As the evening drew in on a sweltering mid-August day in 2020, California’s strained electricity grid buckled. Amid an intense heatwave, surging power demand — amplified by soaring air conditioning use — forced the state’s grid operator to initiate two days of rolling blackouts. An inability to meet demand during the evening peak led to more than 800,000 homes losing power for up to two and a half hours.

It was the first outage of its kind in California in almost 20 years — and raised questions about the state’s reliance on intermittent renewable energy.

The fallout has spurred a boom in mega battery development. Enabled by state policies, California’s battery storage capacity has more than tripled to 13GW of power, with plans to add another 8.6GW by 2027.

Now, as cheap, plentiful solar power floods the grid in the middle of the day, hundreds of battery installations bank the energy and discharge it in the evening when people return home from work and demand — as well as prices — spike. This has shored up the grid, extended the state’s use of renewable energy and reduced its reliance on fossil fuels.

Elliot Mainzer, president of the California Independent System Operator (Caiso), which manages the flow of power across most of the state, says the blackouts in 2020 were “a clear call for action” and that batteries have “added a whole new dimension of capacity”.

© PowerChina; Terra-Gen; Saudi Arabia Ministry of Energy; New South Wales EnergyCo

California has become ground zero for the battery storage revolution, but the example is being followed all over the world. Global capacity is expected to rise by 67 per cent to 617GWh this year and to grow tenfold by 2035, according to energy research firm BNEF.

The US and China dominate the market, accounting for about 70 per cent of projects by power capacity. Batteries are also playing a growing role in Australia and the UK and countries from Chile to Saudi Arabia are announcing plans to ramp up deployment.

