Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

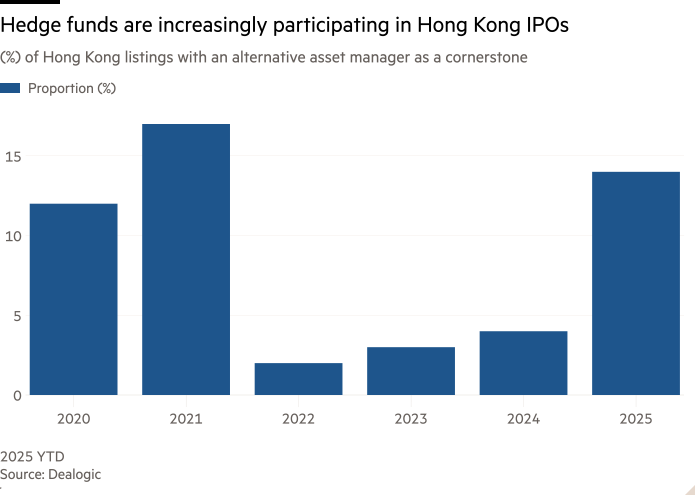

Global hedge funds are participating in Hong Kong listings at the highest rate since 2021 as the so-called “smart money” returns to the Chinese market after an extended slowdown.

Millennium, Qube Research & Technologies and Oaktree are among the asset managers that have participated as early investors in Hong Kong initial public offerings this year.

They have helped drive the proportion of listings with a hedge fund as a cornerstone investor to 14 per cent, just below 2021 levels, according to data from Dealogic. The data included alternative asset managers that run hedge fund strategies, including Boyu Capital.

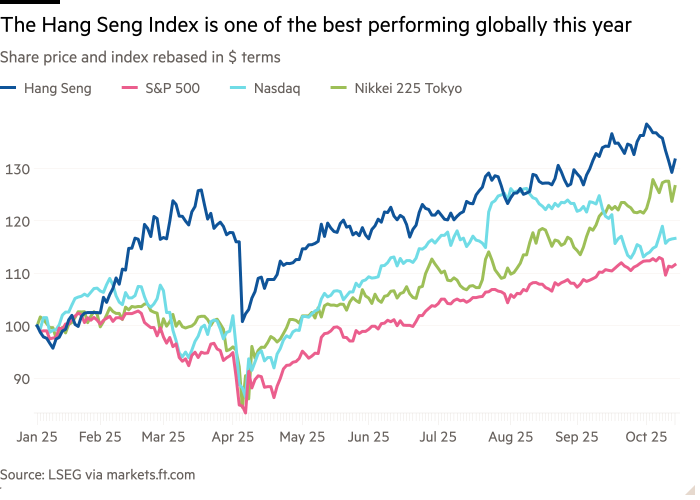

The Hang Seng is one of the world’s hottest markets this year, with a strong run of listings by companies from mainland China, including the world’s largest EV battery maker Contemporary Amperex Technology and miner Zijin Gold. The AI boom has also reignited investors’ interest in Chinese technology.

“There are two things that global investment managers have been underweight: commodities and China,” said Frank Carroll, managing director and portfolio manager of Oaktree’s emerging markets equity strategy.

He noted that hedge funds are also being joined by more traditional asset managers in coming back to Hong Kong. “[Zijin Gold] was the first deal where we said ‘wow OK, it’s not just the alternative managers, also the long only [funds] are coming in.’”

Carroll added: “The recent trend of asset allocation has been reducing the very large overweight to US markets and trying to balance it to rest of world.”

Hong Kong is poised to claim the top spot for global listings in 2025, according to KPMG, with about 300 IPO applications in the pipeline.

“A lot of the hedge funds in Hong Kong pulled back in 2022, but now they’re back,” said Craig Coben, former global head of equity capital markets at Bank of America.

“It looks a lot like the 2020-2021 boom, just with a different thematic, and they will ride the momentum for as long as they think it will last.”

Recent IPOs in Hong Kong have sharply increased in price on the first day of trading, meaning cornerstone investors can pocket sizeable profits after just one day.

Millennium most recently took part in the IPO of Zijin Gold, a spin-off of Chinese company Zijin Mining’s overseas gold assets, which closed 68.5 per cent higher on its first day as the price of the precious metal traded at record highs.

Oaktree participated in CATL’s secondary listing in Hong Kong — the largest of the year — which raised more than $5bn and closed 16 per cent higher on the day. Quant fund Qube participated in Apple supplier Lens Technology’s listing.

“Hedge fund portfolio managers are telling me the trade is China equities,” said one prime broker based in Europe, adding that many investors were bullish on stocks of Chinese tech companies in the belief they would “catch up” with US rivals this year, barring further geopolitical shocks.

Recent Goldman Sachs prime brokerage data suggested that broader hedge fund allocations to China, including Hong Kong, increased to 6.5 per cent of the average fund’s total exposure in the start of October.

Additional reporting by Amelia Pollard in New York and Costas Mourselas in London