Stay informed with free updates

Simply sign up to the Russian business & finance myFT Digest — delivered directly to your inbox.

Chinese exporters have been raising prices for Russian military-industrial buyers, exploiting the Kremlin’s reliance on their supplies as western sanctions restrict imports, new research has revealed.

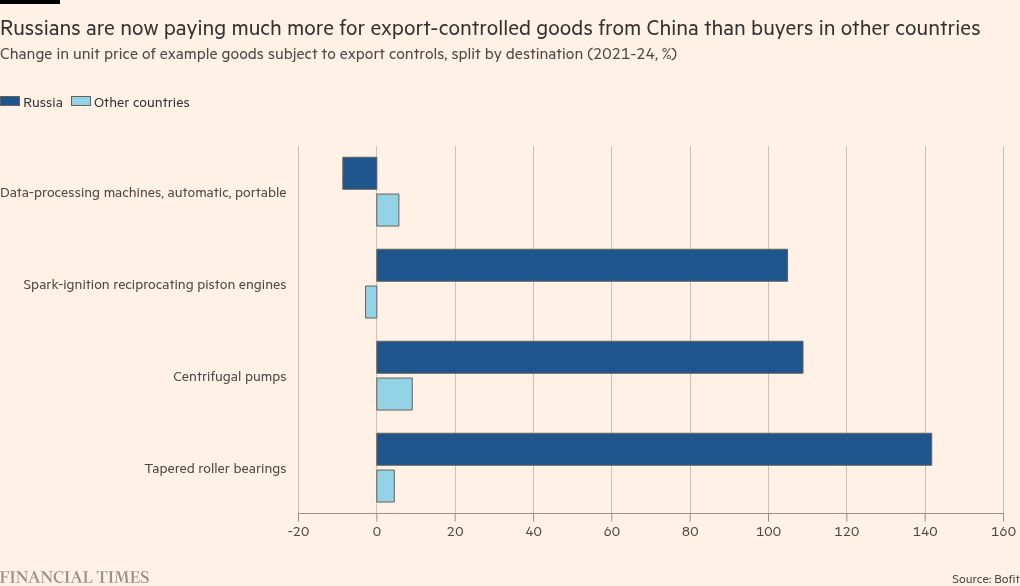

Prices of export-controlled products shipped from China to Russia rose 87 per cent between 2021 and 2024 on average, according to a new paper from the Bank of Finland Institute for Emerging Economies (Bofit). The price of similar goods shipped elsewhere rose only 9 per cent.

The research shows that while Russia has been able to use Chinese suppliers to get around western restrictions on the purchase of products that have potential military uses, the wave of sanctions imposed in the wake of the full-scale invasion in 2022 has pushed up costs for the Kremlin.

A senior western sanctions official told the Financial Times that while they would like to see Russia’s military-industrial complex “cut off” from its suppliers, Chinese companies “ripping them off” was a “pretty good outcome. If you increase the price of a good by 80 per cent, you nearly halve what they can actually buy.”

The authors, Iikka Korhonen and Heli Simola, focused on a major pinch point: the trade in goods listed as “machinery and mechanical appliances”, a category that includes a large number of items identified as being of importance to the war-industry push.

They concluded that sanctions have “limited Russia’s technological capabilities by making the importing of critical goods more expensive”.

In some cases, they found that increases in the value of export-controlled imports from China to Russia had been driven entirely by price rises rather than an increase in trade flows. By 2024, Russia’s imports of Chinese ball bearings had surged 76 per cent since 2021 in dollar terms. But the volume of exports dropped 13 per cent over that time.

Using slightly different methods, the researchers also found a significant rise in prices charged to Russian importers for sanctioned goods in Turkey, with prices rising 25 to 55 per cent compared with other exports.

Using data from 14 countries, they estimated that the median price of imports subject to export controls rose 75 per cent between 2021 and 2024 while remaining flat for other imports.

The research found that the impact of sanctions on prices also appears to be strengthening, possibly because stricter enforcement has allowed exporters to demand higher premiums from Russian customers.

Relief from sanctions remains a critical goal of the Kremlin. In the original 28-point peace plan devised by the US and Russia and presented last week to Ukraine, the document states “the lifting of sanctions will be discussed and agreed upon in stages and on a case-by-case basis”.

China has previously denied providing lethal weaponry to Moscow and has said it opposes unilateral sanctions that interfere with business between Chinese and Russian companies.