneider. As prominent baby-boomer gallerists exit earlier than expected, many of their potential successors are working to completely redefine success in the field.