Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

China’s homegrown robot makers are driving a wave of low-cost automation that is helping local factories churn out more goods at lower prices, allowing the country to increase its share of exports, even in labour-intensive products.

President Xi Jinping’s Made in China 2025 plan and other government initiatives have pushed to build up domestic robot makers and pump investment and credit into manufacturing.

Chinese factories are installing about 280,000 industrial robots every year, or half the global total, bringing the country’s robot-to-worker density ahead of Germany and closing in on leader South Korea, according to the International Federation of Robotics.

Data from Chinese research group MIR Databank shows that about half of those robots are made by domestic groups such as Chengdu CRP Robot Technology, which has won local customers by undercutting global rivals on price.

“Not everyone needs an Audi A8. For many scenarios our functionality and stability will suffice,” said CRP’s chief Li Liangjun. His welding robots sell for about 60 per cent of the price of Japanese rivals Yaskawa and Fanuc, and those from ABB and Kuka.

Economists believe aggressive automation may help explain why China has defied the typical development trajectory of losing low-end manufacturing as wages rise.

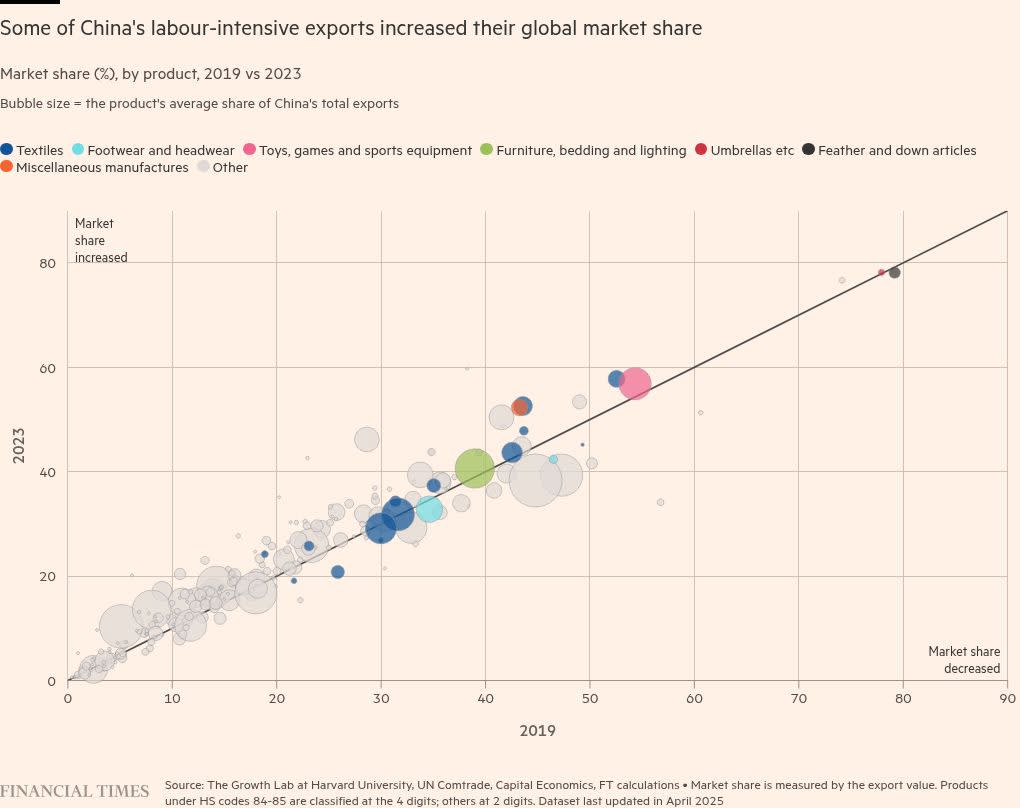

Trade data compiled by Harvard’s Growth Lab shows China grew its global export share in a swath of labour-intensive industries from 2019 to 2023.

The country’s global export share of small manufactured goods, such as brooms, mops and pens, rose 9 percentage points to 52.3 per cent over the four-year period. Furniture exports gained about 1.5 percentage points of market share, while China’s proportion of the world’s toy exports rose from 54.3 per cent to 56.9 per cent.

This comes even as the average factory worker in Dongguan makes about Rmb5,200 ($729) a month while an Indian counterpart may earn Rs17,100 ($194), according to government statistics in both places.

“It’s quite striking,” said Leah Fahy, China economist at Capital Economics. “Historically, as countries develop, labour costs rise and they move away from producing these goods.”

The trend can be seen in a factory in Sichuan, a south-western province, where welding robots from Chengdu CRP are fusing steel pieces together to form the chassis of a three-wheeled electric cart.

“With each robot, our labour costs come down by half and our efficiency increases,” said Song Ling, deputy manager of Shuangsheng New Energy Vehicle, the small company which owns the factory. “There is no choice but to automate.”

Over the past three years, Shuangsheng has automated about half of its production line, opting to buy dozens of locally made machines after testing them against several from Japanese groups. The factory is now shipping growing volumes of Rmb6,000 cargo-carrying carts and tuk-tuks to south-east Asia as well as Africa and the US.

CRP’s chief Li said local factories were buying his more affordable Chinese robots to make a variety of low-end goods, including three-wheeled carts, furniture, fitness equipment and bicycles.

“In the past China relied on its large population of 1.3bn people and abundant cheap labour to gain its status as a manufacturing powerhouse,” Li added. “Now China is maintaining its labour advantage with robotic labour instead of human labour.”

At Shuangsheng, dozens of CRP robots began replacing welders who could demand monthly wages of up to Rmb15,000. The government hopes many blue collars workers can upgrade their skills into an expanding “purple collar” workforce of robot technicians.

But overall employment in labour-intensive industries is declining. From 2011 to 2023, employment at large companies in 12 labour-intensive industries fell by about 26.5 per cent, according to Chinese government data.

Jiang Xiangqian, vice-president at robot maker Topstar, said that ultimately robots would replace all factory workers. “We won’t need a single person in the entire chain,” he said.

In the southern textile hub of Keqiao, Jay Ye, owner of Shaoxing Longkai Textile, has purchased several massive printing and embroidery machines to replace workers and increase productivity.

Ye said the locally made machines had helped double his factory’s output while increasing profit margins. “In India they are still embroidering by hand,” Ye said. “We are using machines.”