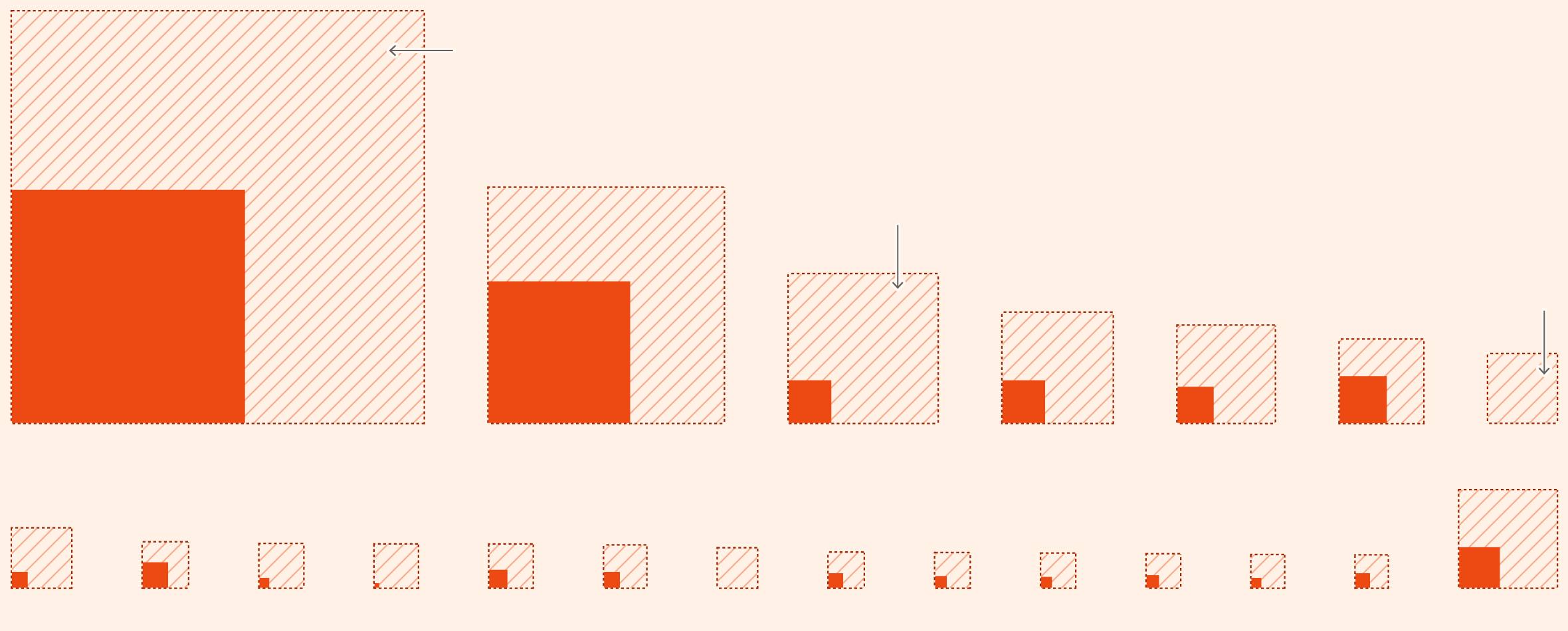

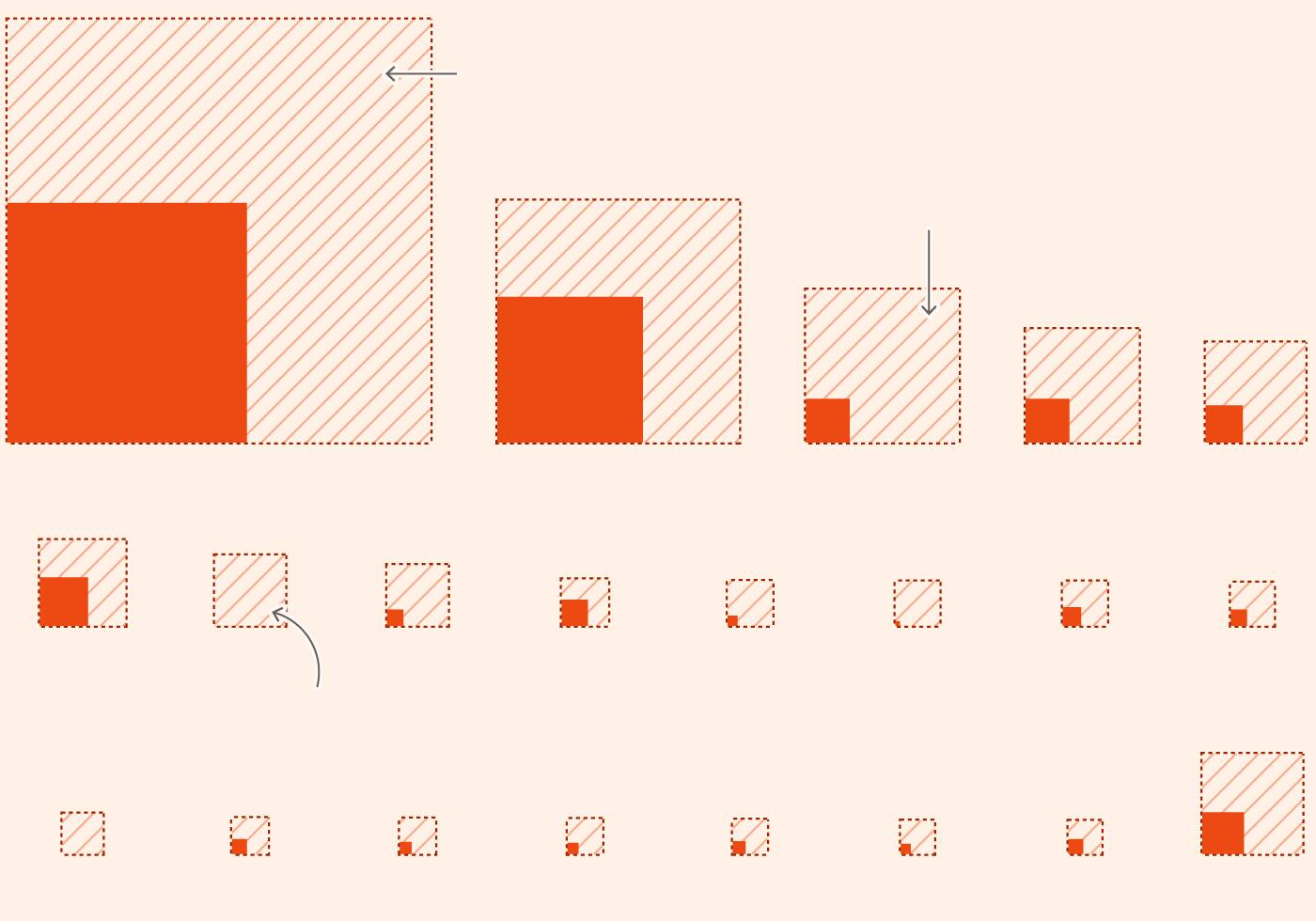

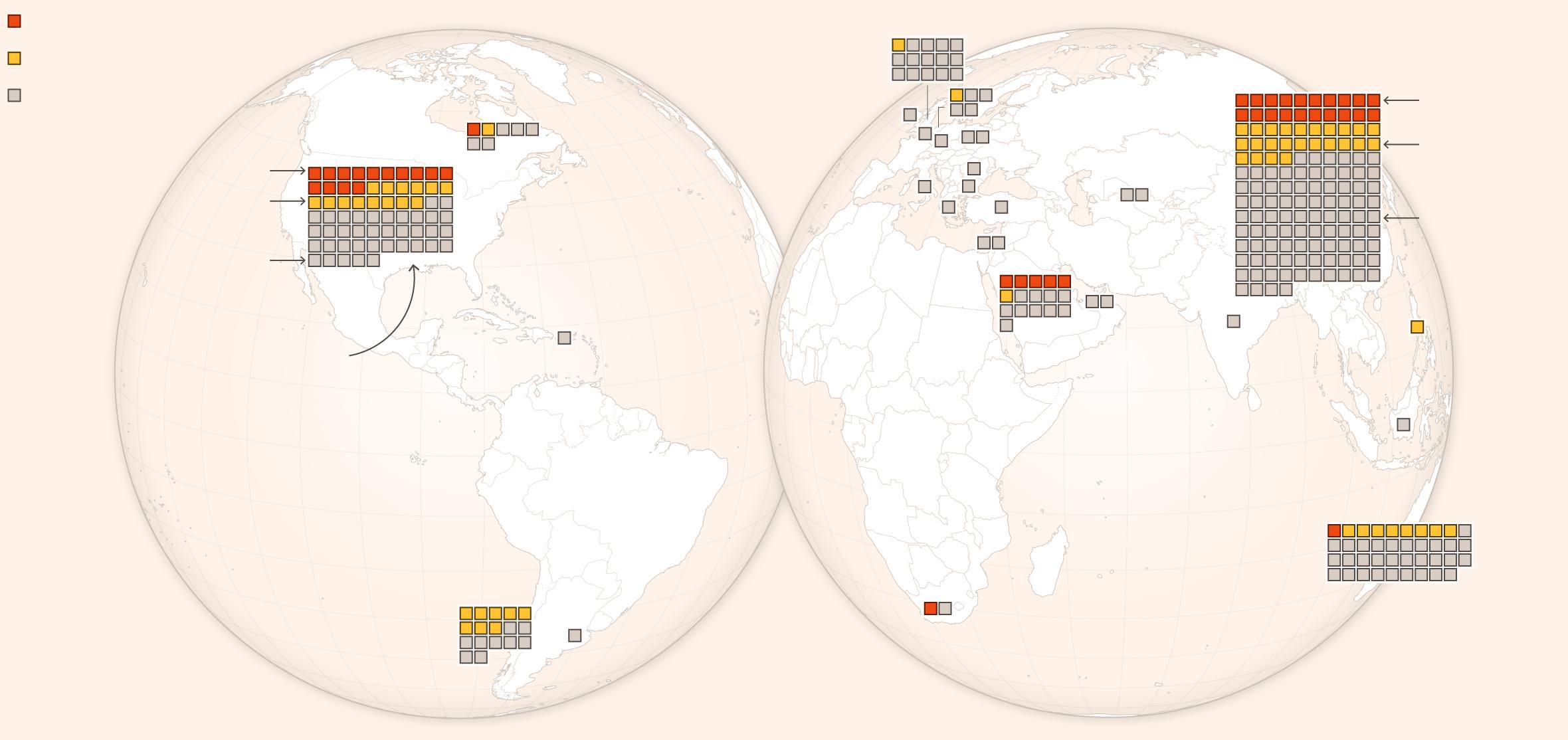

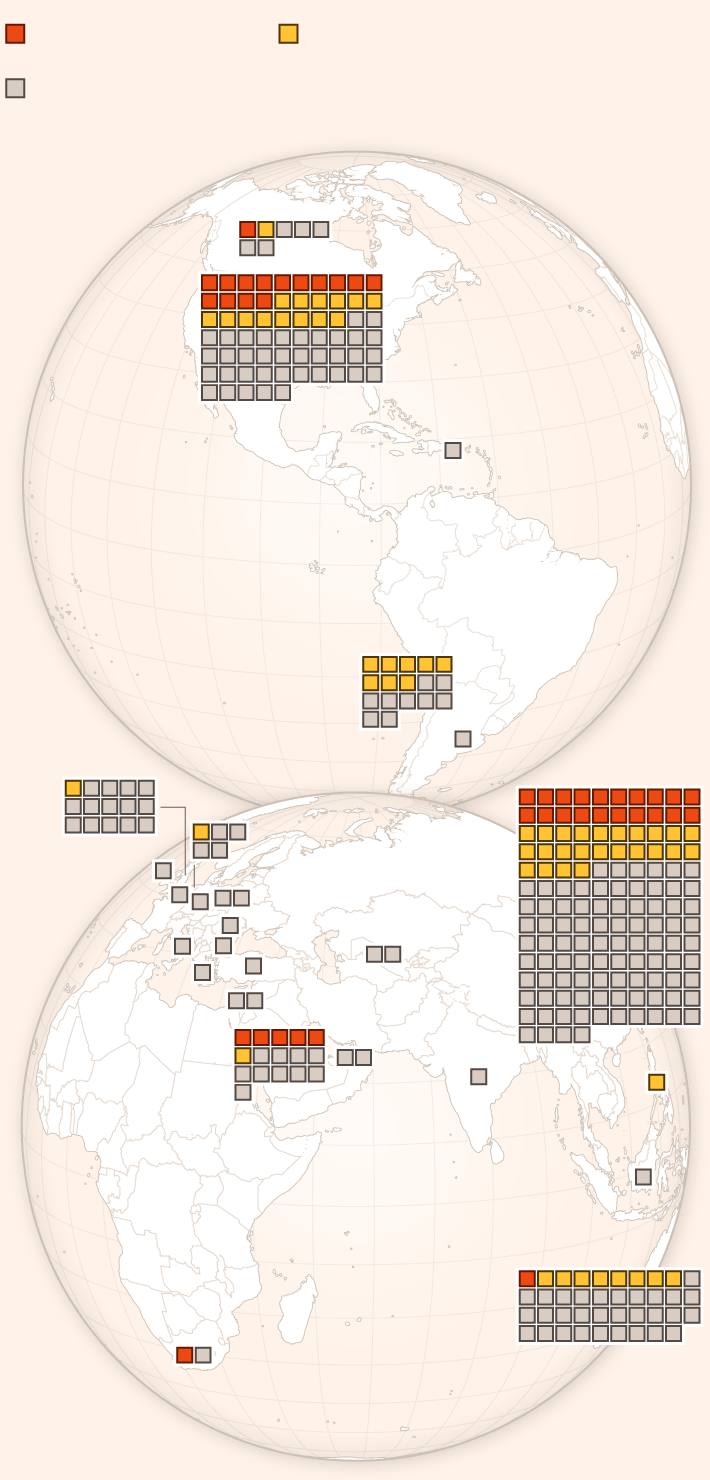

Several countries are planning to massively expand their battery capacity

Operational and in-development battery energy storage capacity up to 2027

Graphic: A chart titled “Several countries are planning to massively expand their battery capacity” which shows the total operation and in-development energy storage capacity of countries up to 2027. It shows that China has the most capacity installed (289 GWh) and in development (612 GWh), by a wide margin. Following China is the US, Australia, the UK, Chile, Saudi Arabia and the UK.

