Stay informed with free updates

Simply sign up to the Chinese economy myFT Digest — delivered directly to your inbox.

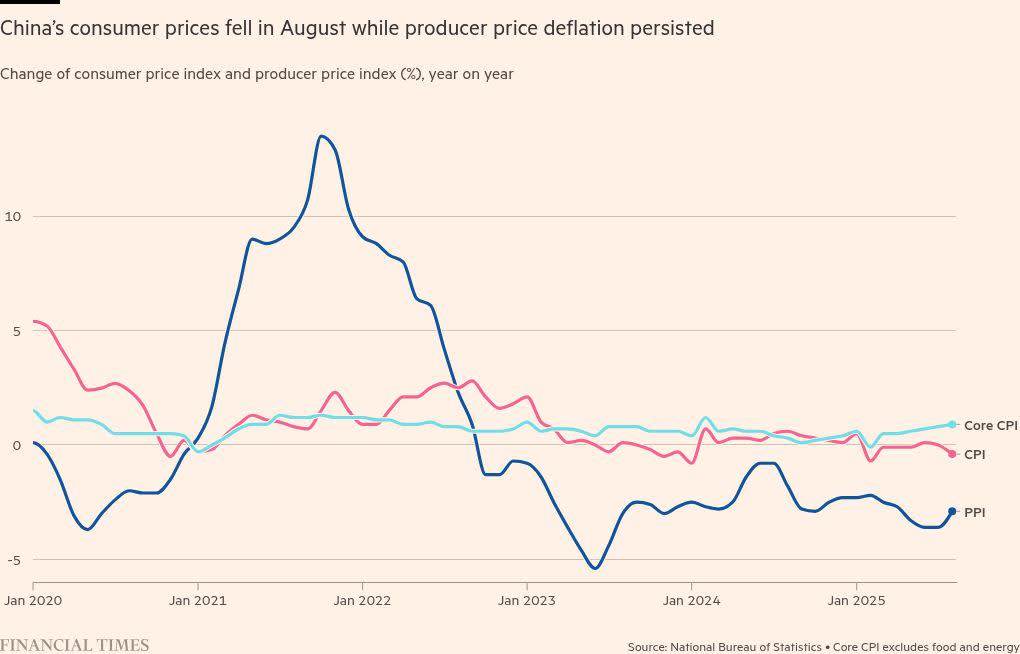

China’s consumer prices slipped into deflation in August, adding to signs that the world’s second-largest economy is losing momentum after exports grew more slowly last month.

The official consumer price index contracted 0.4 per cent year on year last month, official data showed on Wednesday, a sharper fall than the 0.2 per cent decline forecast in a Bloomberg poll of analysts. CPI was flat in July.

China’s producer prices index, meanwhile, fell 2.9 per cent year on year in August, the figures from the National Bureau of Statistics showed, compared with the 3.6 per cent drop in July and the first time in five months that the gauge showed signs of improvement.

The weakness of the figures will increase scrutiny of Beijing’s anti-involution campaign, under which policymakers are pressing some industries to reduce overproduction and restore pricing power and counter long-running deflationary pressures.

Dong Lijuan, the bureau’s chief statistician, attributed the return to CPI deflation to a high base of comparison with a year earlier and weaker food prices.

The soft inflation data follows figures showing that China’s export juggernaut grew at its slowest pace in six months in August, as US President Donald Trump’s trade war weighed on manufacturers and frontloading of shipments to pre-empt tariffs tailed off.

Beijing has relied on strong exports in recent years to meet its ambitious annual growth targets of about 5 per cent in the wake of a property slowdown and weak consumer demand.

Authorities have also backed heavy investment in manufacturing to fuel growth, but resistance to China’s exports overseas and a lack of domestic demand has led to producer deflation, which in August marked its 35th month.

Beijing has also unveiled a series of measures aimed at strengthening spending and supporting consumer prices, from offering subsidies for trading in old household appliances to covering part of the cost of interest on consumer loans.

“Policymakers are ramping up their campaign against ‘involutionary’ competition in an attempt to combat deflation,” research group Gavekal wrote ahead of Wednesday’s inflation data. “There’s little evidence that the effort has lifted prices so far.”

Gavekal added that weak economic figures in July indicated that the anti-involution campaign risked leading to a slowdown in investment and a pullback in growth.

But Dong of the NBS said core CPI for August, which excludes energy and food prices, had expanded for the fourth consecutive month, growing 0.9 per cent year on year.

“Policies to expand domestic demand and promote consumption continue to take effect,” Dong said.

He also noted that producer prices had ended eight months of month-on-month declines and were flat in August compared with a 0.2 per cent drop last month.

Data visualisation by Haohsiang Ko in Hong Kong