Stay informed with free updates

Simply sign up to the Chinese economy myFT Digest — delivered directly to your inbox.

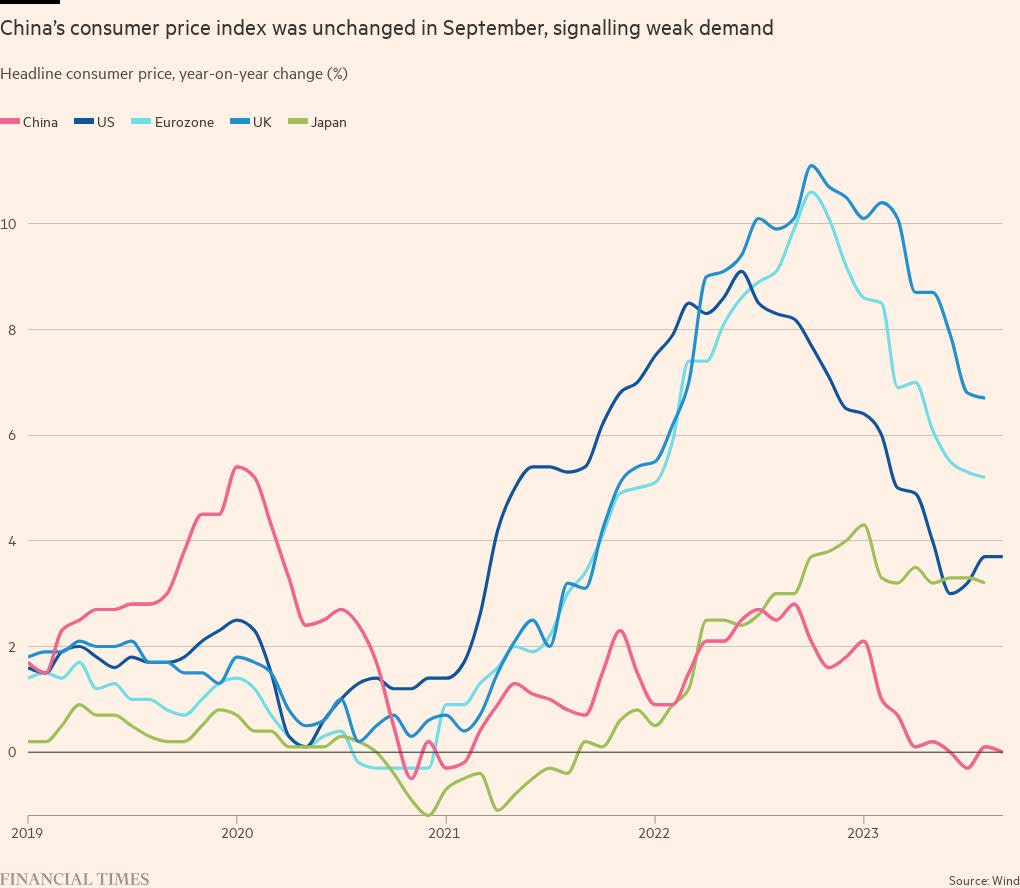

China’s consumer prices teetered on the edge of deflation last month as Beijing struggled to rekindle confidence among consumers and investors and stabilise the country’s crisis-hit property market.

The consumer price index was unchanged year on year in September, after edging into positive growth in August. The producer price index, which measures the price of goods sold by manufacturers, declined 2.5 per cent year on year in September, official figures showed on Friday.

Both inflation metrics were marginally weaker than forecasts from analysts polled by Reuters. In August, the CPI rose 0.1 per cent, up from negative territory the month before, while the PPI contracted 3 per cent.