Most batteries currently used in storage can discharge power at full output for a maximum of two to four hours, which means their involvement varies by region and power system. As a relatively new grid technology, they also face policy uncertainty and market hurdles.

But rising demands for power — fuelled by energy-guzzling AI data centres, concerns over grid reliability and a glut of renewable supply — mean batteries are expected to become a crucial cog in energy systems across the world, especially with their costs plummeting.

Global renewable generation overtook coal in the first half of 2025, according to data from Ember, highlighting the huge growth in solar and wind power. This only increases the importance of storage solutions, which have lagged behind, says Daan Walter, an analyst at the energy think-tank.

Walter likens the ongoing transformation of electricity systems to an “agricultural revolution”, with batteries a critical component. “We are moving from an era where we track down and gather fossil fuels to one where we can harvest renewable electricity in place.”

A technological revolution

Breakthroughs in battery design have played a major role in improving efficiency, says Iola Hughes, head of research at commodities data group Benchmark Mineral Intelligence.

“Combined with lower raw material prices, these advances have materially improved project economics,” she says, adding that the global average price of battery storage systems have more than halved over the past two years.

Lithium-ion battery costs have also fallen — by 90 per cent since 2010 — a drop that Artem Abramov, deputy head of research at energy consultancy Rystad, says is likely to continue.

Packed full of hundreds of powerful batteries, a standard 20-foot storage unit once provided 3-4 megawatt hours (MWh). Now they typically deliver 5-6MWh, with several suppliers developing 10MWh containers — enough to power around 30,000 UK homes for an hour.

This innovation has ushered in a wave of battery farms. In 2022, there was only a single gigawatt-scale facility — defined as having a capacity of at least 1GWh, able to supply roughly 3mn UK households for an hour — in operation worldwide. Today there are 42 such sites.

Five times as many giga-projects are set to come online in the next couple of years, including in the UK, the Netherlands, Chile and the Philippines.

