This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

EU backs tariffs on cheap Chinese steel

Supreme Court blocks Trump from immediately firing Fed’s Lisa Cook

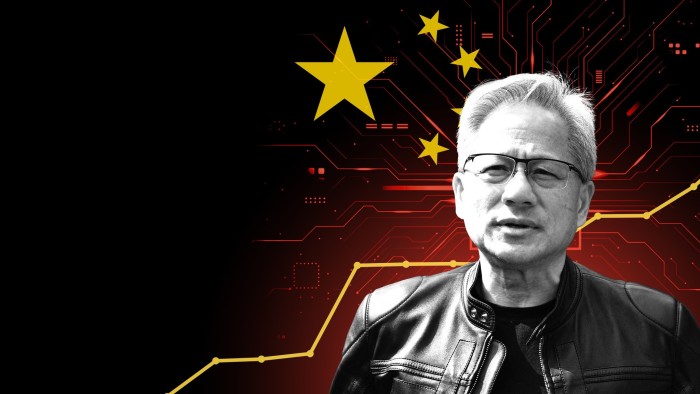

Can Nvidia save its China business?

We begin in Brussels where the EU is planning to join US and Canadian efforts to tackle cheap Chinese steel imports by reducing import quotas and increasing tariffs.

What’s happening: The European industry commissioner promised industry bosses and unions to levy tariffs of up to 50 per cent on foreign steel at an emergency meeting on Wednesday, according to two people briefed on the talks. Stéphane Séjourné said the European Commission would “reduce foreign steel quotas by almost half” and “significantly increase customs tariffs, in line with what our American and Canadian partners are doing”, the people said.

Why it matters: The EU is hoping the move will satisfy the White House that it is acting to keep a glut of Chinese steel out of big world markets, and that the bloc will secure lower US tariffs in return. Séjourné said the EU must not be “naive”, in a pointed reference to China. “We refuse to be open without limits to foreign overcapacity. We refuse to accept dumping prices made possible by massive subsidies.” But some EU countries and industries — including carmakers — are warning that curbing cheaper imports could drive up prices. Read the full story.

Here’s what else we’re keeping tabs on today:

Economic data: South Korea publishes September inflation data and Singapore reports PMI for the month. Japan releases the latest consumer confidence survey.

Japan: The 62nd US-Japan Business Conference begins in Tokyo, running for two days.

Five more top stories

1. The Supreme Court has refused to let Donald Trump immediately fire Lisa Cook, in a pivotal victory for the Federal Reserve governor and the US central bank’s independence. The top US court deferred a decision on the president’s bid to sack Cook until the justices hear oral arguments in the case in January 2026.

2. South Korea’s leftwing president has announced a steep rise in military spending, following pressure from Washington to shoulder more responsibility for the country’s defence. Lee Jae Myung said the annual defence budget would rise by 8.2 per cent next year, the largest increase since 2008, in response to “an era of increased conflict, where it’s every man for himself”.

3. Taiwan has been buying millions of tonnes of oil product naphtha from Russia since the full-scale invasion of Ukraine, raising concerns that China could lean on Moscow to choke off supplies and threaten Taipei’s economic security. Read more about Taiwan’s dependence on Russian naphtha, which is used to make chemicals for technology and semiconductor manufacturing.

4. First Brands Group’s $1.1bn rescue loan faces a legal challenge from a Utah-based private asset-backed finance specialist, which has emerged as the largest known creditor to the bankrupt US auto parts company. Onset Financial built up $1.9bn of exposure to auto parts manufacturer First Brands in the years before it collapsed into bankruptcy, according to legal filings.

5. A long-awaited rise in interest rates and a number of corporate governance reforms have made Japan a major global target for private credit funds, according to one of KKR’s top executives in Asia. Diane Raposio, who oversees both KKR’s credit and capital markets businesses in Asia, said it was tapping Japan’s vast pool of insurance assets to make loans in yen to companies. Read the full interview.

The Big Read

China has been a critical market for Nvidia for years and the AI chipmaker is embedded in key parts of the country’s software-hardware infrastructure. But that symbiosis is in jeopardy as Nvidia’s chips become a bargaining tool in superpower politics. Jensen Huang, the Nvidia chief executive who has assumed the unofficial post of global AI diplomat, is on a mission to save his China business.

We’re also reading . . .

Japanese economy: Inflation of the sort reflected in the curry rice price index has collided noisily with the country’s politics, writes Leo Lewis.

‘Patriot’ bonds: Indonesia’s richest tycoons are lining up to buy so-called patriot bonds despite below-market yields, in a show of support for President Prabowo Subianto.

Hamas’s final red line: The militant group is under intense pressure to accept a US ceasefire proposal for Gaza. Will it fold?

Chart of the day

Trump is turning interdependence into a chokehold, writes Martin Wolf, but others can play at this game too. China already is, he writes in his column on the new era of predatory superpowers.

Take a break from the news . . .

New research may well challenge ideas about how the first celestial objects formed, and in what order. Did stars and galaxies give rise to black holes, or was it the other way around? Anjana Ahuja reviews the science.