Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

The Trump administration’s incoming fees on Chinese-made vessels visiting US ports will weaken China’s shipbuilding dominance and boost Japanese and South Korean rivals, said the head of one of the world’s biggest shipowners’ groups.

Hitoshi Nagasawa, president of the Japanese Shipowners’ Association, which represents the world’s second-largest ship-owning nation after China, said fleet owners were already rethinking orders to Chinese yards and exploring alternatives ahead of levies set to take effect next month.

“Relying solely on China for shipbuilding is risky,” he said in an interview at the association’s headquarters in Tokyo. “A shift is bound to happen where those ordering 100 per cent of ships from China until now might do 60 to 70 per cent with China and 40 per cent with Japan or South Korea.”

Starting on October 14, Chinese-built vessels must pay $18 a tonne or $120 per container discharged when docking at US ports, rates that will increase over three years. An average-sized container ship can expect to pay more than $680,000 a visit, based on UN figures of US port calls in 2023.

Fees may be cancelled or remitted if shipowners order a US-built vessel within three years, according to the plan by US President Donald Trump’s administration, which is partly aimed at reviving US shipbuilding.

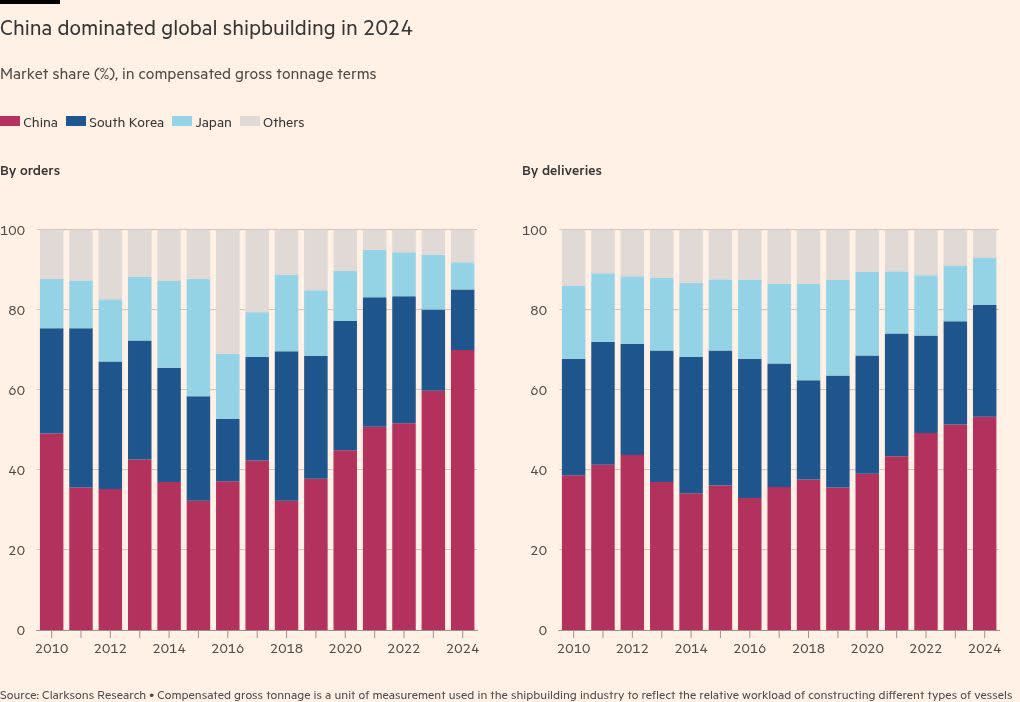

The port fees have provoked a backlash from the shipping industry because China is the world’s largest builder of vessels, making about a third of the global commercial fleet by tonnage, according to Clarksons Research.

Chinese-built or operated ships accounted for 29 per cent of port calls to the US last year, according to Lloyd’s List. But analysis by Goldman Sachs showed only 4 per cent of total US port calls would fall under the new rules due to various exceptions, including for vessels that are small, on short voyages or empty upon arrival.

Critics have questioned whether the fees will reduce China’s grip on shipbuilding, after the Trump administration lowered them from an initial proposal of $1mn to $1.5mn per port call following industry pushback, especially from US farmers who export to China.

Nagasawa signalled support for the measure, saying: “Nobody thought there would be a person to say such a thing — we’re imposing port fees just on you, Chinese ships — but that person has come.”

Nagasawa, who is also chair of shipping company NYK Line, said “inquiries were indeed increasing significantly” to Japanese shipyards, but it was difficult to secure orders because the yards were “sold out for several years”.

Japan’s capacity-constrained shipbuilding sector is in crisis as its share of new-build orders has fallen to less than 7 per cent from a recent peak of 29 per cent in 2015, despite a global boom in demand. China, meanwhile, took 70 per cent worldwide share last year.

Trump’s move could provide a tailwind to Japan’s plan to revive its shipbuilding sector, once the world’s biggest but now behind China and South Korea. The country has proposed establishing a $7bn fund to upgrade and enlarge its yards.

However, Nagasawa said Japan would need to address labour shortages, outdated facilities and high steel prices.

Nagasawa admitted that South Korean rivals were better placed to invest in Trump’s shipbuilding drive, given their larger scale, but he saw potential to service US naval vessels in Japan and to collaborate on icebreakers.

Shipbuilding was singled out as a key sector for $550bn of Japanese investment into the US agreed in July as part of a trade deal.