Stay informed with free updates

Simply sign up to the Chinese business & finance myFT Digest — delivered directly to your inbox.

Beijing has stepped up efforts to curb price wars between China’s largest technology groups, launching a wave of regulatory probes as policymakers take action against deflationary pressures in the economy.

The market regulator said this week it was investigating Ctrip, China’s leading travel booking platform, after launching probes into food delivery businesses run by tech groups Meituan and Alibaba last week.

Beijing’s enforcement activity underscores the government’s urgency to rein in aggressive price cutting as companies slash prices to compete for market share. The campaign against “involution” — the term used by Chinese media to describe hyper competition — is in response to persistent deflation, with producer prices declining every month for more than three years as supply outstrips domestic demand.

“The moves are closely tied to the government’s broader push against so-called ‘involution-style’ competition — particularly subsidy-driven price wars that generate headline growth but can damage the underlying economics of the sector,” said Angela Zhang, a professor at USC Gould School of Law in Los Angeles and an expert in Chinese technology regulation.

Beijing’s attempts to subdue the price wars span multiple industries, from electric vehicles to solar panels, and are taking place at a time of slowing economic growth. Intensifying competition at home has pushed more Chinese companies to seek growth overseas, helping drive the country’s trade surplus to $1.2tn in 2025.

The latest action came on Wednesday when the State Administration for Market Regulation (SAMR) announced an investigation into CTrip, China’s leading travel booking platform.

Zhang said the move “fits a related pattern of heightened scrutiny of platform conduct, including allegations that platforms squeeze suppliers, such as hotels and Chinese Airbnb-style operators, while also engaging in discriminatory and potentially fraudulent pricing practices that exploit consumers.”

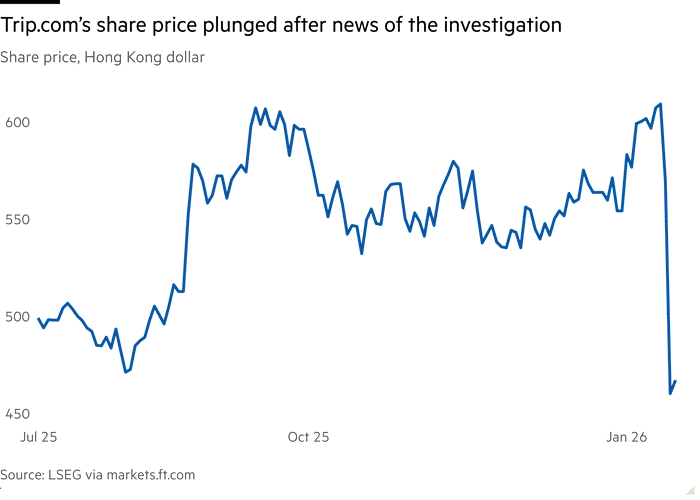

The Hong Kong-listed shares of CTrip’s parent company Trip.com have fallen over 20 per cent in the past week after news of the investigation. “The company will actively co-operate with the investigation. Its business operations remain normal,” said CTrip in a statement on Wednesday.

Several Chinese scholars with close knowledge of SAMR said the recent cases showed the watchdog felt sufficiently confident to resume more frequent investigations after several years of light enforcement. That period followed a bruising crackdown on internet platforms that peaked in 2021, when authorities moved to curb the monopolistic power of companies such as Alibaba.

However, they cautioned that SAMR remained short-staffed and lacked the resources to pursue complex investigations at scale. As a result, the agency has relied more heavily on less resource-intensive measures, such as summoning executives for warnings, while leaning on the State Council, China’s cabinet, to publicly support its efforts to discourage price wars.

Regulators have focused their firepower on the food delivery sector. Last year, Alibaba and JD.com made aggressive moves into the sector, challenging incumbent Meituan. The resulting subsidy war eroded the profitability of the platforms funding discounts on burgers and bubble tea and put pressure on restaurants to cut prices for consumers.

Despite public calls from regulators to halt the competition in July and summoning executives in for a meeting, the price war persisted throughout the summer as platforms kept battling for market share.

“In practice, it is difficult for regulators to stop this price war without taking serious action in the form of fines,” said a senior executive at one major food delivery platform. The executive added that the government was wary of imposing harsh penalties on companies that employ millions of delivery workers and restaurants at a time of weak job growth.

Chelsey Tam, tech analyst at Morningstar, noted that it appears that heavy subsidies by the food delivery platforms “have reduced from the peak”.

Even though subsidies in food delivery appear to be reducing, the delayed action taken by the companies underscores the tense relationship between SAMR and the tech industry.

Last month, tensions between SAMR officials and PDD Group escalated during an on-site inspection of the company’s Shanghai headquarters. A fight broke out between the PDD employees and the officials, who were gathering information about the company’s pricing practises and treatment of suppliers, according to local media reports at the time and since confirmed by two people with knowledge of the incident. PDD and SAMR declined to comment.

One person familiar with the regulator’s thinking said the incident could presage more serious action against PDD.

“The regulators were furious with PDD, thinking the behaviour was that of an arrogant tech giant,” they said, “there are likely to be more actions against it in the future.”

Additional contributions from Cheng Leng in Beijing