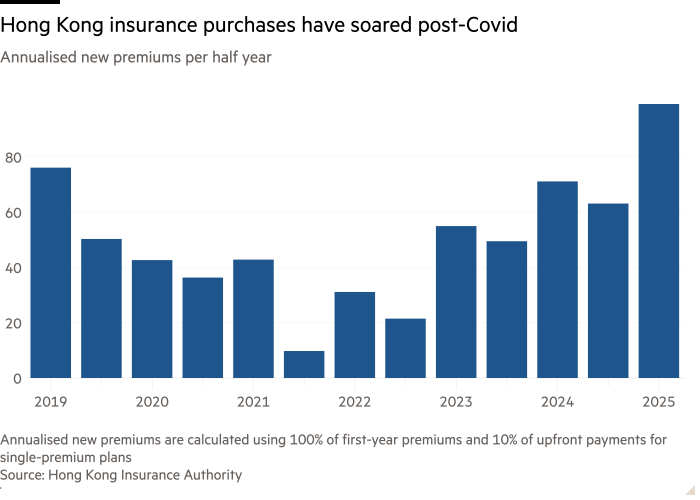

Purchases of Hong Kong insurance policies, a key conduit for individuals to move capital out of mainland China, surged to a record high in the first half of the year as Chinese investors hunt for higher returns abroad amid a sluggish economy at home.

The value of annualised new premiums, an industry metric for the value of new insurance business, surged 39 per cent from a year earlier to HK$99bn (US$12.7bn) in the first six months of 2025, according to provisional data from the Hong Kong Insurance Authority.

A major driver of sales has historically been mainland Chinese crossing into the territory to buy Hong Kong dollar- and US dollar-denominated policies, which function as savings products and can offer higher returns than fixed-income products at home.

While the Insurance Authority this year stopped breaking out purchases by mainland Chinese visitors to Hong Kong, one industry executive who was not authorised to speak publicly told the Financial Times the proportion was 30 to 40 per cent of their company’s sales.

Another executive estimated mainland Chinese purchases comprised more than a third of the industry’s total this year, compared with about 30 per cent of total annualised new premiums in 2024, the latest data available.

Wenwen Chen, an analyst at S&P Global Ratings, said “the interest rate differential between Hong Kong and mainland China, coupled with access to multicurrency savings insurance products” continued to drive demand this year.

The boom has benefited global financial groups such as HSBC, AIA and Manulife, which dominate Hong Kong’s insurance industry. HSBC and its subsidiary Hang Seng sold almost a quarter of total annualised new premiums this year, while AIA sold another 11 per cent, according to the Insurance Authority.

AIA on Friday said its value of new business, a measure of profitability, rose 25 per cent year on year in the third quarter to $1.5bn. In Hong Kong that measure rose 40 per cent to a record high, driven by “excellent growth from both our domestic and mainland Chinese visitor customer segments”, the insurer said.

HSBC this week said fee income from wealth management in Hong Kong increased 61 per cent in the same quarter to $646mn, driven by insurance and investment.

“Hong Kong has become the go-to financial market for affluent and mobile mainland Chinese individuals, who have an appetite for US dollar- or other international currency-denominated products and services, as a base from which they can manage the long-term wealth for their families,” Phil Witherington, chief executive of Manulife, said at a banking event in Toronto last month.

The policies have become more attractive to mainlanders as the 10-year Chinese sovereign bond rate hovers around 1.8 per cent, compared with 4 per cent in the US, and to Hongkongers as long-term investments. Hong Kong’s interest rates track the US because of the local currency’s peg to the US dollar.

The purchases also come as China’s property market, where households have traditionally held most of their savings, remains in the doldrums and the economy struggles with deflationary pressures, even as the domestic stock market has performed strongly this year.

The majority of policies purchased in the second half were US dollar-denominated, with annualised new premiums rising 45 per cent to HK$77bn.

“Insurance has long been a cover option for capital flight,” said Alicia García-Herrero, chief Asia-Pacific economist at Natixis. “This is a way to bypass capital controls in a legal way.”

Besides insurance, there are few other avenues for mainland Chinese individuals to move and hold money abroad, as Beijing maintains strict capital controls to manage the renminbi.

Individuals can only purchase up to US$50,000 of foreign currency a year, though this does not include credit card transactions, and China’s State Administration of Foreign Exchange has tried to limit overseas insurance purchases in the past.

Two Hong Kong insurance brokers told the FT that mainland buyers typically used cash or mainland credit cards to make initial premium payments. They would then open local bank accounts to pay future premiums using Hong Kong dollars converted from renminbi, the brokers said.

In a sign of the sales data’s political sensitivity, the Insurance Authority at the start of the year stopped breaking out the contribution of mainland buyers to the total.

In July, the regulator said it was “conducting a comprehensive review of the scope and criteria concerning data collection on non-local policy holders” and would not publish mainland buying statistics “pending the completion of this exercise”.

The Insurance Authority did not respond to a request for comment.

“Looking ahead, we forecast total premium income to grow by 5 per cent to 10 per cent over the next two years, supported by resilient domestic demand and steady new business from mainland Chinese visitors,” said S&P’s Chen.

Additional reporting by Gloria Li in Hong Kong