Economists and investors in China and beyond are calling on Beijing to allow a sharper appreciation of the renminbi, arguing that the currency is significantly undervalued and is being used to fuel an unprecedented trade surplus.

Over the past year, the People’s Bank of China, which manages the renminbi’s exchange rate, has allowed a gradual appreciation of the currency against the dollar. At the end of 2025 it crossed the level of Rmb7 to the dollar for the first time since 2023 and is now trading at about Rmb6.99.

But with the dollar’s rapid fall last year against currencies such as the euro, this has meant Chinese exports to Europe have become substantially more competitive, stoking trade tensions and prompting calls for Beijing to increase the rate of appreciation.

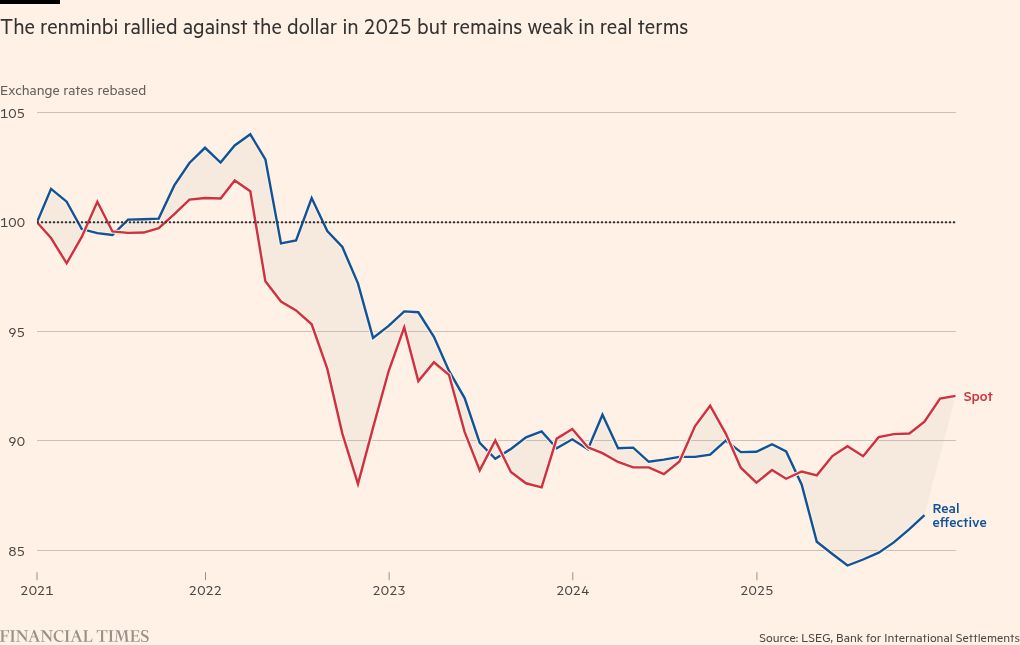

Although the renminbi strengthened 4.4 per cent against the dollar last year — defying fears of a devaluation following Donald Trump’s tariff announcements — its real inflation-adjusted rate against the currencies of its trading partners shows that a substantial depreciation since 2021 continued for much of 2025.

“The renminbi is actually down 15 to 20 per cent in real terms since 2021. That has corresponded with an explosion in China’s trade surplus,” said Brad Setser, a senior fellow at the Council on Foreign Relations and a former US Treasury official. “Unless something changes, the surplus is going to continue to go up.”

After the US and China dropped their most extreme tariffs, the renminbi began to gradually appreciate, Setser noted, and the PBoC has appeared determined to ensure that the currency trades tightly within the bounds of its daily “fix” against the dollar.

Hao Hong, chief investment officer at hedge fund Lotus Asset Management, said the renminbi could rise “substantially” in 2026, which would be supportive of Chinese assets and mitigate criticism overseas.

“China is using its exchange rate to subsidise its exports,” Hao said. “If you continue to use the exchange rate as a subsidy, you’re bound to arouse protests and trade barriers from other countries.”

The impact on European exporters has been clear, with the euro’s rise last year against both the dollar and the renminbi putting further stress on the continent’s already shaky economy by making its exports less competitive.

Mitul Kotecha, head of Asian FX & EM macro strategy at Barclays, said the depreciation of the renminbi against the euro had “really hurt European exporters at a time when the economy is already under pressure”.

“Europe hasn’t been able to do much about it,” he said.

Jens Eskelund, president of the European Chamber of Commerce in China, raised the issue in unusually pointed remarks in December, citing a “weak Chinese exchange rate” as one factor fuelling Europe’s trade deficit with the country. He was speaking shortly after French President Emmanuel Macron warned of “unsustainable” imbalances in the EU-China relationship during a visit to Beijing.

International financial bodies have added to the pressure, with the IMF’s managing director Kristalina Georgieva calling for a “market-based exchange rate that reflects fundamentals”.

But analysts said the most likely outcome was a continuation of last year’s trend — a gradual strengthening of the renminbi against the dollar that does not address the broader valuation gap.

Analysts at Goldman Sachs estimate that China’s currency is about 25 per cent undervalued in real terms. They expect the currency to appreciate to Rmb6.85 a dollar by the end of 2026, a bigger move than the median forecast in a Bloomberg survey.

“Despite a bifurcated economy with weak domestic demand, we think the underlying macro drivers and still-significant undervaluation [in the renminbi] call for further RMB appreciation versus the USD,” said Danny Suwanapruti, head of Asia emerging markets foreign exchange and rates strategy at Goldman Sachs.

Prominent Chinese economists have also laid out the case for a stronger currency.

Sheng Songcheng, a former PBoC official, and Miao Yanliang, a former official at the State Administration of Foreign Exchange, now at investment bank CICC, have both made the case for a strengthening renminbi in recent weeks.

Not all economists are convinced, however, with many citing China’s deflationary environment.

“I’m very sceptical of some of my peers’ view that the renminbi has to appreciate massively,” said Tai Hui, chief Asia market strategist at JPMorgan Asset Management. “If you look at the trade surplus, yes that makes sense. But China’s going through very low inflation if not deflation and a stronger [renminbi] doesn’t help.”

Adam Wolfe, emerging markets economist at Absolute Strategy Research, said that China’s deflationary environment made a meaningful appreciation in the currency unlikely.

“There’s this view that China’s government controls everything — that they can dictate exports and the exchange rate. I don’t think that’s really true,” said Wolfe. “China is stuck in a deflationary slump and what you see in a deflationary slump is that relative interest rates go down and exchange rates depreciate.”

One lingering question is why the US has not made China’s exchange rate a bigger priority in trade talks.

“The biggest problem I see is that for reasons that I don’t fully understand, secretary Bessent and President Trump haven’t made China’s currency a significant issue in the second term,” Setser said. “I think they’re overestimating what they can get out of the tariffs.”

Data visualisation by Haohsiang Ko in Hong Kong