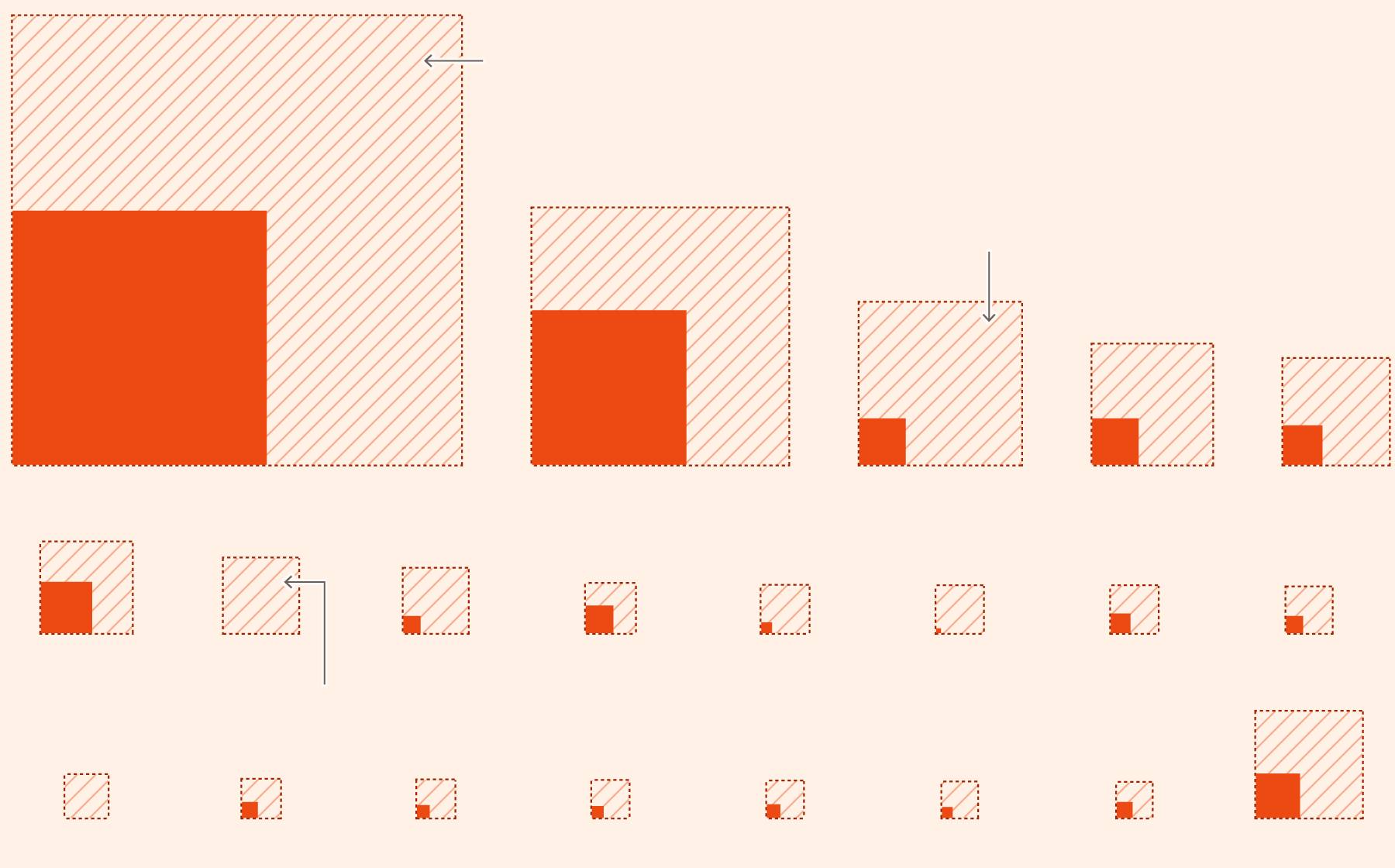

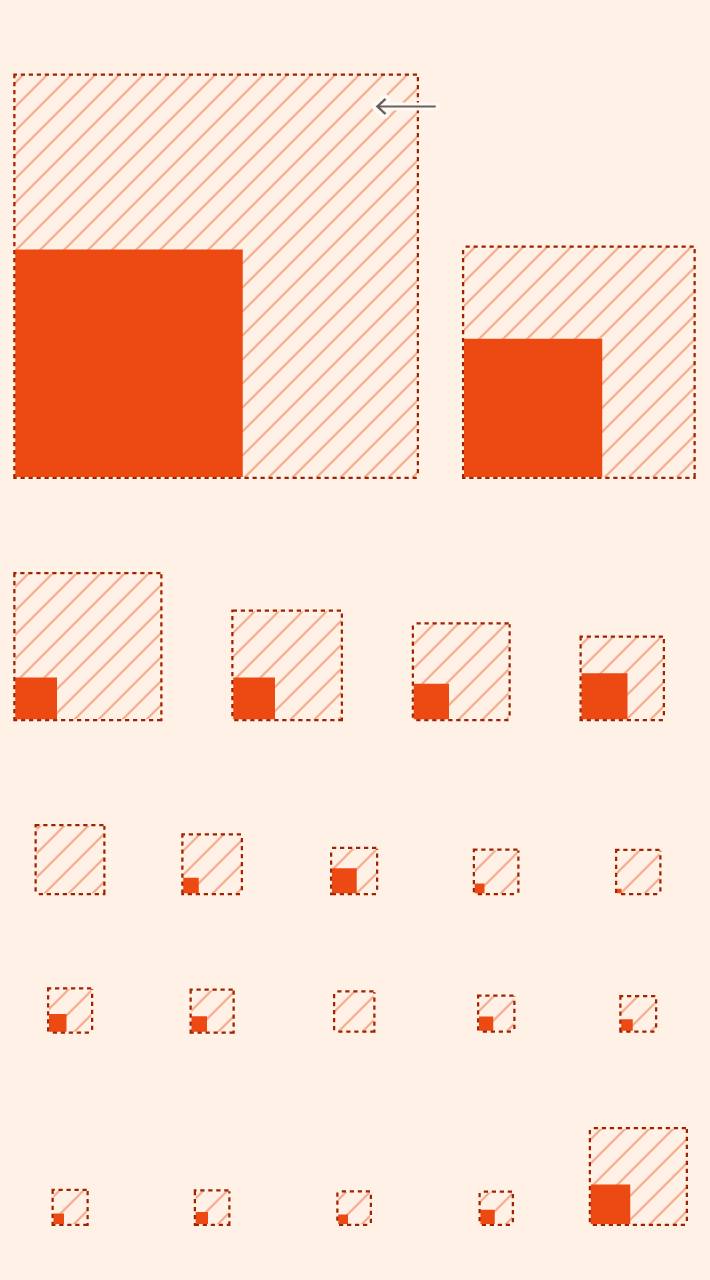

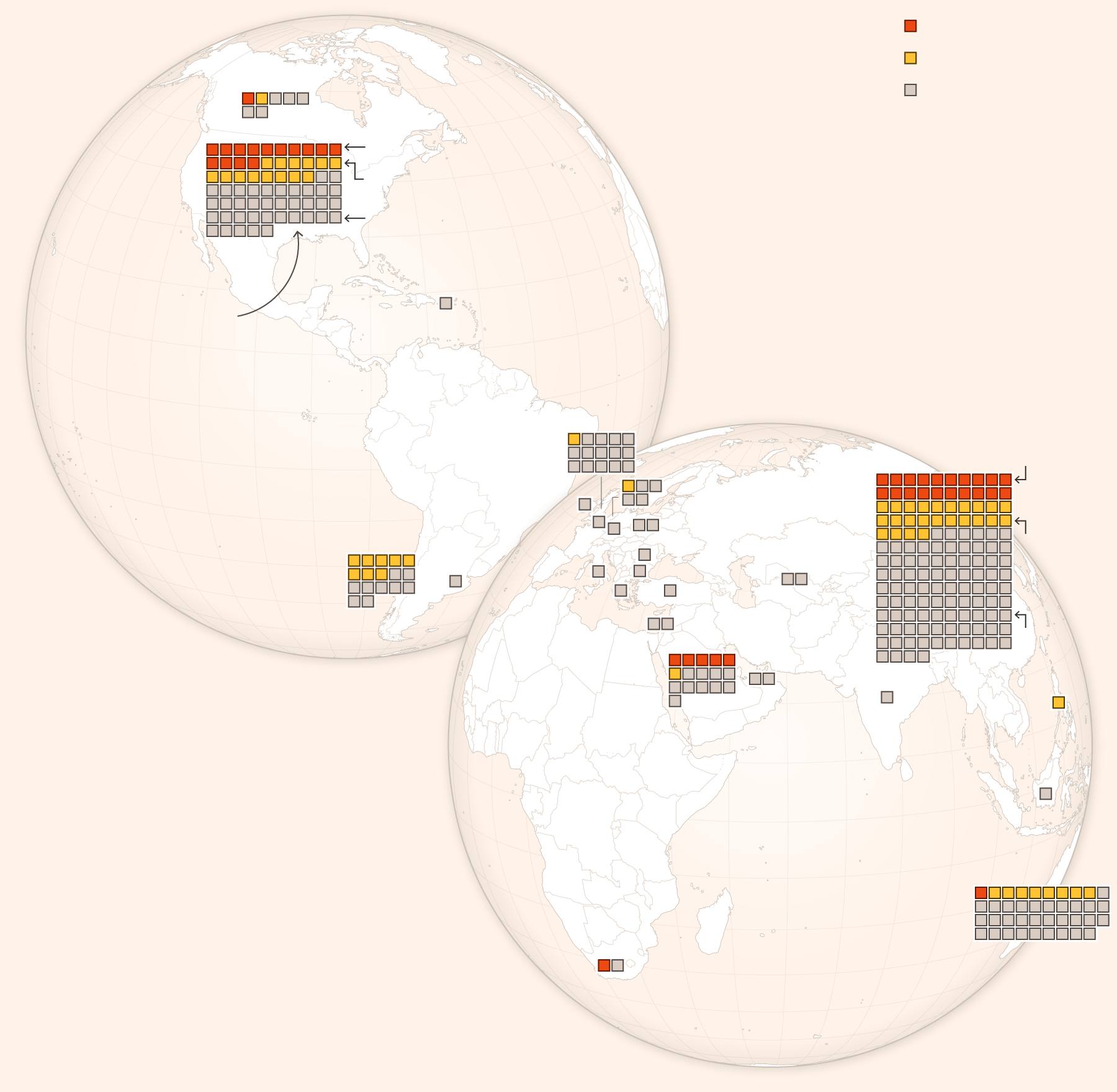

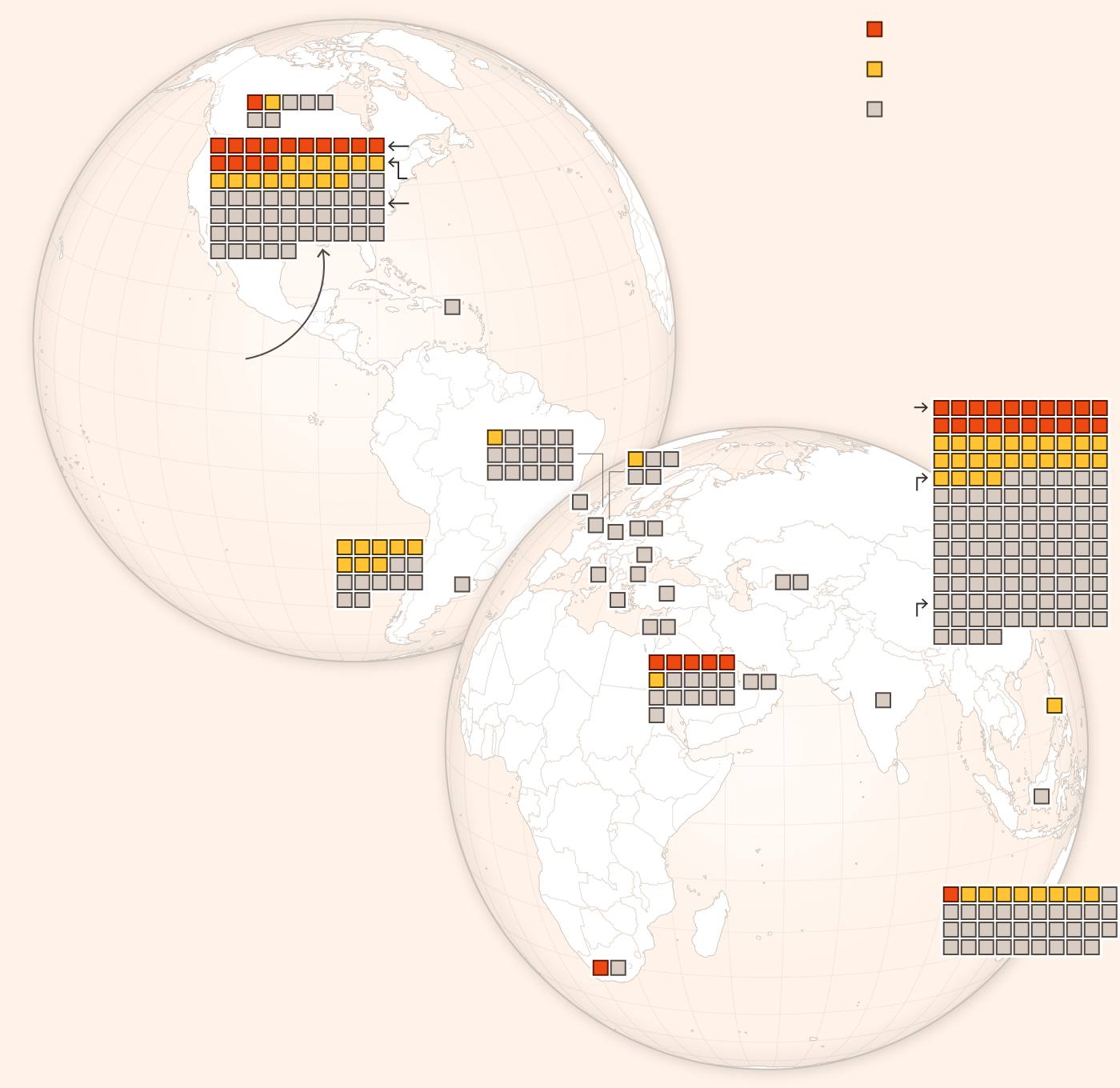

Over 250 gigascale projects could come online within two years

Gigawatt-scale projects, with total capacity of at least 1GWh

Graphic: A visual titled “Over 250 gigascale projects could come online within two years”, showing the total number of battery projects over 1GWh, by country. It shows a large number of projects under development in China, the US, Australia, Chile, the UK, and Saudi Arabia, as well as a number of projects across Europe.

Last month, Tesla — the only non-Chinese company in the top five battery storage system manufacturers globally — unveiled Megablock, a large-scale battery system that the company says will significantly cut installation times and reduce construction costs.

Megablock will be built and pre-packaged within a Tesla factory, with a design that reduces the number of electrical connections. Mike Snyder, vice-president of energy and charging, said at a launch event in Las Vegas that Megablock would allow Tesla to install 1GWh in 20 business days, the equivalent of “bringing power to 400,000 homes in less than a month.”

A week later, Chinese EV giant and battery maker BYD announced its new Haohan battery system, which has twice as much power as a Tesla battery block when adjusted for size.

China, which produces over three-quarters of batteries sold globally, has played a crucial role in the energy storage boom. Chinese companies, supported by state backing, have brought down costs through mass production.

Domestic demand in China is also skyrocketing, with Bernstein predicting a 90 per cent year-on-year rise to 335GWh by the end of 2025 — smashing expectations of only a modest increase after months of uncertainty over new electricity pricing rules.

