Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

China’s exports rose faster than expected last month, official data showed, ahead of the expiry next week of a tariff truce with the US that threatens to reignite trade tensions between the world’s economic superpowers.

Exports added 7.2 per cent in July on a year earlier in US dollar terms, the fastest rate of growth since April and exceeding forecasts of 5.4 per cent in a Reuters poll. Imports added 4.1 per cent, the strongest reading in a year.

The data released on Thursday by China’s customs administration came as Donald Trump’s sweeping new tariffs came into effect for US trading partners from India to Switzerland, pushing Washington’s levies to the highest level in a century.

The latest wave of US tariffs did not directly affect China, which has been locked in close negotiations with Washington for months over tariffs and trade flows of goods ranging from rare earths to semiconductors.

The sides had agreed to a 90-day truce that reduced tariffs from levels as high as 145 per cent in April, as initial agreements raised hopes of a longer-term deal. That armistice — and associated reduced tariff levels — is set to expire on Tuesday.

Trade between the two has already been hit substantially, however. The July figures showed China’s exports to the US declined 22 per cent on a year earlier, after having previously sunk in May by the most since the start of the Covid-19 pandemic.

China’s exports to south-east Asia, which have by contrast continued to grow at double-digit rates in recent months, have drawn scrutiny over so-called “transshipment” of goods through third-party countries before reaching their final destination.

The US president’s latest tariff salvo included a blanket 40 per cent levy on transshipped goods, though it did not offer further detail on how those shipments would be defined.

“We think simple transshipment is less attractive now,” analysts at Citi wrote, pointing to “tighter US enforcement to prevent tariff evasion”.

China’s exports have been a crucial growth driver for policymakers in the world’s second-largest economy, given a four-year property sector slowdown that has weighed on consumer confidence. Authorities have targeted GDP growth of around 5 per cent for 2025.

The country’s trade surplus was $98.2bn last month, below $114.7bn in June.

Trump’s administration in April introduced steep levies globally, but the measures had largely been paused to allow for bilateral negotiations with trading partners.

The president on Wednesday also pledged to introduce a 100 per cent tariff on semiconductor imports, with apparent exemptions for groups that invested in the US.

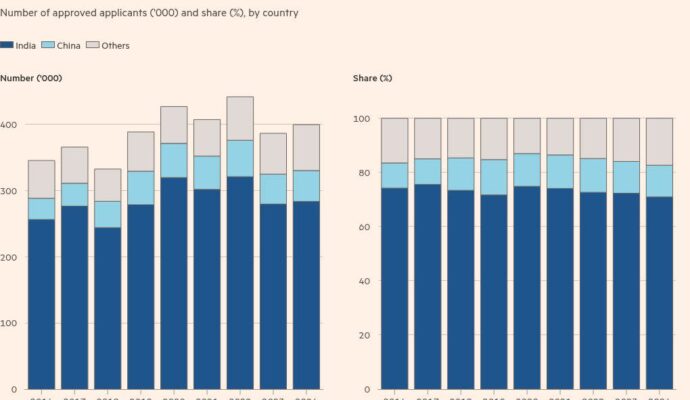

Data visualisation by Haohsiang Ko in Hong Kong