Hi everyone, this is Cissy from Hong Kong.

When I was preparing for the earnings results of PDD Holdings on Tuesday, I noticed that its market cap was already 80 per cent that of rival online retailer Alibaba. As I had a strong feeling that PDD’s earnings would beat expectations, I texted a friend at the company and joked, “Do you think PDD’s market cap will surpass Alibaba soon?” He laughed and said, “If it does, I think it says more about them than us.”

PDD’s triumph came more quickly than expected. Its market cap surpassed Alibaba at one point during Wednesday morning trading in New York, making it — briefly — the most valuable Chinese company listed in the US.

But what my friend said is partially correct. Of course, PDD has secrets to its success, but its rapid rise does say a lot about Alibaba, the once unchallengeable Chinese ecommerce conglomerate.

Alibaba’s ecommerce head Trudy Dai has repeatedly said this year the platform will prioritise users, but a close look at their Taobao app shows little evidence that they are making much effort on that front. And while many observers say PDD’s success and Alibaba’s slow growth are due mostly to a consumption downgrade amid China’s economic downturn, that is not the full picture. It goes beyond low prices to the different business models behind PDD and Taobao.

Personally, I’m not surprised by PDD’s rally. Many users outside of China might not have heard of Temu, the company’s cross-border ecommerce service that ships cheap Chinese goods around the world, despite an aggressive marketing blitz, particularly in the US.

But in China, it is a different story with PDD’s bargain shopping app Pinduoduo. A friend living in the US told me that she was shocked when she visited her grandmother in China earlier this year. “My grandma is 85 years old, she doesn’t even know how to send a red packet on WeChat,” she told me, referring to an in-app feature for sending money. “But she knows how to get a lower price on Pinduoduo via WeChat.”

Retail rivals

China’s ecommerce industry has reached a historic point: for a brief moment, PDD Holding’s market cap in the US surpassed that of compatriot Alibaba after the Temu parent’s July-September revenue nearly doubled, writes Nikkei Asia’s Cissy Zhou.

The results were well above Wall Street’s consensus because analysts had underestimated Temu, according to some research notes. However, like before, PDD’s latest financial report did not disclose revenue, marketing expenses or any other data related to Temu, and management sidestepped questions about Temu at its earnings calls.

Temu, now available in more than 40 countries, competes on ultra-low prices, like its Chinese counterpart Pinduoduo. With the slogan “Team Up, Price Down”, the platform also uses a similar tactic of offering group discounts to gain users.

But as PDD’s overseas market expands, it is also facing increasing scrutiny abroad, particularly in the US. A congressional report in June accused Temu in particular of neglecting to prevent goods made by forced labour from being sold in the US.

Alibaba, meanwhile, appears to be feeling the heat from its rival. Founder Jack Ma, in an internal message to employees on Wednesday, acknowledged concerns about PDD’s rapid rise and exhorted workers to “make sacrifices” for Alibaba’s continued success.

To China, with love

Bart Baker, a US influencer who has more than 20mn followers in China, records a video in which he smashes his Apple iPhone after buying a smartphone made by Chinese rival Huawei. “This thing is broken,” he says, picking up the iPhone he has just stamped on. “I love Huawei.”

Baker is one of a cohort of more than 120 “foreign online influencers” living in China, writes the Financial Times’ James Kynge. Over the last four years, even as China has expelled several western journalists, such influencers have flourished and won effusive outpourings of official praise.

Scores of the video blogs, or vlogs, produced by these foreign stars reveal a consistent formula. They hold up almost everything Chinese — food, culture, society, infrastructure, government policies — for lavish praise. By contrast, they reserve their sharpest criticism for the western media, western society and even some western products.

President Xi Jinping has exhorted the country’s propaganda machine to “tell China’s story well”, but critics see foreign influencers as tools of that machine that are capable of damaging the image of western governments and brands.

An iron grip on clean tech

China is poised to strengthen its position as a leading force in renewable energy markets across developing Asian nations. This comes as coal-fired power initiatives are put on hold and Beijing shifts its focus away from funding emissions-heavy investment abroad, writes Nikkei Asia’s Sayumi Take.

In the past decade, Chinese companies have made significant progress in the energy sector by installing 128 gigawatts of power overseas, surpassing Australia’s current capacity and representing an estimated investment value of $200bn, according to Wood Mackenzie.

