Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Chinese businesses are sending increasing volumes of goods to the US via south-east Asia in a bid to evade the tariff wall erected by Donald Trump as part of his trade war, data suggests.

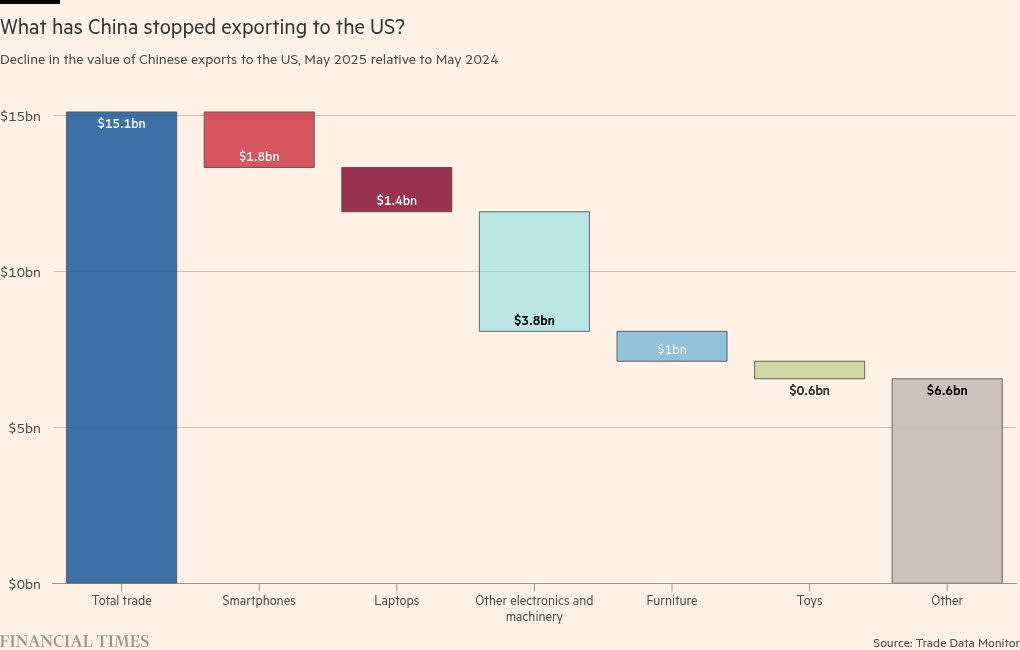

The value of Chinese exports to the US dropped by 43 per cent year on year in May, according to figures published by the US census bureau — equivalent to $15bn-worth of goods.

But the country’s overall exports rose by 4.8 per cent in the same period, official Chinese data showed, as the shortfall in trade with the US was offset by a 15 per cent increase in shipping to the Association of Southeast Asian Nations trade bloc and a 12 per cent rise to the EU.

This week Washington struck a trade deal with Vietnam that includes a 40 per cent levy on goods that are trans-shipped through the country, in a move that was widely thought to be targeting Chinese re-exports to the US.

Scores of other countries have not yet reached trade deals with Washington. The pause on Trump’s “reciprocal” tariffs ends on Wednesday, and any future deals could also include additional trans-shipment levies. US Treasury secretary Scott Bessent said on Sunday that the higher tariffs would take effect in August.

