Stay informed with free updates

Simply sign up to the Artificial intelligence myFT Digest — delivered directly to your inbox.

The writer is CEO of 01.AI, chair of Sinovation Ventures, former president of Google China and co-author of ‘AI 2041’

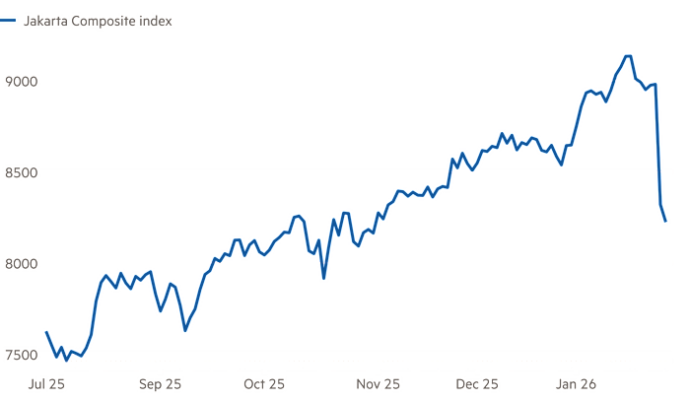

When Chinese artificial intelligence company DeepSeek released its R1 large language model in January, America’s Nasdaq index fell 3 per cent in one day. The model rivalled market-leading US AI models in performance while using a fraction of their computing power, suggesting that America’s head start in generative AI might be shrinking. What’s more, it was made available open-source. Anyone could download it free and adapt it for their own commercial use.

Today, there is more reason than ever to believe Chinese AI companies can rival their US peers. DeepSeek’s latest two new models match the reasoning performance of OpenAI’s GPT-5 and Google’s Gemini-3 Pro. The runaway success of R1 and Alibaba’s Qwen have made open-source models the norm in China. Companies like Baidu, Zhipu, Moonshot AI and Meituan all allow users to download their cutting-edge models, interrogate how they work and adapt them. Contrasted with the secretive development of LLMs in the US, they offer a distinct Chinese pathway for progress in AI.

Open-source AI gives users the ability to customise models — fine tuning them for use in a specific industry, for example. The models can also be run on a customer’s internal servers, which means corporate users don’t have to send their data to AI companies. And free, open-source models make state-of-the-art AI affordable for researchers, students, hobbyists and entrepreneurs.

I know this from personal experience. Back in 1988, after finishing my PhD on speech recognition, my adviser, Turing Award recipient Professor Raj Reddy, suggested I open-source the toolkit. Decades later, it is still being used and updated. This has shown me the power of open-source communities and the longevity of a shared resource.

As more Chinese AI companies have open-sourced their models, development has accelerated. Engineers at different companies study each other’s models as well as the thousands of variants developed independently, allowing innovators to cherry pick features and make incremental improvements. The effect is akin to studying together to ace a test, rather than relying on individual intelligence. Today, there is more reason than ever to believe Chinese AI companies can rival their US peers.

This was born from necessity. While Meta promotes an open-source approach to AI through its Llama model, most US developers keep their cutting-edge LLMs to themselves. America’s early lead in generative AI was developed in classic Silicon Valley fashion. Companies like OpenAI, Anthropic and xAI used huge quantities of venture capital to procure high-performing graphic processing units (GPUs) and the best researchers to develop models in closed labs. They are now engaged in a winner-takes-all battle to build the best-performing model, squash competition and establish a monopoly.

Forced to play catch-up, China’s AI industry has focused on efficiency, developing models that require less computing power and so are cheaper to use. DeepSeek chose to give away its model to encourage customers to build an ecosystem of products on top of it. Within days of the release of its R1 model, for example, developers on AI community Hugging Face had created more than 500 derivative models, which were downloaded 2.5mn times.

Today the 10 top-ranked open-source AI models are almost all Chinese. The dominance is now so pronounced that former Google CEO Eric Schmidt has warned that US companies risk ceding open-source AI to China completely.

None of this means China will necessarily win the AI race against the US. American companies continue to lead in research and to pour huge resources into development. Their corporate customers are willing to pay high subscription fees to access closed models, thus funding further R&D. Unlike Chinese businesses, which face US export restrictions on Nvidia chips, they also enjoy unencumbered access to the best-in-class GPUs — a hardware essential to AI computation.

The future of AI development could therefore resemble the rivalry between Apple and Google in smartphone operating systems. Like Apple’s iOS, US companies are building a closed ecosystem, charging high prices to access a premium product. China’s AI approach is closer to Google’s open and customisable Android operating system.

While iPhones are popular with wealthy consumers and highly profitable, Android powers over 70 per cent of smartphones globally. China’s AI companies are following a similar “Android strategy”, aiming for broader reach through open technologies.