Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

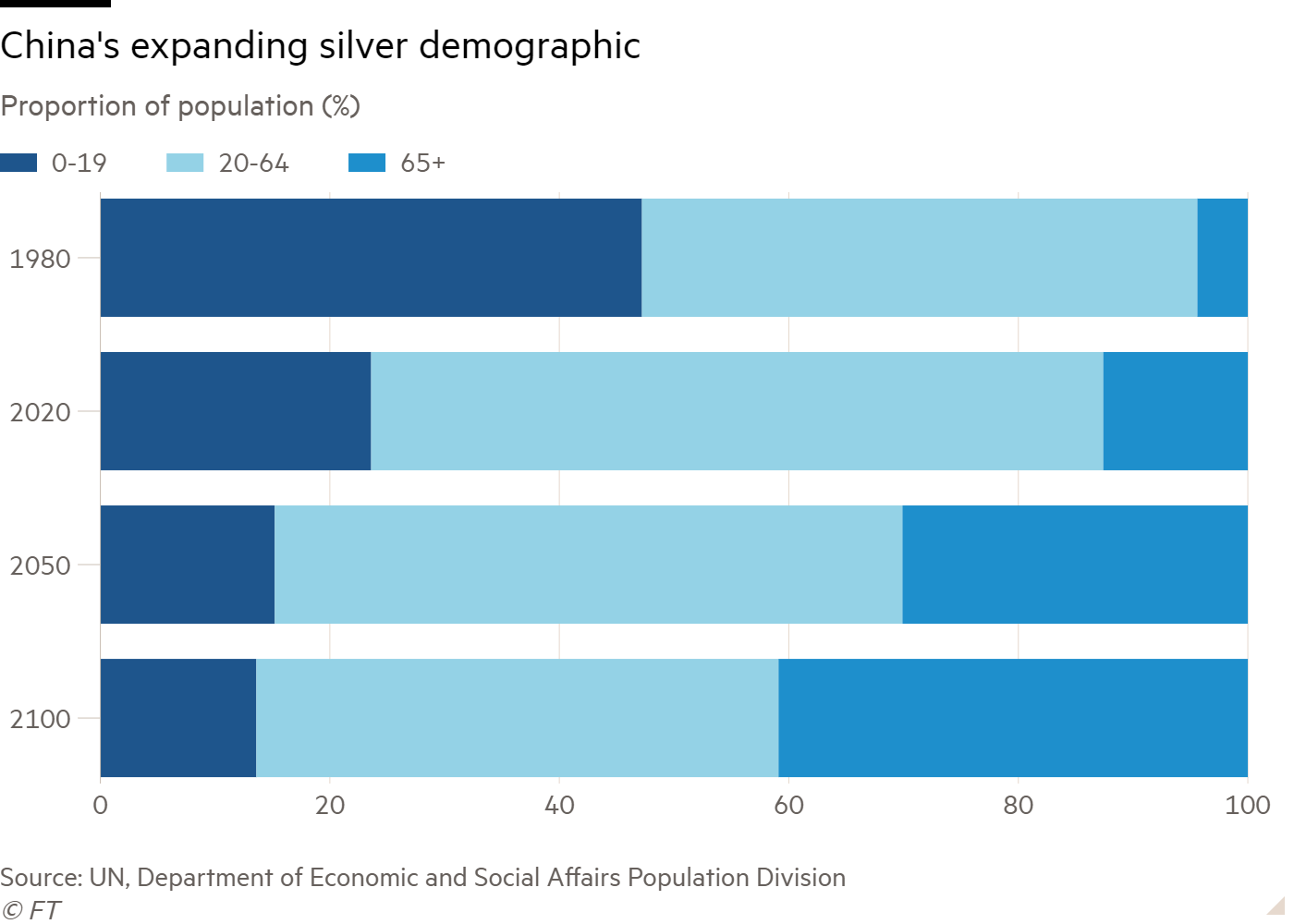

China’s demographic collapse is accelerating. Births fell to a record low in China in 2023, speeding up its population decline. The potential economic drag prompted Chinese stocks to fall after the figures were announced on Wednesday, along with weak property data.

This shift has serious implications for the country’s economic status. It stymies a 2020 forecast that China would soon surpass the US as the world’s largest economy. But it is not all bad news. Some sectors stand to benefit from Beijing’s new policies to cope with changing demographic trends.

The country’s population fell more than 2mn to 1.41bn last year, according to government data. The drop, which was more than double that of the previous year, results from both the lowest number of babies being born since the founding of the People’s Republic of China in 1949 and the highest death rate since 1974.

A big worry is falling labour supply and, as a result, higher wages. China already faces worker shortages in its manufacturing sector as younger workers shun factory jobs. Average wages in China have more than doubled in the decade to 2022, outpacing those in south-east Asian countries such as Thailand and Vietnam.

Yet the sheer size of China’s elderly population — a fifth of the country’s population was 60 or older as of 2022 — should mean new growth sectors that should start to attract more funding.

Beijing this week seized the initiative with a plan to develop a “silver economy” that caters to senior citizens with tailored products and services, a market estimated to be worth trillions of dollars. Health-related consumption, ranging from medical devices to pharmaceuticals, would account for the biggest share of spending among the older age group.

That push would provide a welcome boost for the biggest local biotech and pharma groups, including Jiangsu Hengrui, WuXi Biologics, Shanghai Fosun Pharma and Sinopharm. These were hurt by an industry slowdown as the Covid-19 effect wore off. Shares of WuXi are down 60 per cent in the past year, while Fosun fell almost 40 per cent. Part of the problem was that in August the sector became a target for an unprecedented anti-corruption campaign by Beijing.

Another overlooked sector has been robotics. As the need for automation in the manufacturing sector grows, top local robotics groups, including Siasun Robot & Automation and China Shanghai Step Electric, would be leading beneficiaries. Shares of the latter, on an enterprise-value-to-sales basis, at present stand at just 2 times, a discount to global peers.

The impact of China’s shrinking population will reverberate around the global economy. But it should also create the next wave of investment opportunities as government spending shifts to match changing demographic and consumption trends.

The Lex team produces timely commentary on capital trends and big businesses. We’d like to hear more from readers. Please tell us what you think in the comments section below or email lexfeedback@ft.com