Driven by both strong power consumption growth — from data centres, electric vehicles and air conditioning — and the country’s long-term replacement of coal with renewable energy, battery storage demand in China is expected to reach 652GWh by 2030, at a compound annual growth rate of 14 per cent, according to Bernstein data.

Energy storage has emerged as a “key part” of China’s green transition, says Caroline Wang, a China expert with Climate Energy Finance, a Sydney-based think-tank. “They’ve added massive amounts of solar and wind in the last decade and now there are some issues with intermittency and grid stabilisation — energy storage is seen as a critical solution.”

China’s battery makers, benefiting from sustained policy support and amid fierce market competition, are investing in options which can store more energy, such as solid-state batteries. This could make installations more efficient if brought to mass scale, Wang adds.

But there is rising concern from Xi Jinping’s administration over the rise of “zombie factories”, where battery factory capacity in older technologies has been overbuilt or is no longer needed. To improve the sector’s financial health, companies are expected to retire and eliminate lower value factories while also boosting exports.

In the US, Trump’s aggressive pushback against renewable energy is threatening to slow the sector’s momentum. But analysts anticipate a combination of the significant drop in battery costs and the need to store energy means that projects will still get built.

Battery storage capacity in the US jumped 63 per cent in the first half of this year, according to data from S&P Global, driven by a surge in Texas.

Allison Weis, global head of storage at energy consultancy Wood Mackenzie, told a conference last month that she expected deployment to remain at high levels as demand from data centres and manufacturing increases.

