This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning, happy Friday and welcome back to FirstFT Asia. In today’s newsletter:

Beijing signals concern over falling investment

Disney’s $1bn deal with OpenAI

“Extortionate” World Cup ticket prices

How China racked up a $1tn trade surplus

China’s leaders have for the first time explicitly committed to reversing a fall in investment, one of main drivers of growth in the world’s second-largest economy.

What to know: The pledge, made at the end of a two-day economic policy conference of top Communist party officials, was the first official indication that a sudden and sharp slowdown in fixed-asset investment in recent months is worrying leaders.

“We will promote the stabilisation and recovery of investment,” said a report of the meeting, which was chaired by President Xi Jinping. This would be achieved by increasing central government investment, implementing key projects and stimulating private investment, said the report published by state news agency Xinhua.

A sharp decline: Government data released last month showed China’s fixed-asset investment fell 1.7 per cent in the year to October, following a 0.5 per cent decline recorded for the year to September. China’s economy has for decades relied heavily for growth on investment, particularly in infrastructure and property, but also in recent years in high-end manufacturing of products ranging from electric vehicles to semiconductors.

Here are the other issues China’s leaders raised during the meeting.

Global tax stand-off: China and a clutch of EU countries have objected to planned exemptions for big US multinationals from global tax obligations, raising the risk of Donald Trump resurrecting a “revenge tax” on foreign investment.

Here’s what else we’re keeping tabs on today:

Economic data: India publishes November inflation figures.

Ask an Expert: Has there been a “vibe shift” in politics and culture since Trump’s return to the White House? Join FT columnist Jemima Kelly who will be answering readers’ questions later today.

How well did you keep up with the news this week? Take our quiz.

Five more top stories

1. A military court in Pakistan has sentenced former spymaster Faiz Hameed to 14 years in prison, in an unprecedented move against a one-time rival of army chief Asim Munir. Read the full story.

2. Oracle stock slumped after it reported disappointing revenues on Wednesday alongside a $15bn increase in its planned spending on data centres this year to serve artificial intelligence groups. Shares in Larry Ellison’s database company fell as much as 16 per cent yesterday. Here’s why investors are worried about Oracle’s AI push.

3. Taiwan has begun trade secrets investigations in its critical chipmaking sector under newly broadened national security laws. Unexpectedly, however, the first cases are not implicating companies from China — long seen as the main culprit in technology theft — but from the island nation’s closest allies.

4. The Walt Disney Company has agreed to invest $1bn in OpenAI as part of a deal that will allow the artificial intelligence start-up to use Disney’s characters in its flagship products. As part of the three-year deal, Disney will make more than 200 Marvel, Pixar and Star Wars characters available within ChatGPT and Sora, OpenAI’s video-generation tool.

5. Football fan groups have called on Fifa to halt ticket sales for next summer’s World Cup, warning that “extortionate” prices are a “monumental betrayal” of the event’s tradition of being open to all. The main ticket ballot for the tournament — due to be held across North America next summer — opened yesterday.

News in-depth

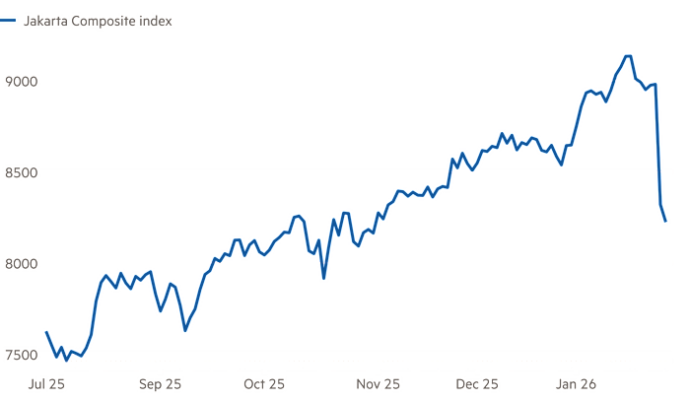

In a year dominated by US President Donald Trump’s tariffs, a blizzard of tit-for-tat levies and stop-start trade negotiations, China’s $1tn surplus has made clear that it remains an unstoppable trade juggernaut. Here’s how Beijing has shaken off the damage caused by Trump’s trade war.

