From west Africa’s Sierra Leone and Liberia to Kiribati and Tonga in the Pacific, the impact from China’s rising dominance as the world’s first significant “electrostate” is beginning to be felt.

Chinese solar panel exports reached 236GW in 2024, more than triple the volume of 2019, and should hit a new record high again this year, according to data from French bank Natixis and Ember Research, a UK think-tank. In Africa, imports of Chinese-made solar panels in the year to the end of June topped 15GW, an increase of 60 per cent from the prior 12 months, Ember data also showed.

The statistics, however, highlight just one of a panoply of clean-technology industries now dominated by China.

Similar trends — of booming Chinese cleantech exports — can be found across electric vehicles and trucks, batteries, wind and gas turbines, and small-scale nuclear reactors as well as transformers and other key electricity transmission equipment for modern power grids.

Tim Buckley, director of Climate Energy Finance, a Sydney-based research group focused on China, says the country’s long-term cleantech ambition is “profound” and stands in stark contrast to Beijing’s rival superpower, the US, where President Donald Trump has embraced fossil fuel industries and gutted his predecessor’s support for renewable energy.

“I think China is using it in a very, very geopolitically savvy way, taking advantage of America’s stupidity and regression back into a petrostate,” he says, adding: “China just wins. America has abrogated the playing field.”

From one perspective, China’s path to electrification and consequent dominance of clean tech industries makes for impressive, if not alarming, reading.

In a report released in September, Ember highlighted a litany of statistics showcasing the country’s clean energy and electrification boom.

Among them, China’s investments last year of $625bn in clean energy, which amounts to nearly one-third of the global total. And the $1.9tn contribution of clean energy to China’s economy last year is about one-tenth of GDP and equivalent to the entire Australian economy.

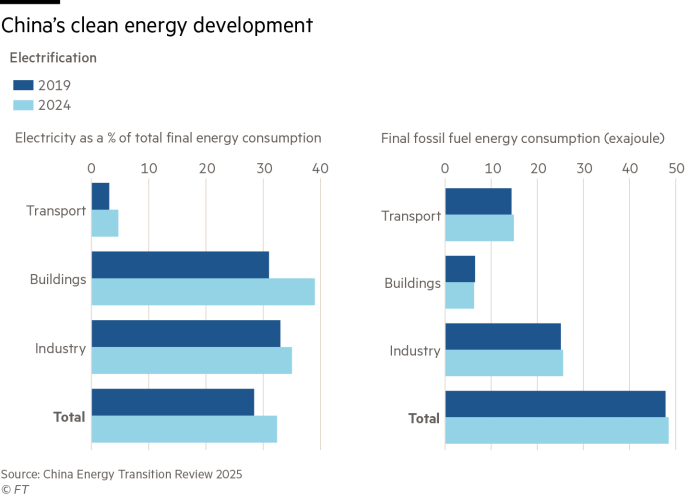

The pace of electrification, which refers to swapping a reliance on fossil fuels for electricity, is also notable. In China this reached 32 per cent in 2023, and is growing by about one percentage point annually, while electrification rates in Europe and the US have plateaued over the past decade.

Taken together, these achievements have led to analysts referring to China as the world’s first significant “electrostate”, a global manufacturing superpower with a rising share of industry coming from electricity — rather than fossil fuels — and an economy increasingly driven by clean technologies.

While China’s energy transition has been welcomed by environmental groups, Christoph Nedopil Wang, a China energy and finance expert with Australia’s Griffith University, in the Ember report highlights the underlying strategic reasons for Beijing’s decarbonisation efforts.

“First, it locks in China’s role as the global manufacturing hub for the clean energy age. Second, it fixes a major vulnerability — reliance on imported fossil fuels,” he says, adding: “China is serious about this shift. When it sets a direction and commits, it rarely turns back.”

For many developing countries, the abundance of China’s cleantech creates an opportunity to not only eradicate a reliance on fossil fuels, but also to build new manufacturing industries around cheaper power supplies.

And yet from a different perspective, on the ground in China, the path to becoming an electrostate has myriad complexities that are far from being resolved.

Among the key challenges is reducing the use of coal in electricity generation and for thermal use in the country’s heavy industries, including making steel and cement.

China consumes about half the world’s coal and has long faced criticism from western officials and climate campaigners that, despite its progress in renewable energy, it remains too slow in cutting coal use.

Steel, where China is by far the world’s biggest producer, is a clear example. Beijing in 2022 set a relatively modest target for the share of steel production to be made using electric arc furnaces — rather than traditional coal-based blast furnaces — to reach 15 per cent by this year.

But as Xinyi Shen and Belinda Schäpe, analysts from the Centre for Research on Energy and Clean Air, noted in a recent report, the actual share has remained stagnant at about 10 per cent for the past decade. They also point out that missing the 2025 EAF target will increase China’s carbon emissions by more than 160mn tonnes, “nearly equivalent to the entire EU steel sector’s footprint”.

David Fishman, a Shanghai-based energy analyst at The Lantau Group, a consultancy, says that Chinese policymakers and engineers are spending “a great deal of energy” on overcoming the challenges of electrifying China’s heavy industry. And progress will be crucial if China is to meet the ambitious guidelines Beijing has set for energy and carbon intensity for the industrial sector.

“They’re working on every single hard-to-abate segment in heavy industry that can be electrified,” he says. “Sometimes it’s a straightforward ‘process change’, and you just need to invest in the retrofits. And sometimes the technology is very cutting edge and will have to be piloted and demonstrated and it will be very difficult.”

China’s cleantech sectors have also not been immune from Beijing’s campaign against so-called neijuan, or “involution”. The term refers to surging industrial output which is far outpacing demand. This is not only adding to China’s stubborn deflationary pressures but is exacerbating tensions with the country’s biggest trading partners — many countries accuse China of dumping, exporting products on such a scale and low cost that foreign manufacturers struggle to compete.

Still, there are increasing signs that Beijing believes it can leverage its cleantech dominance and promote itself as a reliable long-term partner, offering to the developing world an alternative to the US.

Ilaria Mazzocco, an expert on industrial policy with the Center for Strategic and International Studies, a Washington think-tank, points to long-term geopolitical implications as Chinese cleantech companies are becoming more embedded in markets that US companies are retrenching from.

“The patterns could end up resembling the fight over 5G and Huawei, but without the backing of Europe and even fewer alternatives to offer,” she says, adding: “I actually don’t think Washington has really woken up to just how popular these new energy and electro technologies that China is exporting are.”