Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Sir Keir Starmer will fly out of China this week a step closer to a possible bilateral services agreement, raising the hopes of British businesses that the prime minister said were “crying out for ways to grow their footprints” in the country.

Starmer and Chinese leader Xi Jinping agreed on Thursday to launch a “feasibility study” on possible negotiations for a bilateral services pact, alongside a host of other agreements including visa-free travel.

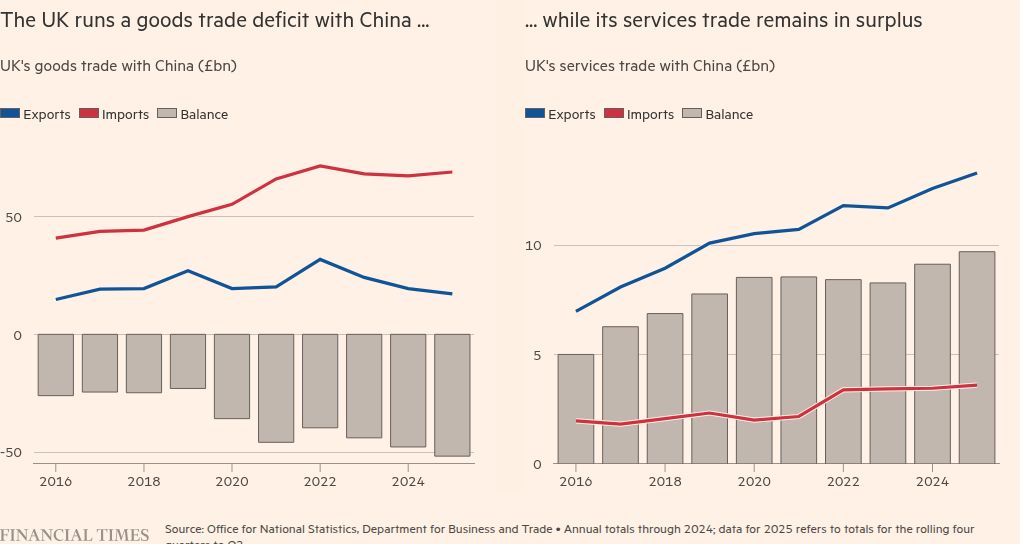

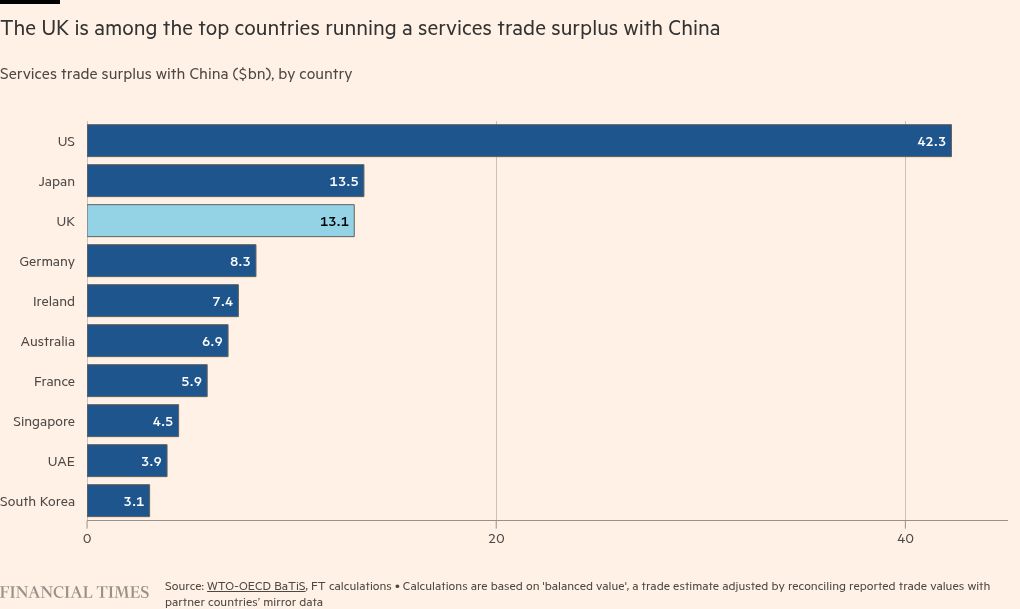

In contrast to its £52bn trade deficit in goods with China in the year to the end of last June, the UK had a £10bn surplus in services, and it hopes the City’s financial and professional services firms can play a greater role in China in coming years.

Starmer, who was met on the tarmac in Beijing this week by China’s finance minister Lan Fo’an, was accompanied by a delegation that reflected those ambitions, including the likes of Aberdeen, Bridgepoint Group, Barclays and Freshfields, as well as representatives from manufacturing, science and creative industries.

Business leaders from Brendan Nelson, HSBC group chair, to Melissa Geiger, chair of KPMG UK and Switzerland, welcomed the government’s push and signs of “opening up”.

But the foreign services sector in China has for years fallen short of its hopes for growth, and business chambers often complain about a lack of market access and other barriers to growth.

“Professional services — especially legal and financial — have historically been heavily regulated in China,” said Chris Torrens, chair of the British Chamber of Commerce in China.

The UK offered a hedged assessment of the progress this week — which one official described as “a starting point” and “talks about talks” — reflecting the long-standing challenges for foreign companies in China after a series of earlier initiatives lost momentum.

But business and trade secretary Peter Kyle said there were huge growth opportunities for services, which were currently “underweighted”. More than half of the UK’s services exports to China come from travel, a component which also includes education, and it exports more goods overall.

China’s financial sector, which is dominated by state-owned institutions, has recently seen a wave of top-down consolidation. Other areas of previous UK focus, such as China’s nascent corporate bond market, have seen foreign participation shrink.

