Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Tit-for-tat tariff battles are generally a net negative for the global economy. But even bad ideas can produce pockets of good. Some UK retailers provide a clue as to how this trend can play out.

Last week, sofa specialist DFS Furniture said its full-year profit was going to be higher than analysts had been forecasting. Analysts at Panmure Liberum think its gross margin — what it makes in revenue minus the cost of what it sells — will rise by 1 percentage point in the full year.

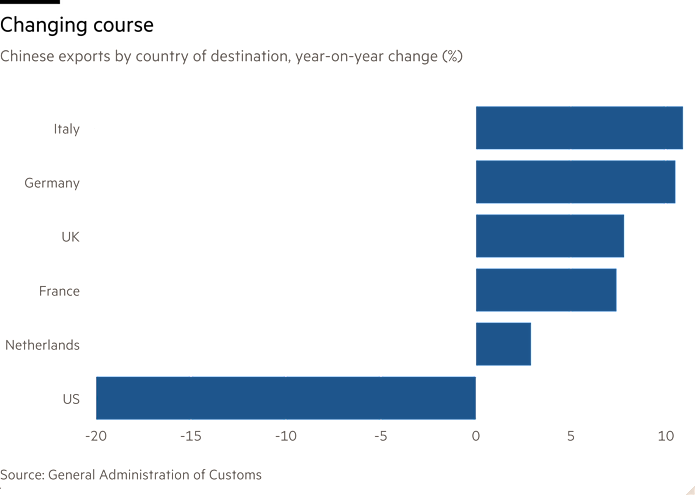

There are lots of reasons why gross margins can go up, including steeper prices and customers choosing more profitable goods and services. But DFS may also be benefiting from US-China trade tensions and the rerouting of goods into Europe. While Chinese shipments to the US fell by a fifth in 2025, exports to Europe rose by 8.4 per cent, according to China’s General Administration of Customs.

That surge hurts industries that already faced cut-throat Chinese competition. Jim Ratcliffe, chairman of chemicals maker Ineos, has partly attributed an increase in low-priced Chinese imports into Europe to the fact that “President Trump’s actions have pushed them out of the US”.

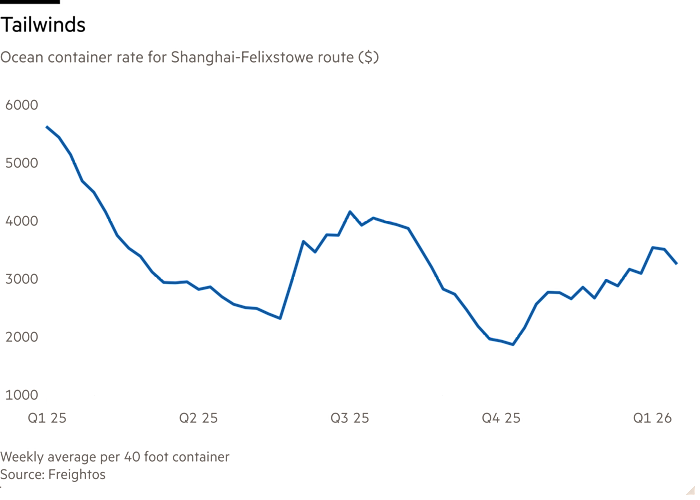

But the glut may improve matters for European companies that source goods from China. Analysts at Berenberg say a third of what DFS sells, measured by cost, comes from China, adding that the company has received better terms from Chinese suppliers. It also helps that freight rates from Shanghai to Felixstowe have fallen by two-fifths in the past year, according to Freightos data.

DIY retailer Kingfisher may be another beneficiary of this trend. Up to a quarter of its goods, by cost, come from east Asia, of which the majority is China. Analysts estimate that Kingfisher’s gross margin will improve by 0.6 percentage points in the fiscal year ending January 2026, according to S&P Capital IQ. At furniture retailer Dunelm, which imports about a third of its products from east Asia, gross margin is expected to rise by 0.4 percentage points in 2026.

How much of the benefit of lower sourcing costs retailers can keep partly depends on what they sell. For small, commoditised things — think screwdrivers — any cost advantage may well be competed away by Amazon or Temu. Big-ticket purchases such as sofas, which are harder to deliver and often require a “sit test” in stores, may be relatively shielded.

To the extent that savings are passed on to consumers, that will help contain inflation, bolstering the case for interest rate cuts. Professor Alan Taylor, external member of the Bank of England’s Monetary Policy Committee, recently suggested that the inflation-lowering effects of trade diversion might be larger than baseline forecasts, allowing the UK to meet its targets by the middle of this year.

None of this tips the balance in favour of trade wars. But amid the chaos, sofa sellers are an example of how unintended winners can come out sitting pretty.