Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

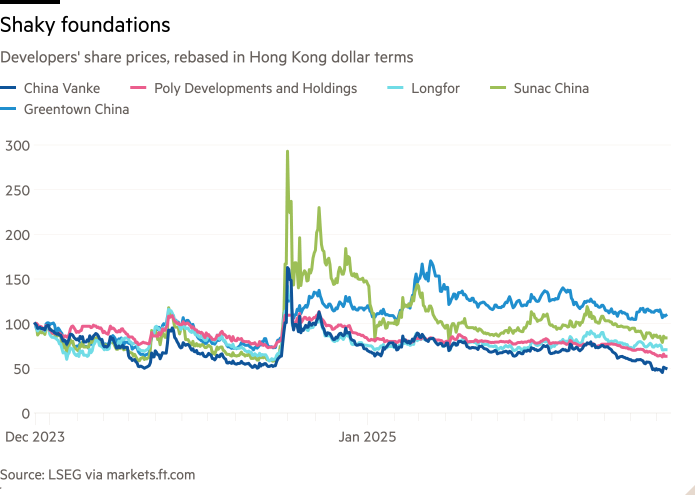

Have Chinese real estate stocks become a bargain? It is a question that comes up every time the sector starts staging a rebound. The result is volatility. For developers’ shares to swing over 20 per cent in a day is no longer unusual.

Even stocks like China Vanke, once the most safe and stable of the country’s builders, move dramatically on nothing more than a few hints of policy support. That reflects how quickly investor perceptions of the sector are shifting. This week, bondholders denied Vanke permission to delay repayment of a RMB2bn ($280mn) onshore note, a wake-up call for the sector. If Vanke can be pushed to the edge, then the line separating viable developers from casualties is thin.

Previously, throughout the sector’s four-year-long downturn, each rally was read as a sign that perhaps the old model still worked. And indeed, it is not all gloom. While hundreds of small developers have gone bankrupt each year — over 230 housebuilders filed for bankruptcy in 2023 alone — the result is that the remaining developers face much less competition. Meanwhile, local households are sitting on nearly RMB162tn in savings this year, almost double 2020 levels and near a record high.

Stock valuations are indeed at rock-bottom levels. China Vanke trades at the equivalent of just one-third of its book value. Even local peer Poly Developments trades at less than half its book value, despite having a stronger balance sheet and the backing of a state-owned enterprise. Those levels may look tempting for investors bottom fishing.

Yet despite repeated promises and policy pledges to support the sector, the market has shown little sign of stabilising. China’s home price decline has continued into November, with new home prices in 70 cities, excluding state subsidised units, down almost 0.4 per cent from October, according to data from the National Bureau of Statistics, the seventh straight month of decline. The previous month saw the sharpest drop in a year.

One big problem is that the people China needs to buy homes are increasingly unable to do so. Younger households’ income is stagnant, and youth unemployment remains high at over 17 per cent in October, making mortgages harder to obtain. Older households that already own properties have little incentive to bet on a market that no longer guarantees appreciation.

This downturn is not a typical cyclical slump. Shrinking demographics, weak confidence and policies that prioritise stability over expansion mean the underlying structure is rapidly shifting away from property as the country’s default savings vehicle. The old model, and the assumption that property stocks rebound with the cycle, may not return.