The business model

Mega batteries provide all kinds of services, from balancing supply and demand to restarting the system in emergencies, which allows them to tap into multiple revenue streams.

“What grid operators and utilities value from batteries is flexibility,” says Mark Dyson, a managing director at the Colorado-based nonprofit RMI. “They can be a ‘swiss army knife’ and do whatever is needed on the grid, when and where that is required.”

In April, a blackout triggered by a voltage surge left almost 60mn people in Spain and Portugal without electricity. As part of its response, the Spanish government is trying to change regulations so battery owners can earn revenue for helping to stabilise the grid’s voltage, one of several key services.

In markets like the UK, battery operators also get paid for being on standby to provide vital backup capacity when supplies are tight.

But as renewable power becomes more abundant, the main opportunity for battery owners is to buy electricity at low costs and sell it back to the grid when prices increase.

Power prices are highly volatile — they dip when too much renewable electricity is generated and rise sharply when there is a shortage in supply. In particularly sunny or windy spells, prices can even drop below zero, where producers must pay wholesale customers or storage operators to take excess power off their hands, or switch off.

This year, wholesale electricity prices — not the retail tariffs paid by most consumers — were negative for a record number of hours across several European countries. Spain, where nearly a third of summer supply came from solar power, logged more than 500 hours of prices below zero this year, having never experienced them before 2024.

