Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

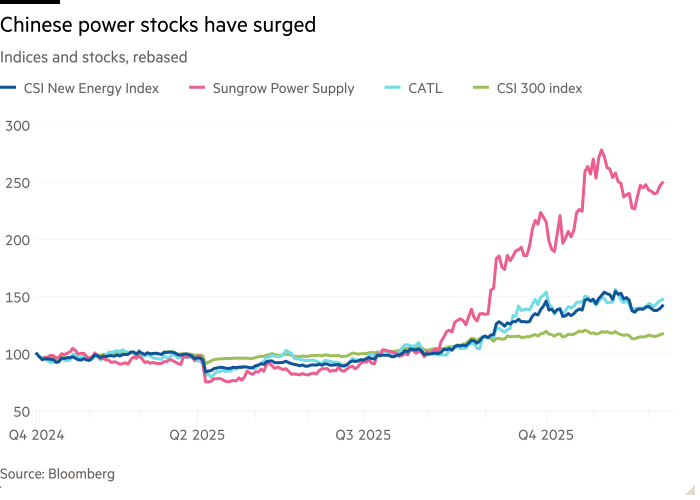

Shares in Chinese makers of batteries, transformers and other equipment vital for the global build-out of artificial intelligence have rocketed this year, as power-hungry data centres rush to secure alternatives to overstretched legacy grids.

Profits at Chinese companies such as CATL, the world’s largest battery maker, and Sungrow, the world’s second-largest supplier of integrated energy storage systems after Tesla, have soared on the back of domestic and foreign demand.

CATL’s shares are up 45 per cent this year, with Sungrow shares up 130 per cent. They are the two largest companies in the Shenzhen Stock Exchange’s CSI New Energy index, which has risen 38 per cent in 2025.

“Suddenly there’s a scramble for this power equipment,” said Brian Ho, an equity research analyst at Bernstein covering the global energy storage sector.

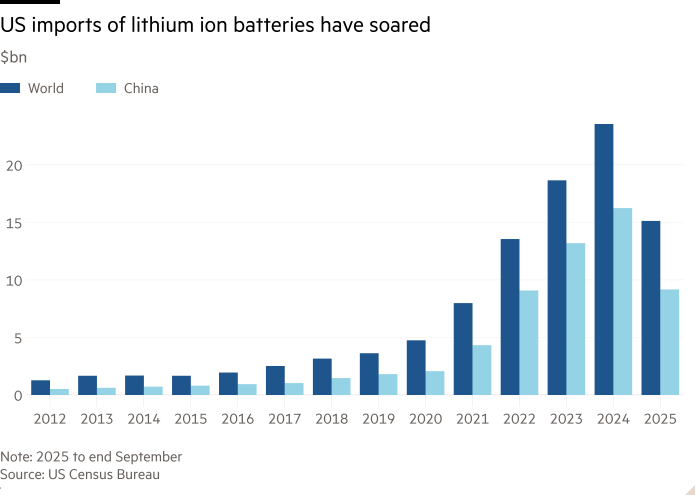

Neither Chinese company discloses US sales, but official data shows China accounts for the majority of US battery and energy storage system imports.

“China is not only powering China,” said Matty Zhao, co-head of China equity strategy at BofA Global Research. “It’s actually powering the US, Europe and the rest of the world.”

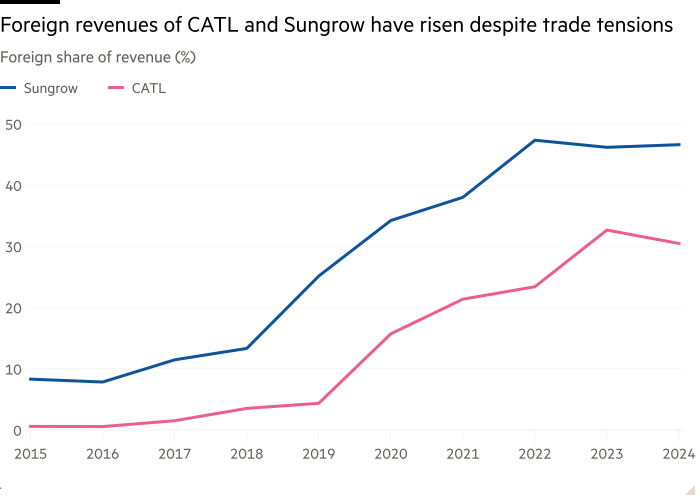

Despite Donald Trump’s tariffs, it is export sales that are driving profits, as intense competition in China means companies can make bigger margins overseas, Zhao added.

For energy storage systems, which include batteries, DC to AC converters and other equipment, Zhao estimates that profit margins are three to five times greater for exports than for domestic sales. For transformers — vital in data centres to ensure each component gets the right power — sales domestically have 10 to 20 per cent gross margins compared with 40 to 50 per cent for sales to the US and Europe, she said.

“They would rather continue to export and eat up the tariff,” Zhao said.

The International Energy Agency forecasts that by 2030 data centres will consume 945 terawatt hours of electricity — more than a fifth of all the electricity currently generated annually in the US — up from about 415 terawatt hours last year. Legacy grids are already coming under strain.

Companies building data centres are turning to banks of batteries and to “micro grids”, which operate independently of conventional grids. The US Department of Energy notes that micro grids are growing quickly and will make up a “significant majority” of US distributed energy resources in the future.

In the first nine months of this year, 60 per cent of US lithium ion battery imports came from China, according to the US Census Bureau, up from 43 per cent in 2020. The total value of such imports was $15bn this year to September, more than three times the value in the whole of 2020.

This comes in spite of US efforts to reduce the country’s dependence on China amid warnings that it is leaving itself vulnerable to supply shocks. The Council on Foreign Relations, a US think-tank, said in an October report that the biggest threats to the US in its race with China to develop AI “stem from supply chains”.

“China and the US have basically not decoupled,” said Raymond Yeung, chief economist for greater China at ANZ. “They’re a single economy of two different jurisdictions.”

Yeung pointed to a “structural advantage” of Chinese manufacturers in the AI supply chain. For example, companies such as CATL are global leaders in producing lithium iron phosphate batteries, which are safer and have longer lifespans than alternatives.

“Despite all these tariffs and the decoupling, the demand for [lithium iron phosphate] batteries is strong,” said Ho at Bernstein, adding that there are “just no other suppliers outside China”.

Chinese companies also have the advantage of price and speed of delivery.

For transformers, for example, “If you buy from Korea you have to wait two to three years,” said Zhao. “If you have to urgently build out your grid for a data centre, you cannot wait for two years.”

Both CATL and Sungrow have seen foreign revenues surge since 2018, when Donald Trump first raised tariffs on Chinese goods, highlighting the global lack of alternative suppliers.

Power equipment and batteries are part of a broader and largely unacknowledged US dependence on Chinese inputs for AI. US data centre companies use optical transceivers — used to convert electrical signals into light, for transmission, and back again — from Chinese companies such as Zhongji Innolight, as well as printed circuit boards produced in China.

However, current trends may not continue. Next year, the Trump administration plans to raise tariffs on Chinese batteries from 30.9 per cent to 48.4 per cent and to make it harder for equipment with high levels of Chinese content to get federal tax credits.

In a recent note, HSBC said that this year there had been “frontloaded installation in the US ahead of the implementation of the foreign entity of concern requirements on new [energy storage system] projects”.