Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Asked about the business mood in Hong Kong, one longtime financier recently summed it up to Lex in a word: Labubu. A craze for the tiny dolls has trebled the shares of their locally listed maker and helped reignite the city’s equity market. Where equity markets lead, financial advisers typically follow, requiring swanky offices. Could this mean an end to the city’s six-year slump?

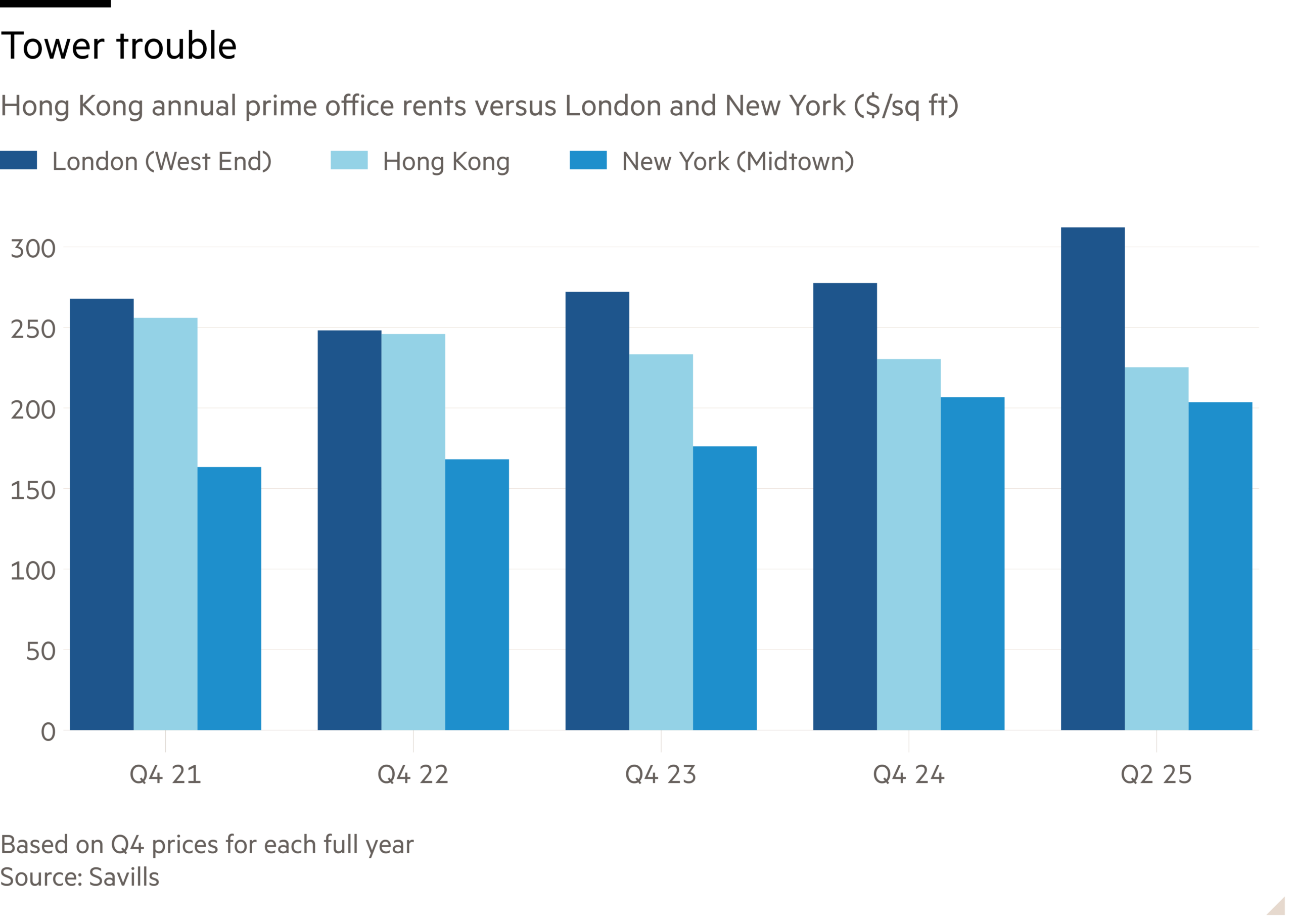

Before the pandemic and Beijing’s 2020 national security crackdown shook international confidence in the city’s laws and business norms, Hong Kong boasted the most expensive offices in the world. Then, top space commanded just over $300 a square foot per year, half as much again as midtown Manhattan. More recently, China’s sluggish economy and its tightened political grip on Hong Kong have damped demand. Vacancy rates of 13.6 per cent by June this year were just below record levels while rents have slid by about a quarter from their peak.

In financial markets at least, the mood has started to turn. Hong Kong vaulted to the number one spot globally for listings in the first half of this year, excluding the blank-cheque companies that bolster US numbers. About 200 companies are lining up to float.

Splashy property deals are returning too, notably trading firm Jane Street’s $4mn a month leasing of space in a new harbour front development, and a rare $810mn sale of space in the core Central district to the city’s stock exchange. The seller, Hongkong Land, said this month that the value of its portfolio in the city had stabilised for the first time since 2019.

Shares in the city’s biggest developers have been on a tear, outperforming the Hang Seng index over the past three months. Soggy prices are back to their 10-year averages, of about 40 per cent of net asset value.

Precise location matters. Hong Kong’s choicest spots are grouped in a small walkable area home to many of Hongkong Land’s sites. Hong Kong East, a newer business district where Swire has a big presence, was 14 per cent empty in June. Across the harbour, Kowloon East was 21 per cent unoccupied.

And not everyone is sounding cheerful. CK Asset said last week that the tenancy rate for its new prime building was “not where we like”. Its biggest skyscraper, home to several investment banks, is currently about 25 per cent empty. A week earlier, rival Swire Properties reported a 5 per cent decline in Hong Kong office rents.

The Hang Seng is up 25 per cent so far this year, more than twice as much as the S&P 500 and FTSE 100. It is logical enough that a stock market revival first breathes life into the buildings closest to it. If the renaissance continues, it may help warm up the rest of the city’s business world too, and deliver a reprieve for Hong Kong’s landlords.