We’re also reading . . .

Jan Marsalek’s missing millions: An FT investigation sheds light on the Wirecard fraudster’s activities in north Africa and shadow life as a Russian agent of influence.

‘Hollywood is shocked’: In the eyes of many in the industry, the battle for control of Warner Bros Discovery boils down to two unappealing options.

Tech IPO boom: If SpaceX, OpenAI and Anthropic go public it will break new ground — potentially with the scale of their losses, writes Richard Waters.

M&A: Alphaville’s Bryce Elder rounds up the 10 best worst hostile takeovers ever, starting with Charles Clore’s takeover of J Sears & Co in 1953.

Chart of the day

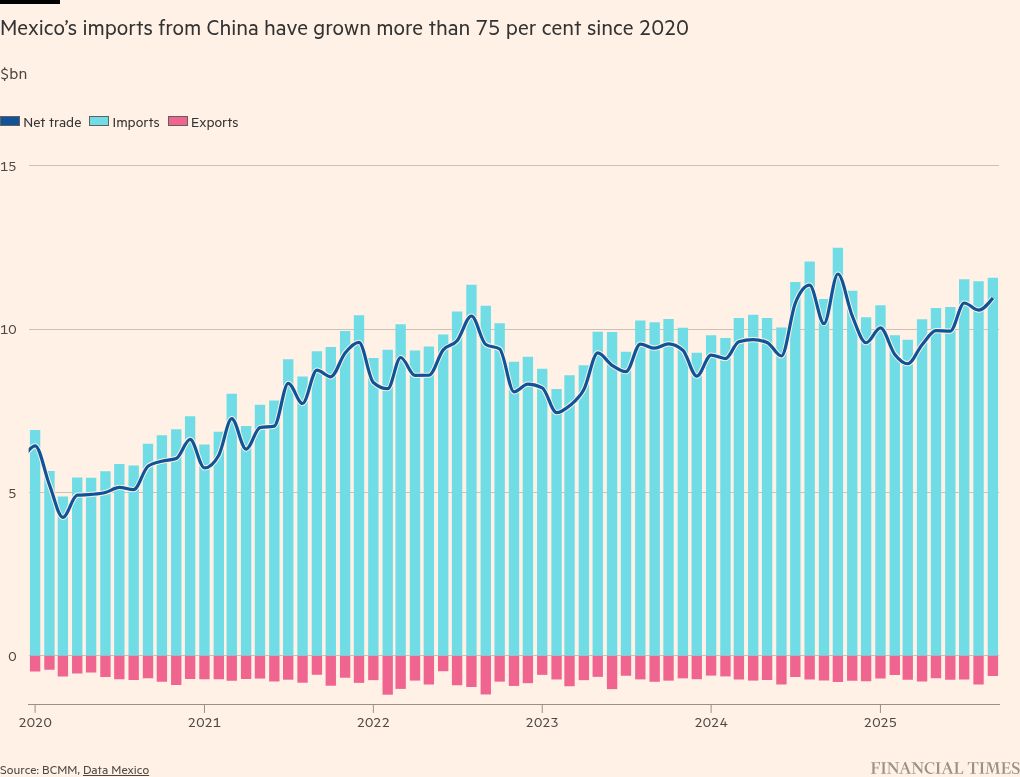

Mexico has approved tariffs of up to 50 per cent on Chinese cars and other goods, as it seeks to preserve a pivotal free-trade deal with the US next year. Mexico’s imports from China have grown more than 75 per cent since 2020, though its northern neighbour remains its top trading partner.

Take a break from the news . . .

The approval of three new licences for casinos in New York has caused alarm among the city’s poker players. John Ganz, a habitual gambler, who plays poker at least once a week, describes the romantic, and sometimes dangerous, appeal of New York’s many private games and “underground” poker clubs.