Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

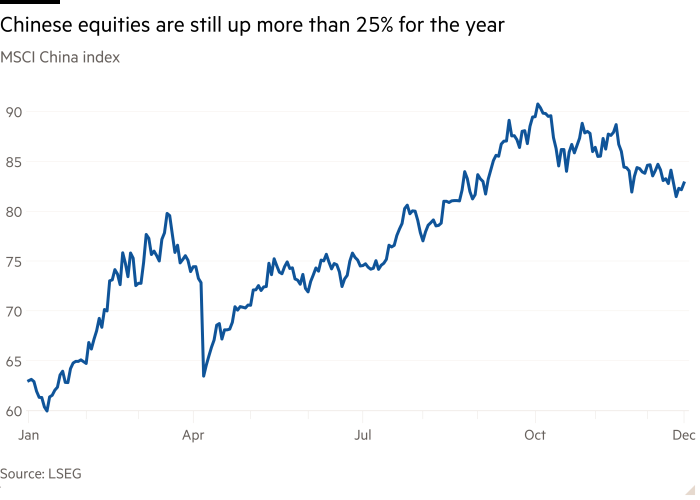

A steep rally in Chinese stock markets has cooled in the past three months, as weak economic data and profit-taking bring this year’s steep rally to an end.

The MSCI China index has fallen 7.4 per cent since September, its worst three-month performance in an otherwise strong year for the country’s equities, with gains fuelled by optimism over Chinese technological innovation and government support for markets.

The index is still up 28.7 per cent in the year to date, with several investors and strategists attributing this quarter’s pullback to profit-taking. “Hong Kong and China have been up two years in a row,” said Nicholas Chui, a portfolio manager at Franklin Templeton. “Profit-taking is a very natural reaction.”

But recent weak economic data from China has contributed to cooling sentiment, highlighting the country’s structural challenges of low consumer confidence and deflation. Beijing’s crackdown on industrial overcapacity has led to a steep decline in investment that has not been offset by greater consumption.

“Recently released macro data is affecting sentiment,” said Wei Li, head of multi-asset investments for China at BNP Paribas.

November data showed falling fixed asset investment and consumer goods sales, as well as money supply, which together indicate cooling economic activity.

Chinese stocks have underperformed other Asian markets in the final three months of the year. South Korea’s Kospi has gained over 17 per cent, Japan’s Topix is up 7.8 per cent, and Taiwan’s Taiex has risen 7.3 per cent. India’s Nifty 50 index is up 5.8 per cent.

Tai Hui, chief Asia market strategist at JPMorgan Asset Management, said the decline was likely due to profit-taking as well as uncertainty over China’s growth prospects.

“Some of the macro numbers have been on the softer side,” he said.

Hui said investors were concerned that the weak growth would hit corporate earnings, which on average are still lower than when the MSCI China index peaked in 2021.

“Lots of the rally we’ve seen onshore and offshore China is valuation re-rating,” Hui said. “The risk is they will not be immediately rewarded with stronger earnings.”

In Hong Kong, falling levels of southbound investment from mainland China, which surged to record highs earlier this year and helped revive the territory’s capital markets, have also hit the market’s performance.

“The Hong Kong stock market is very sensitive to liquidity,” said BNP Paribas’s Wei. “If we look at the southbound flow in recent months, it actually dropped quite a lot.”

Despite the weak end to the year, many investors in Chinese equities remain optimistic.

“I think this is one of those times where you have a very natural and healthy correction,” Chui said. “It sets us up for a decent start to 2026.”

Looking ahead, some investors expect Beijing to step in and support economic growth, providing a backstop for sentiment and earnings, while enthusiasm over innovative Chinese technology companies remains strong.

“The recent central government conferences released very positive policies to support the market as well,” Wei said. “On one side is government support. The other side is technological innovation.”

Not everyone agrees that recent government announcements have been reassuring for investors worried about signs of China’s slowing economic growth.

“Policy commitment to bring growth on a higher trajectory is not super strong,” JPMorgan’s Hui said.