Stay informed with free updates

Simply sign up to the Chinese business & finance myFT Digest — delivered directly to your inbox.

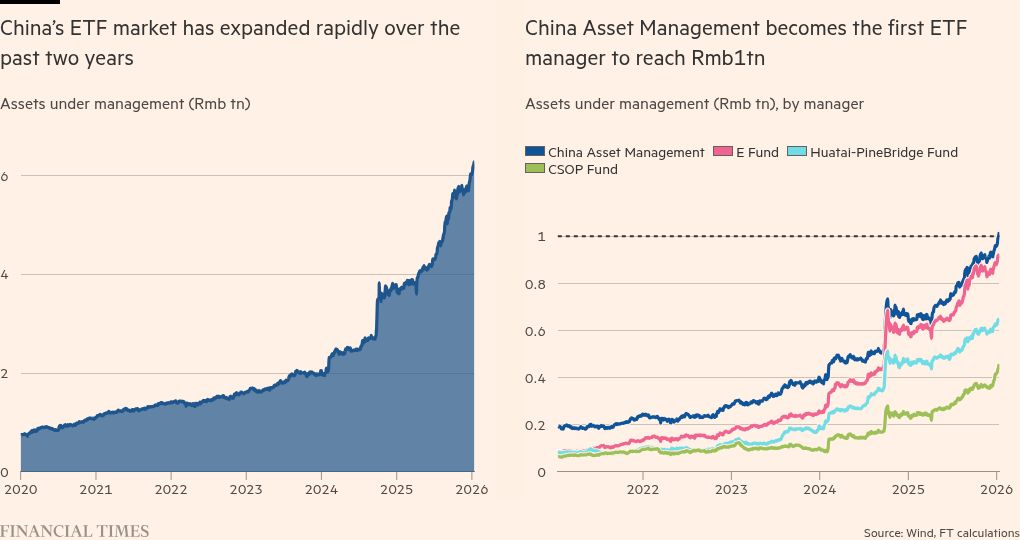

One of China’s largest asset managers has become the first company in the country to pass Rmb1tn ($143bn) in exchange traded funds under management, a beneficiary of Beijing’s push to get the “national team” to support stocks.

The value of China Asset Management’s ETFs reached Rmb1.02tn earlier this week, according to data company Wind. E Fund, another leading Chinese asset manager, is also approaching that amount.

While China’s ETF market is still small compared with the US, where there were $13.5tn in assets under management in 2025, it has exploded in size, growing by Rmb2.3tn last year to be above Rmb6tn at the end of 2025.

The products have evolved into “a key vehicle and essential infrastructure” for investors to access the onshore stock market, said a Beijing-based industry expert in a leading mutual fund house.

“This is a trend that aligns closely with the direction encouraged by regulators and national policy,” said the expert.

Beijing has been promoting ETFs as a way to boost the market since a protracted sell-off between 2021 and 2024 caused the blue-chip CSI 300 index to lose 45.6 per cent of its value. The government increasingly relies on ETFs to stabilise its stock markets, directing its so-called national team of prominent state-backed investors to invest during times of turbulence.

China Investment Corporation, the country’s sovereign wealth fund, held Rmb1.6tn of ETFs as of the middle of 2025, more than a quarter of the assets under management for Chinese ETFs, according to Bloomberg data.

“In China definitely there’s been an institutionalisation of the market,” said Brendan Ahern, chief investment officer at KraneShares, an ETF provider with products investing in China.

“[ETFs] might start off very retail [oriented] but it becomes a tool utilised by pensions, foundations, insurance companies over time . . . that’s part of what drives the growth of the ETF industry.”

Beijing has been working to reform markets to protect investors and encourage longer-term investments.

Management fees for most China ETFs have been reduced to 0.15 per cent of AUM, down from the 0.5 per cent two years ago. Some domestic managers are finding it increasingly difficult to break even unless their AUM exceed Rmb500bn, according to those in the industry.

The reforms, as well as the DeepSeek moment that drew attention to advances in Chinese tech, have helped propel markets higher. China’s benchmark CSI 300 index rose 17.7 per cent last year, while the tech-heavy ChiNext index surged almost 50 per cent.

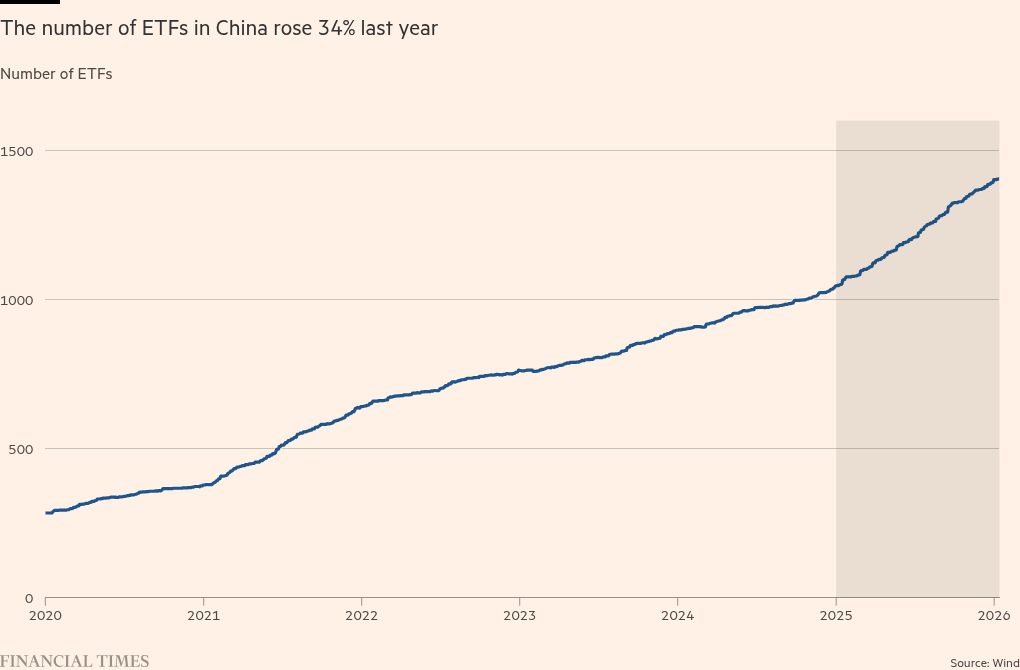

There has been a proliferation of ETFs offering investors a low-fee way to gain exposure to Chinese stocks. Since 2020, more than 750 new ETFs have come to market in China, including more thematic ETFs in areas such as technology.

Foreign investors are also turning to ETFs for exposure to China’s stock market. According to data from EPFR, foreign active fund managers were net sellers of Chinese equities last year but this was offset by substantial inflows into ETFs.

Meng Lei, China equity strategist with UBS Securities, said that while retail investor fund inflows into Chinese broad-based ETFs were flat over the past year, there was a sharp increase in interest in “thematic” ETFs focused on areas such as AI or robotics.

“If you buy a mutual fund, you can’t control what they are investing in. So if I like AI, I just buy the AI ETF,” he said.

Data visualisation by Haohsiang Ko in Hong Kong