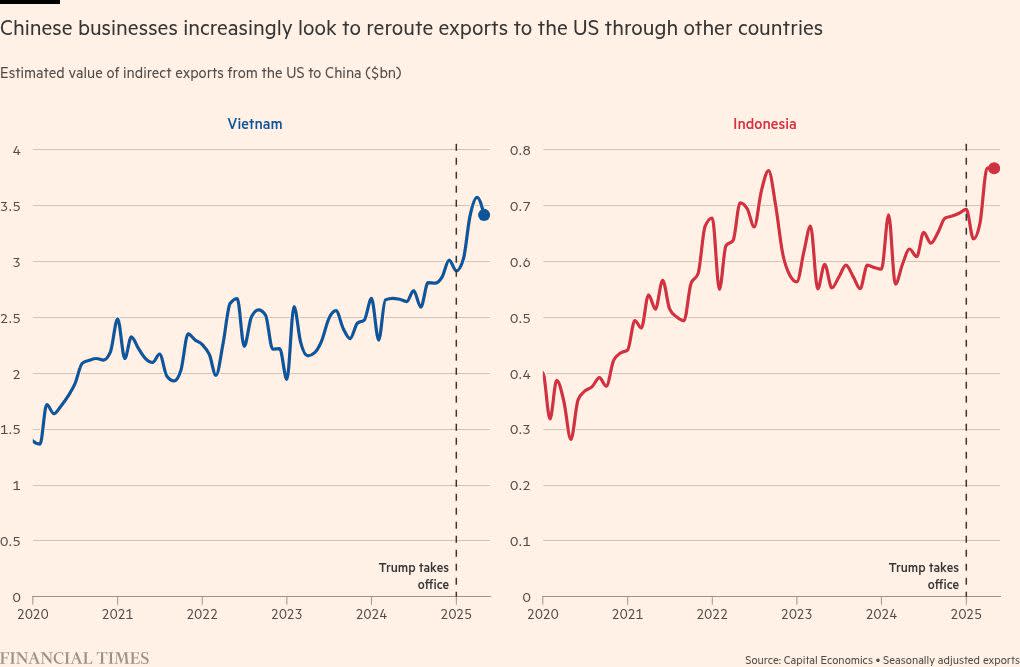

Mark Williams, chief Asia economist at consultancy Capital Economics, said the data showed “a really striking pattern”.

“We saw this during the first US-China trade war. There was a fairly immediate shift. US imports from China dropped off, but they picked up from Vietnam and Mexico,” he said.

Trump’s imposition of tariffs on China during his first presidential term in 2018 significantly boosted Vietnam’s manufacturing industry and there is mounting evidence that the latest measures are giving it a fresh lift.

Separate research by Capital Economics estimated that $3.4bn of Chinese exports were rerouted through Vietnam in May, a rise of 30 per cent compared with the same month last year.

Indirect trade through Indonesia also increased markedly, with an estimated $0.8bn rerouted in May 2025, 25 per cent higher than May 2024.

Exports of electronic components such as printed circuits, parts of telephone sets and flat panel display modules to Vietnam were up by 54 per cent, or $2.6bn, in May 2025 compared with a year earlier, Chinese data shows.

In India, the effects of the Trump tariffs have been heavily concentrated in smartphones, driven in large part by Apple’s decision to shift the assembly of all US-sold iPhones to India as soon as next year.

Indian exports to the US jumped 17 per cent in May compared with a year earlier, while imports from China and Hong Kong rose 22.4 per cent according to Ajay Srivastava, founder of the Global Trade Research Initiative, a research group.

“India’s import surge in electronics and machinery — much of it from China — and rising exports to the US suggest that global supply chains are adapting [to the tariffs] quickly,” Srivastava said.

Trump’s tariffs are also forcing manufacturers to seek other markets to sell output that is no longer reaching America.

In the United Arab Emirates, imports from China rose by $1.1bn in May 2025 from a year earlier, a 20 per cent increase, with smartphones, laptop computers and disposable vapes among the largest items.

Monica Malik, chief economist at Abu Dhabi Commercial Bank, said: “China is targeting other markets for its goods and demand in this region, which has a growing population, a strong investment programme, and little indigenous manufacturing, remains high.”

Anecdotally, Malik added, the visibility of Chinese-branded products including electric vehicles, smartphones and other consumer electronics had grown rapidly in the last couple of years. “You suddenly see a lot of Chinese EVs on the roads here,” she said.

In Europe, analysts say excess Chinese exports are more likely to be consumed than trans-shipped.

The European Commission on Friday reported sharp increases in imports of textiles, chemicals and machinery in the first five months of 2025 compared with the year before. But officials cautioned it was hard to draw conclusions yet.

The most visible early sign of trade redirection has been a sharp increase in low-value products arriving from China after Trump barred China from using the so-called “de minimis” rule which allowed retailers like Temu and Shein to ship goods valued at less than $800 into the US tariff-free.

Since then there has been a sharp drop off in air freight from China and Hong Kong to the US. Chargeable weight flown in the first week of June was down 19 per cent from a year earlier, according to data from WorldACD.

EU officials say they have detected increased advertising by the companies as they target European consumers instead. The bloc has plans to abolish its own “de minimis” rule and levy a handling charge on each packet of €2.

Maria Demertzis of the Conference Board think-tank in Brussels said that the major trade redirection from China visible in Europe was in low-value packages from China.

“You can see it in the number of adverts now bombarding everyone for Chinese e-sellers,” she said. “Those items are being consumed in Europe, not re-exported.”