China’s H World, one of the world’s biggest hotel groups, took in a record 8.3mn guests during last year’s Lunar New Year holiday — more than the entire population of Hong Kong.

As this year’s festivities get under way and hundreds of millions of Chinese take to the road, the company expects to surpass that total.

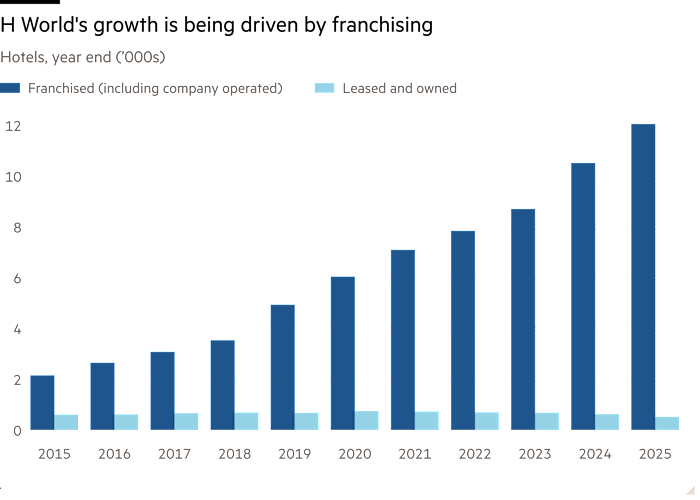

It added an estimated 1,700 hotels over 2025 on a net basis and is aiming for 20,000 by 2030 through US-style franchising, a fourfold increase on pre-pandemic levels.

“With this kind of speed, for 2030 to achieve 20,000 hotels is not an issue,” said Jihong He, chief strategy officer. “[As] a long-term goal, to achieve 30,000, 50,000, is not an issue,” she added.

“We believe that we can achieve Marriott’s kind of position” in China, she said. Marriott has about 10,000 hotels worldwide, but its annual revenues of $26bn, with around $3bn from franchise fees, dwarf those of H World.

H World’s plans show how some domestic companies are not being deterred from rapid expansion plans, despite cautious consumer spending and broader concerns over economic momentum as China’s growth slows.

The Nasdaq-listed company plans to expand by consolidating China’s vast and fragmented hospitality market, bringing existing hotels under its wing. It had 12,700 hotels, spanning several budget and mid-priced brands, as of the end of September — most of them franchises in mainland China that it is involved in running. At the end of 2019, it had 5,600.

H World was launched in 2005 by Ji Qi, co-founder of online travel booking site Ctrip, after he took inspiration from the multi-brand French group Accor.

At a recent 20th anniversary event in Shanghai, thousands of franchisees gathered in a vast conference hall where Ji took to the stage and spoke for more than an hour. “To believe in China is to believe in tomorrow, to invest in China is to invest in tomorrow,” one slide said.

The company’s optimism hinges on its affordable position within a market where consumers are eager to save money.

Its Hanting Inn brand, a fixture of the streets of major Chinese cities, often charges well below Rmb300 ($43) a night, while mid-range Ji Hotels typically cost slightly more. H World has several other brands, while internationally it also operates German brand Steigenberger.

Its franchise model mirrors an approach that other Chinese businesses have used to expand in consumer sectors from bubble tea to fast food.

For the “vast majority” of its franchised hotels, H World retains a degree of control, sending in hotel managers on its own payroll under what it calls a “manachise” approach.

In the US, “typically the franchisees decide almost everything . . . we think in China this would not work,” said He. “A lot of people would not abide by your rules”.

In the third quarter, H World’s revenue from all franchised hotels increased 27 per cent year-on-year to Rmb3.3bn, from total quarterly revenues of Rmb7bn. Its net income rose 15 per cent to Rmb1.5bn.

The company anticipates a shift to more chain hotels in China. It estimates that in the market for bigger hotels — those with 40 rooms or more — chains have about 30 to 40 per cent of the market, compared with an estimated 70 to 80 per cent in the US. H World also says its chains can charge a premium over non-branded hotels.

One of H World’s franchisees is Qiao Weijun, who started working in the security department of a local hotel in the early 1990s after a brief spell in the army. Based a few hours away from Shanghai in the city of Yangzhou, Qiao is part of a consortium that first invested in an H World hotel in 2015 and now has a stake in nine across China.

At his Blossoms hotel in Yangzhou, a city famed for its lakes and association with China’s ancient Grand Canal, rooms were available at Rmb559. The hotel opened in 2022, after being converted from a previous hotel which Qiao says required an investment of about Rmb30mn.

He, the group’s strategy officer, said that after the Covid-19 pandemic, such conversions are “increasing year by year, because there are not so many new hotels built any more”.

She also suggested China’s real estate slowdown, now entering its fifth year, had encouraged other hotel owners to join the franchise model.

“Before the real estate crisis, 2017, 2018, there are a lot of new investors coming into the hotel industry, because the hotel industry was booming,” He said.

“After Covid, people are much, much more cautious . . . that’s why we are getting more and more support from the ex-owners of different brands and other hotels to join.”