Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

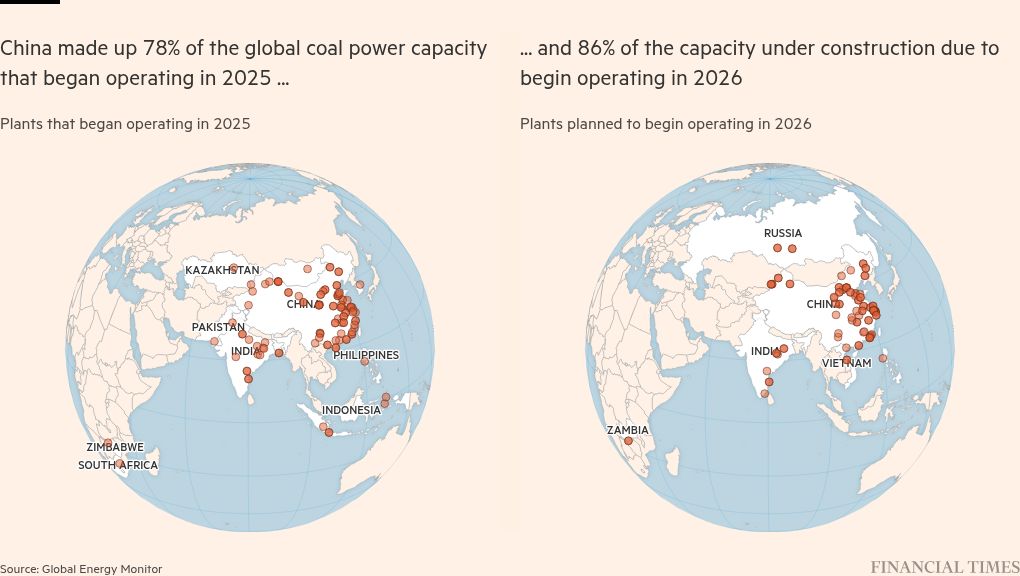

More than 100 coal-fired power station generator units are set to start supplying electricity worldwide in 2026 as China continues to develop projects using the fossil fuel even as it installs huge amounts of wind and solar power.

The 104 projects due to open this year are among 439 under construction, according to an analysis of plans by Global Energy Monitor, highlighting the enduring reliance on coal-fired power stations despite massive progress in lower-carbon technologies.

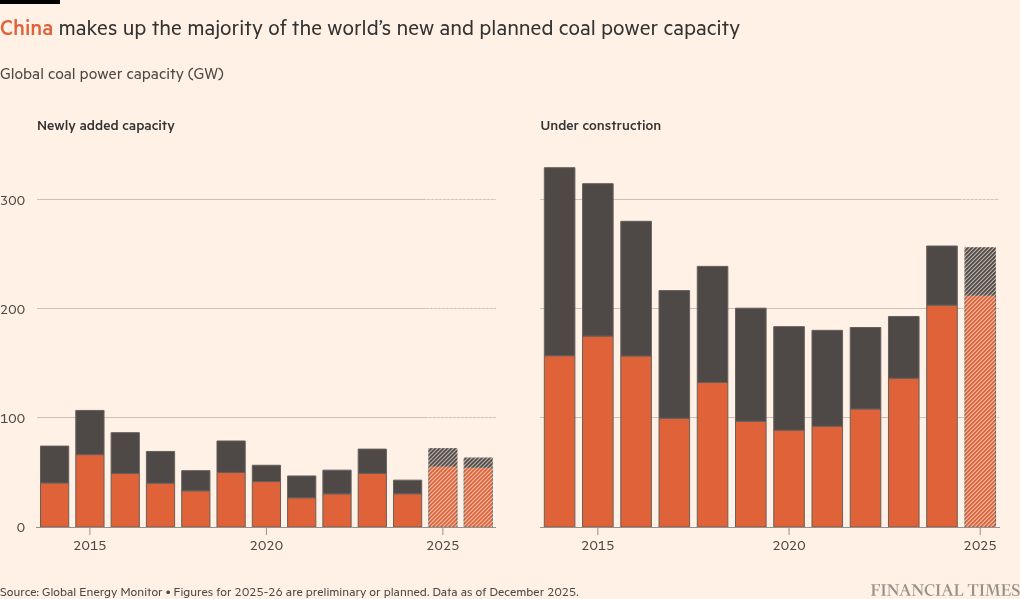

The vast majority of the coal power projects are in China, which accounts for 212 gigawatts of the 256GW total new capacity under construction. China has 85 coal-fired units scheduled to open in 2026, accounting for 55GW of the global 63GW, according to the GEM data. The final tallies could be higher or lower depending on construction timelines.

China’s push on the technology means that total coal-fired power capacity under construction in 2024 and 2025 was higher than any year since 2016, even though it fell in the rest of the world.

India, Vietnam, Indonesia and others are also building new projects. India has about 24GW under construction, according to the GEM data.

Christine Shearer, GEM climate and energy analyst, said attempts to phase out coal to try and cut carbon dioxide emissions “really hinge on China . . . I don’t think we are going to see a big uptick elsewhere in the world. There’s not a lot of new construction.”

However, there are signs that the role of coal-fired power plants in China is evolving since the huge growth of renewable electricity in the country means they may operate less of the time. China has retrofitted many plants to run more flexibly so they can help to back up wind and solar power.

S&P Global Ratings estimates that coal-fired power plants in China will by 2030 on average run for the equivalent of about 4,100 hours at full capacity a year (47 per cent of the time), down from 4,400 hours in 2025.

“The massive scale of solar and wind capacity now online fundamentally changes the operating environment new coal plants must face,” said Shearer, though she said investment could be better spent on lower-carbon forms of backup power, such as batteries.

While China is building new coal-fired plants, GEM data shows it has been retiring old ones with an average capacity of 3GW annually from 2021 to 2025.

China is also leading the way in deploying solar and other green technologies. The country installed 240GW of new solar capacity in the first nine months of 2025 alone.

Analysis published this week by the Centre for Research on Energy and Clean Air for Carbon Brief showed that total coal-fired power generation fell in both China and India during 2025, for the first time since 1973. It fell by 1.6 per cent in China and 3 per cent in India.

The mixed picture for coal in China is reflected around the world, where use of the fuel has been growing but there are signs that may change.

The International Energy Agency said in a report published in December that global coal use — for both factories and electricity generation — was set to hit a fresh record high of about 8.85bn tonnes.

The increase in 2025 was largely due to higher use in the US, where some coal-fired power stations have been exempted from environmental rules, meaning they can stay open, while low wind speeds slowed Europe’s shift away from coal.

The IEA said it believed coal use was plateauing overall as more countries switched towards renewables or gas-fired power stations. Its previous predictions that coal use would have peaked by now have not been borne out.

However, in a landmark moment, renewable electricity sources worldwide generated more electricity during the first half of last year than coal, according to Ember, while growth in solar and wind generation outpaced that of electricity demand.

“Overall, the picture is a complex interplay between expansion in emerging markets and the phaseout challenges in mature systems,” the IEA said.

Data visualisation by Aditi Bhandari

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here