Han Shen Lin, China managing director for the Asia Group, said it was “too difficult” for UK banks to compete domestically for reasons that were “non-political”, including the “cost prohibitive” nature of setting up branches, though he noted that HSBC and Standard Chartered were “much more established” in China due to their association with Hong Kong.

“The latest services partnership will help British companies in areas where the UK is strong — professional services as well as education and healthcare,” Torrens said. “It makes sense for the UK to focus on expanding our sectors of expertise in China not least because that will go some way to rebalancing our trading relationship.”

The mood across the foreign professional services sector has darkened in the mainland since the pandemic, after crackdowns on consultancies and fines for PwC over its audits of failed property developer Evergrande.

US President Donald Trump late on Thursday warned Starmer against pursuing closer business ties with China, which he called “very dangerous”.

Despite the geopolitical tensions, Beijing has recently stepped up its rhetoric on the need to boost domestic consumption as it grapples with flagging economic momentum.

“I think if we look at how China looks at Starmer’s visit, I don’t think they’re looking for British factories to be set up in China, I think they want more British capabilities . . . finance, asset management, life sciences, education, green standards,” said Lin at the Asia Group.

UK law firms operating in China — which reported a more optimistic view this year of the ease of doing business for the first time since the pandemic, according to the British Chamber — could also be placed to take advantage following an exodus of US law firms.

But figures in the legal industry said the uptick represented more a return to the “situation pre-Covid” than an improvement in the business environment, and noted that Chinese authorities only recently resumed issuing approvals for legal joint ventures with foreign firms.

Others pointed to opportunities for UK services as Chinese businesses increasingly look to expand overseas, especially in regions such as south-east Asia.

Lin said it was “very much in China’s interest” to have UK banks helping Chinese businesses “on the outbound side”, and that it was the same situation for the asset management sector. But “in terms of the overall upside”, he added, “I think China benefits more”.

Data visualisation by Haohsiang Ko in Hong Kong