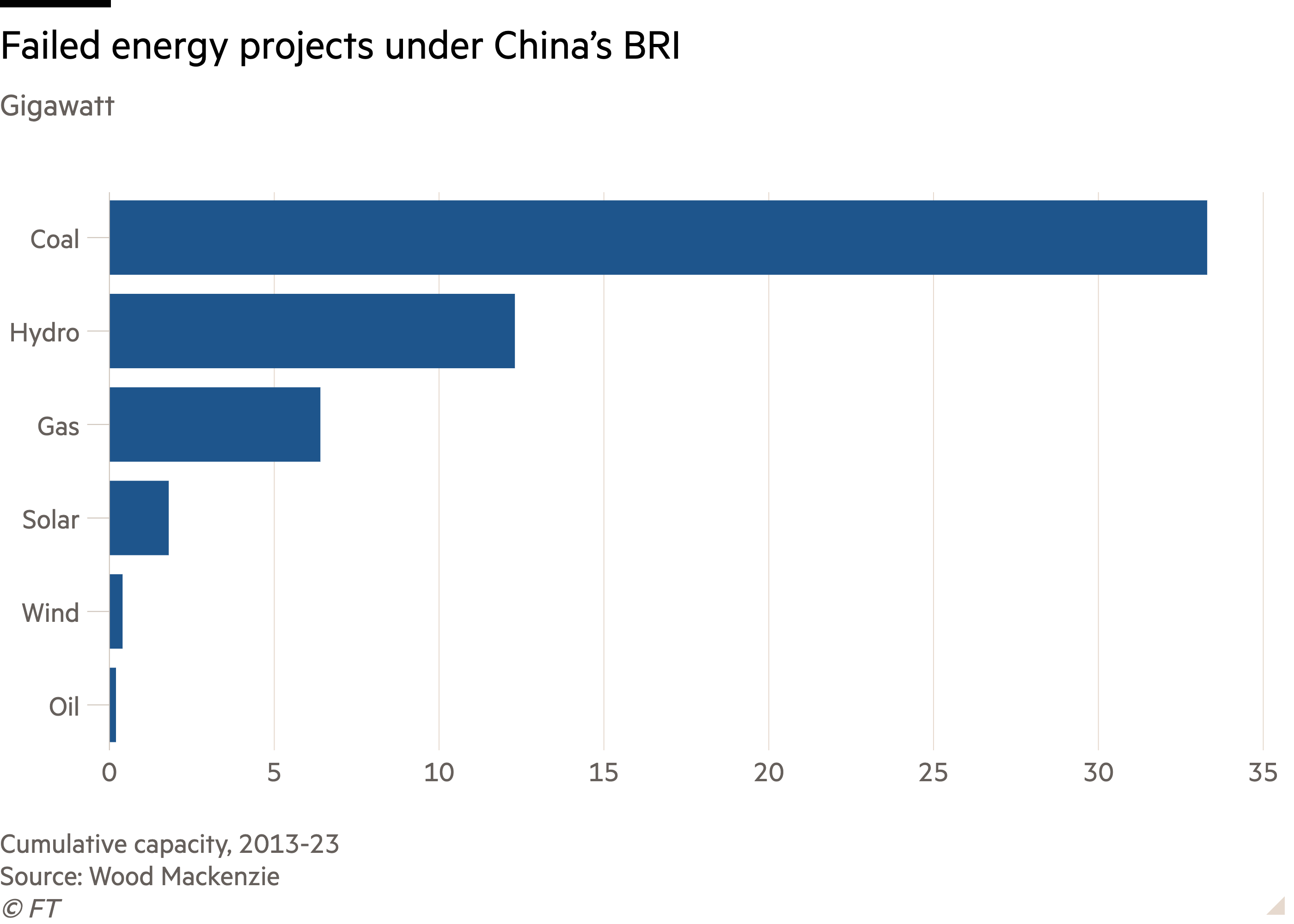

But among 481 China-linked energy projects monitored by the energy consultancy, 72 of them, or 15 per cent, have not been completed. In south-east Asia particularly, many of these coal projects that were originally planned to be built by Chinese companies were shelved or cancelled in the last three years.

In 2021, China announced plans to stop funding new coal projects overseas amid political and financial challenges, as coal is widely recognised as a source of environmental and public health concerns. At the same time, China is likely to become increasingly influential in renewable power markets overseas, with exports of green-power technology and equipment booming, which are often packaged with accompanying construction and financing support.

Games over

Once an aggressive investor in the gaming industry with ambitions of challenging compatriot Tencent, ByteDance has made a strategic shift by shelving most of its gaming projects, writes Nikkei Asia’s Cissy Zhou.

The company will discontinue games that have yet to launch, except for a few innovative projects, while continuing to operate titles already available as it seeks to divest them. The move will include laying off around 1,000 people in the company’s gaming unit, once a key segment for the TikTok parent, according to people familiar with the situation.

While scaling back investment in gaming, ByteDance has followed other big Chinese tech companies in increasing exploration of generative AI.

Compared with rivals, ByteDance has been slow in releasing its own large language models, the technology that underpins generative AI technology like OpenAI’s ChatGPT. But the company’s AI division, called Flow, has intensified development of applications to embed in ByteDance products.

Suggested reads

Huawei and Sharp ink cross-licensing deal for cell phone patents (Nikkei Asia)

Chinese fast-fashion retailer Shein makes confidential filing for US IPO (FT)

Philippines moves to block embattled crypto giant Binance (Nikkei Asia)

Israel tells Elon Musk Starlink can only operate in Gaza with its approval (FT)

Taiwan’s Foxconn seen boosting India iPhone output with $1.5bn plant (Nikkei Asia)

Japan to require tech leak prevention for chip subsidies (Nikkei Asia)

Internet use does not appear to harm mental health, study finds (FT)

New material promises to greatly extend solid-state battery life (Nikkei Asia)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp.