This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

Beijing is set to limit access to Nvidia’s advanced H200 chips despite Donald Trump’s decision to allow the export of the technology to China as it pushes to achieve self-sufficiency in semiconductor production.

What we know: Regulators in Beijing have been discussing ways to permit limited access to the H200, Nvidia’s second-best generation of AI chips. According to two people with knowledge of the matter, buyers would probably be required to go through an approval process, submitting requests to purchase the chips and explaining why domestic providers were unable to meet their needs. The people added that no final decision had been made yet.

Trump on Monday said he would allow Nvidia to export its H200 chip to China. The decision marked a big shift from the Biden administration’s approach, which imposed sweeping export controls on chip-related technology in an effort to slow the modernisation of China’s military.

Nvidia chief executive Jensen Huang has been lobbying for the ban to be lifted. Supporters, including White House AI tsar David Sacks, contend that allowing exports would help America by making Beijing reliant on US technology. But critics say the move will give China a big boost.

Here’s what the return of Nvidia’s advanced chips would mean for Chinese tech giants.

Opinion: China’s open-source approach to AI contrasts with the US’s secretive development and offers a distinct pathway to success, writes Kai-Fu Lee, the CEO of 01.AI and chair of Sinovation Ventures.

Here’s what else we’re keeping tabs on today:

Economic data: China reports November inflation figures.

US Monetary policy: The US Federal Reserve, having delivered two consecutive rate cuts since September, is expected to reduce interest rates again.

Taiwanese chipmakers: Taiwan Semiconductor Manufacturing Company and MediaTek report November sales.

Nobel Peace Prize: A ceremony in Oslo, Norway, will honour this year’s winner, the Venezuelan opposition leader María Corina Machado.

Five more top stories

1. The Bank of Japan’s governor has said the country’s economy has weathered the shock of US tariffs, supporting market expectations of an interest rate rise at the central bank’s crucial meeting next week. The BoJ is expected to consider raising rates from the current level of 0.5 to 0.75 per cent, their highest level in 30 years.

2. Trump’s envoys have given Volodymyr Zelenskyy days to respond to a proposed peace deal requiring Ukraine to accept territorial losses in exchange for unspecified US security guarantees. A person with knowledge of the timeline proposed to Kyiv said Trump was hoping for a deal to be agreed “by Christmas”.

3. The oil market faces a “super glut” next year as a burst of new supply collides with weakness in the global economy, one of the world’s biggest commodity traders has warned. Saad Rahim, chief economist of Trafigura, said yesterday that new drilling projects and slowing demand growth were likely to weigh further on already depressed crude prices.

4. JPMorgan Chase shares were on track for their biggest fall in eight months yesterday after the biggest US bank by assets warned that its expenses would rise by more than $9bn next year. The bank said that rising costs in it consumer unit was a “big part” of the overall increase in spending.

5. The French Assembly has voted narrowly in favour of a social security budget that will suspend the country’s pension reforms, in a major victory for embattled premier Sébastien Lecornu. The centre-left Socialist backed the government bill to deliver a razor-thin majority in the lower house of parliament.

News in-depth

The rise of IndiGo, India’s largest airline, has been central to Prime Minister Narendra Modi’s goal of opening the skies to hundreds of millions of Indians. But the low-cost carrier’s reputation for ruthless efficiency and reliable performance has been rocked over the past week after it cancelled thousands of flights amid a shortage of cockpit crew. The mayhem has put IndiGo’s senior management under direct scrutiny from New Delhi — and raised broader questions about India’s aviation ambitions.

We’re also reading . . .

China’s $1tn trade surplus: Beijing’s latest milestone underscores its industrial strength — and growing economic imbalances, writes the editorial board.

CNN’s fate: The bidding war over Warner Bros Discovery, the new network’s parent company, has turned CNN into a political bargaining chip.

Weight-loss drugs: Appetite-suppressing drugs are disrupting the economic models that shape our food system, writes Henry Dimbleby, ushering in a new commercial reality.

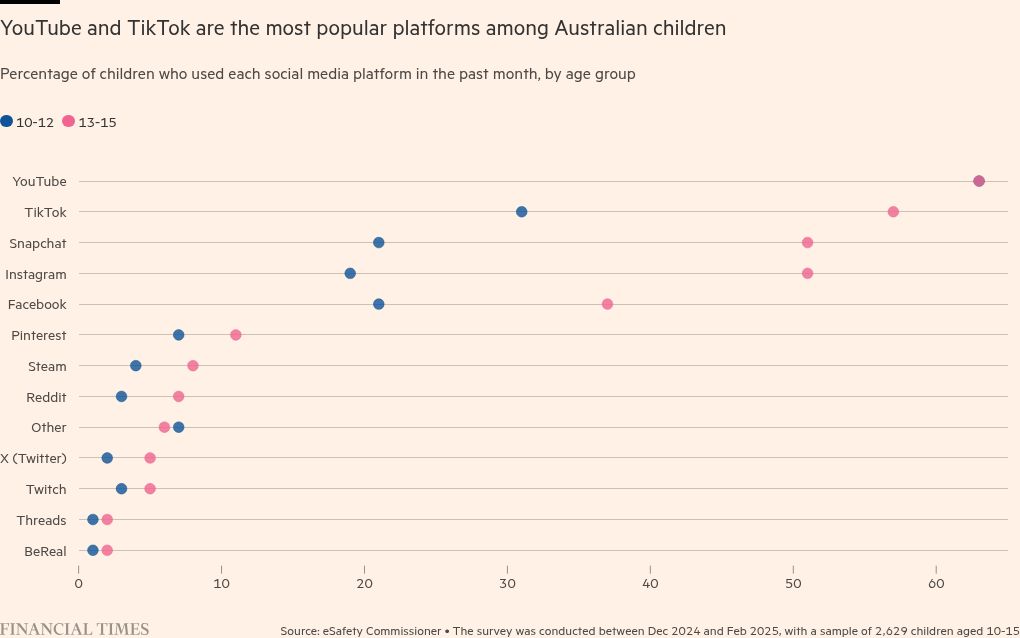

Chart of the day

Australia is the first country to ban social media accounts for children under 16. The legislation comes into force today. But will it work?

Take a break from the news . . .

Spotify’s Wrapped this year generated 500mn shares in the first 24 hours and prompted other companies to follow suit. Here’s why Emma Jacobs thinks it’s marketing genius.