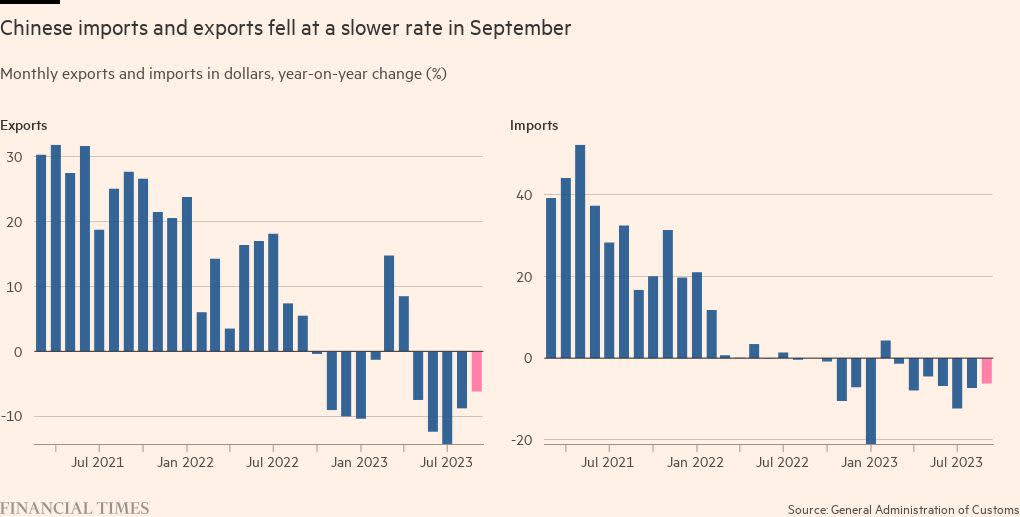

Trade data also released on Friday provided better news for Chinese policymakers, with exports declining less than expected last month despite challenging global economic conditions and weak demand for manufactured goods.

“CPI inflation at zero indicates the deflationary pressure in China is still a real risk to the economy,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management.

The CSI 300 index of Shanghai- and Shenzhen-listed stocks was down as much as 1.2 per cent after the data release.

Beijing has released a steady stream of piecemeal support for the world’s second-largest economy, which is still recovering from strict coronavirus lockdowns last year but has been hamstrung by lagging foreign trade and a property sector liquidity crisis.

Economists blame low consumer and investor confidence for the malaise and argue that Beijing should step up stimulus measures.

“The recovery of domestic demand is not strong without a significant boost from fiscal support,” said Zhang. “The damage from the property sector slowdown on consumer confidence continues to weigh on household demand.”

But Chinese policymakers argue that the economy is resilient and on track to meet the official gross domestic product target this year of 5 per cent, the lowest in decades. The country is set to release third-quarter GDP growth figures next week, after a disappointing reading for the April to June quarter.

“In September, the consumer market continued to recover,” said Dong Lijuan, chief statistician of the Urban Department of China’s National Bureau of Statistics. “However, affected by the higher comparison base in the same period last year, the year-on-year increase turned flat.”

China’s exports fell 6.2 per cent in September compared with the previous year, an improvement from the previous month’s decline of 8.8 per cent and beating analyst expectations of a contraction of 7.6 per cent.

Imports also shed 6.2 per cent, better than the previous month’s 7.3 per cent contraction but marginally worse than expectations. The country’s trade balance for the month was $77.71bn, up from $68.36bn in August.

Heron Lim, greater China economist at Moody’s Analytics, said the dip in consumer price growth was mainly due to falls in food and energy. The core inflation index, which strips out food and energy, was up 0.8 per cent year on year.

The PPI, which measures manufacturing activity, has fallen every month for the past year, but the pace of decline in September was slowed slightly from August, indicating that the economy was not oriented towards another bout of deflation, “but demand is definitely way softer than what policymakers would like to see”, Lim said.

He added that Chinese consumers were becoming more budget-conscious in their purchases because of worries over the gloomy economic outlook and the persistent weakness in the property sector, dragging down demand.

Additional reporting by Hudson Lockett in Hong Kong