Battery operators can capitalise on these low prices — storing energy when it is cheap and redistributing it when it is expensive — and major companies are now investing heavily in the sector. Trafigura, one of the world’s largest suppliers of commodities, now owns 50 per cent of battery storage and renewables developer Nala Renewables, alongside funds managed by IFM Investors. Rival trader Vitol invests in batteries through its US subsidiary VC Renewables, and through VPI Vitol, the UK-based company it backs.

Sunbelts and bottlenecks

Research by the Energy Transitions Commission (ETC) shows that in “sunbelt” locations — countries from India to Mexico with ideal conditions for solar power — batteries could meet almost all power balancing needs. In these regions, solar follows a predictable daily pattern and is relatively consistent between seasons, enabling batteries to play a role on a daily basis.

This presents a “huge economic opportunity”, says Elena Pravettoni, head of analysis at the ETC, a global coalition of companies working towards a net zero economy by 2050. “The combination of solar and batteries means clean power costs in sunbelt regions could be 50 per cent lower than today’s fossil-based systems.”

In countries more reliant on wind power — such as the UK, Germany and Canada — batteries alone will not suffice, according to the ETC. Wind is less consistent, and current battery technology cannot fill the gap over multiple days.

Falling lithium-ion costs could enable batteries to be stacked up in greater numbers and supply power for longer. Alternative chemistries, such as flow or iron-air batteries, could also allow storage to be provided over consecutive days. But efficiency improvements and major cost reductions are needed before these solutions are commercially viable.

Ultimately other technologies will be a crucial part of the mix. Pravettoni says these include pumped hydro, compressed air energy storage and low-use gas turbines. RMI’s Dyson also suggests building new transmission lines and shifting demand so power is used when renewable generation is plentiful as additional ways to relieve pressure on grids.

Batteries can reduce the need for more power, but they can face challenges becoming operational. The shift to renewables has triggered a surge in connection requests, from wind, battery and solar farms, overwhelming operators and planners and creating long backlogs.

And when connected, batteries are not always utilised to their full potential. Britain’s network operator has blamed ageing computer systems and an outdated electricity network for batteries being overlooked even when they are cheaper than other power sources.

But in a number of markets, the factor holding investors back is the absence of clear long-term policies, says Coen Hutters, energy transition specialist at Dutch lender Rabobank.

“These projects aim to be online for around 15 to 20 years, but if you only know the policy for the next one to five years then that causes a big issue,” he says. “This creates a lot of uncertainty for investors and developers.”

In some countries, batteries are subject to double-charging, having to pay fees to draw power from the grid as well as when injecting energy back into it.

This illustrates the complicated regulatory and policy frameworks developers must navigate. The US has seven wholesale power markets, each with their own rules, policies and price signals, while the EU’s patchwork of regulations poses its own challenges.

“Right now, there are many markets in Europe where, on paper, you could make a very profitable business model out of energy trading with batteries,” says Rystad’s Abramov. “But in reality a lot of projects are at the concept stage — the regulatory environment has to evolve a little bit more from where we are today.”

To manage risk and lock in a stable source of income, some developers are turning to tolling agreements, particularly popular in Germany’s burgeoning market. Under these contracts, the developer effectively hands over control of the battery to a third party — typically a large utility or energy company with a broad portfolio of assets — in exchange for a fixed price.

But Lisa McDermott, who leads financing for battery storage projects at ABN Amro bank, believes “there is a lot of financial innovation” aimed at maximising the technology’s value.

Battery farms can face local opposition, with fire risks one of the concerns raised. Faults can cause rapid overheating, triggering blazes which can release noxious gases and are tough to tackle. Earlier this year, a fire at Moss Landing, California, one of the largest battery storage plants in the world, burned for days, leading to the evacuation of over 1,000 residents.

But these incidents are increasingly rare: a Volta Foundation report in 2024 found that the number of fires or explosions per gigawatt was at its lowest level since 2016.

New battery installations are typically designed with more effective suppression systems, improved site layouts and safer, more fire-resistant battery chemistries, experts say. And mega batteries’ importance to grids is increasingly clear.

In California, batteries consistently supplied more than a quarter of electricity during this year’s spring and summer peaks, data from energy analytics platform Grid Status shows. In the first eight months of 2025, gas generation was down 37 per cent from 2023, according to climate academic Mark Jacobson of Stanford University.

In Australia, several battery farms are being installed at the sites of retired coal plants. The country’s grid-scale battery storage power capacity has more than tripled since the start of 2024 and in early May, batteries contributed more than 5 per cent of power in the evening peak for the first time. Many countries are hoping to see similar results.

Electricity is “the ultimate perishable good”, Ember’s Walter says, and batteries can unlock its potential much like “grain silos stabilised harvests and refrigeration preserved fresh food. The technology to do this may be new, but the economics are as old as civilisation.”

Additional reporting by Edward White, Rachel Millard and Maya de Souza. Additional development by Dan Clark.

Fuel mix, generation and load data from Grid Status. California operating battery facility locations from EIA data, which is preliminary and relies on self-reported data. Capacity figures are based on EIA totals and facilities constructed in multiple phases may be reported as separate sites. Population data from Copernicus GHSL.

Drone footage of Edwards Sanbord from BlackBoxGuild. Aerial images of Kola Energy Storage from NextEra Energy and of Eland from SOLV Energy, courtesy of Arevon.