Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

Global stocks fell on Friday following US President Donald Trump’s threat to impose “massive” tariffs on China.

In a post on Truth Social, Trump accused Beijing of becoming “very hostile”, citing its recent decision to impose export controls on critical minerals.

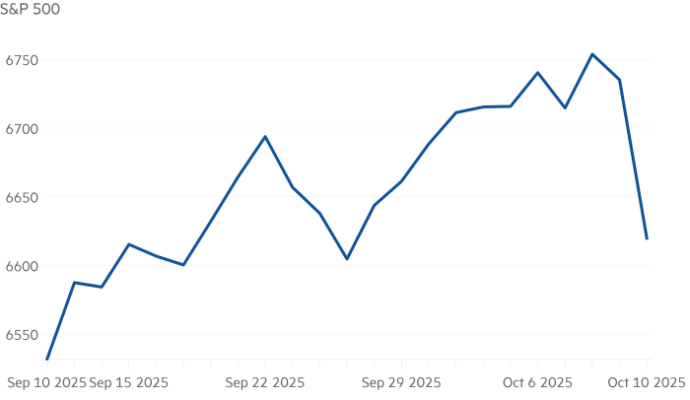

The blue-chip S&P 500 fell as much as 1.6 per cent following the post, before recovering slightly to trade 1.3 per cent lower by early afternoon in New York. The tech-heavy Nasdaq Composite was down 1.8 per cent. Both indices have hit a series of record highs in recent weeks.

Investors flocked to safe haven assets in response, sending the price of government bonds and gold higher.

The yield on the benchmark 10-year Treasury fell 0.09 percentage points to 4.06 per cent following the news. Bond yields move inversely to prices.

The price of gold rose after slipping lower earlier in the day, topping the $4,000-per-troy ounce milestone. Bullion first hit the landmark on Wednesday morning following a dizzying rally in recent months driven by investor fears over inflation and growing debt piles.

Oil prices, which were already lower following the start of Israel’s truce with Hamas, extended declines following Trump’s latest sabre-rattling on trade. Brent crude, the international benchmark, sank 3.8 per cent to trade at $62.70 a barrel.

The US-China fallout will create “short-term higher volatility but might provide good entry levels”, said Matthias Scheiber, head of multi-asset at Allspring Global Investments. “The fundamentals in the US have been improving and earnings are strong.”