This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Americas. On today’s busy agenda:

Tsunami warnings triggered across Pacific region

Investors brace for “pivotal” three days

Companies tighten security after Monday’s fatal shooting

The FT investigates Haitian gangs

Wall Street analysts are calling the next few days the year’s “most pivotal” for US markets. Here’s why.

What’s happening: A flurry of key economic and corporate data are due to be released over the next three days, starting with second-quarter US GDP today. This will be followed hours later by a Federal Reserve decision, with the central bank expected to keep rates on hold despite pressure from President Donald Trump. Earnings season is also reaching its peak, with tech heavyweights Meta and Microsoft reporting today and Apple and Amazon tomorrow. The working week ends with US labour data, expected to show slower jobs growth, and the president’s tariff deadline.

Why it matters: Any one of these events would be market-moving in their own right, analysts note. Some investors have grown uneasy about the scale of gains in US equities, and others will be looking to see if there is a widening schism between Fed chair Jay Powell and his rate-setting committee over the pace of rate cuts. In terms of tariffs, benign economic readings have helped investors “move past the subject”, while recent trade deals have prompted economists to reduce the odds of a potential recession. But risks remain, with uncertainty over whether Trump will go ahead on Friday with levies on countries that are yet to strike deals.

Here’s more on the tone-setting rush of news and data for the rest of the week, and we have more related analysis below:

Stockpicking funds: So-called equity long-short hedge funds have made a comeback during this year’s market turbulence, attracting $10bn from investors.

US companies: Groups are taking advantage of blistering conditions in the debt market to re-price loans and slash borrowing costs.

Opinion: By constantly shifting deadlines, fiddling with duty rates and linking levies to open-ended negotiations, Trump has made it hard for investors to mark assets to market, argues Tej Parikh.

And here’s what else we’re keeping tabs on today.

Pacific earthquake: The US and Japan have issued tsunami warnings after a powerful 8.8 magnitude quake struck Russia’s Far Eastern region.

GDP: Ahead of the US release, Germany reported its economy contracted by 0.1 per cent during the second quarter amid tariff uncertainty.

Results: Aside from the two tech giants Meta and Microsoft, Ford Motor, Hershey, Altria, Kraft Heinz, Qualcomm and Brazilian lender Bradesco are among the companies reporting. See the full list in our Week Ahead newsletter.

Five more top stories

1. An extension to a truce in the US-China trade war will hinge on Trump’s approval, his Treasury secretary has said, calling the talks “very constructive”. After two days of negotiations in Stockholm, Scott Bessent will head back to Washington today to brief the president on the proposal.

More on US-China: Amid tensions with Washington, Beijing is increasing its use of “exit bans”, deepening concerns about business travel to the country.

2. Companies are tightening security after the fatal shooting in New York on Monday. Before taking his own life, the shooter killed four people including Blackstone executive Wesley LePatner, prompting corporate leaders to rethink how to keep their employees safe after the second such killing in the city in less than a year.

3. Exclusive: UK fintech Revolut is weighing buying a US lender in a bid to get an American banking licence rapidly, as it awaits similar accreditation in its home country. People familiar with the matter said it would potentially target a cheap bank that already holds a national licence.

HSBC results: Second-quarter profits fell by nearly a third at Europe’s largest bank as it took a charge on its stake in a Chinese lender.

UBS: Profits more than doubled at the Swiss lender on the back of strong trading revenue from volatile markets.

4. Evercore has agreed to buy elite UK advisory firm Robey Warshaw for $196mn, as the US investment bank steps up its challenge to the likes of Goldman Sachs, Morgan Stanley and JPMorgan Chase in Europe with the addition of some of London’s best-known dealmakers. Read the exclusive story in full.

5. Ghislaine Maxwell has requested clemency in exchange for congressional testimony about Jeffrey Epstein. Lawyers for the late paedophile financier’s co-conspirator and former girlfriend were responding to a congressional subpoena, posing a dilemma for Trump as he seeks to quash controversy around the case.

FT visual investigation

Haiti is one of the most violent places on the planet. Armed with guns imported illegally from the US, gangs have turned into militias. Brandishing military-style weapons, these groups control most of the capital, Port-au-Prince. The UN says they now have greater firepower than the Haitian police. A Financial Times investigation examines where the weapons are coming from and reveals their devastating effect on the country.

We’re also reading . . .

Meta’s AI spree: Will Mark Zuckerberg’s multibillion-dollar hiring and infrastructure plan win over Wall Street?

Trump on Gaza: Harrowing images of starvation and unease among parts of his Maga base may be testing the limits of the president’s support for Benjamin Netanyahu.

‘Technology’: It’s time to retire a word that spans too much and clarifies too little, writes engineer and author Guru Madhavan.

Japanese debt: The return of inflation has brought public finances back under control, writes Asia editor Robin Harding.

Chart of the day

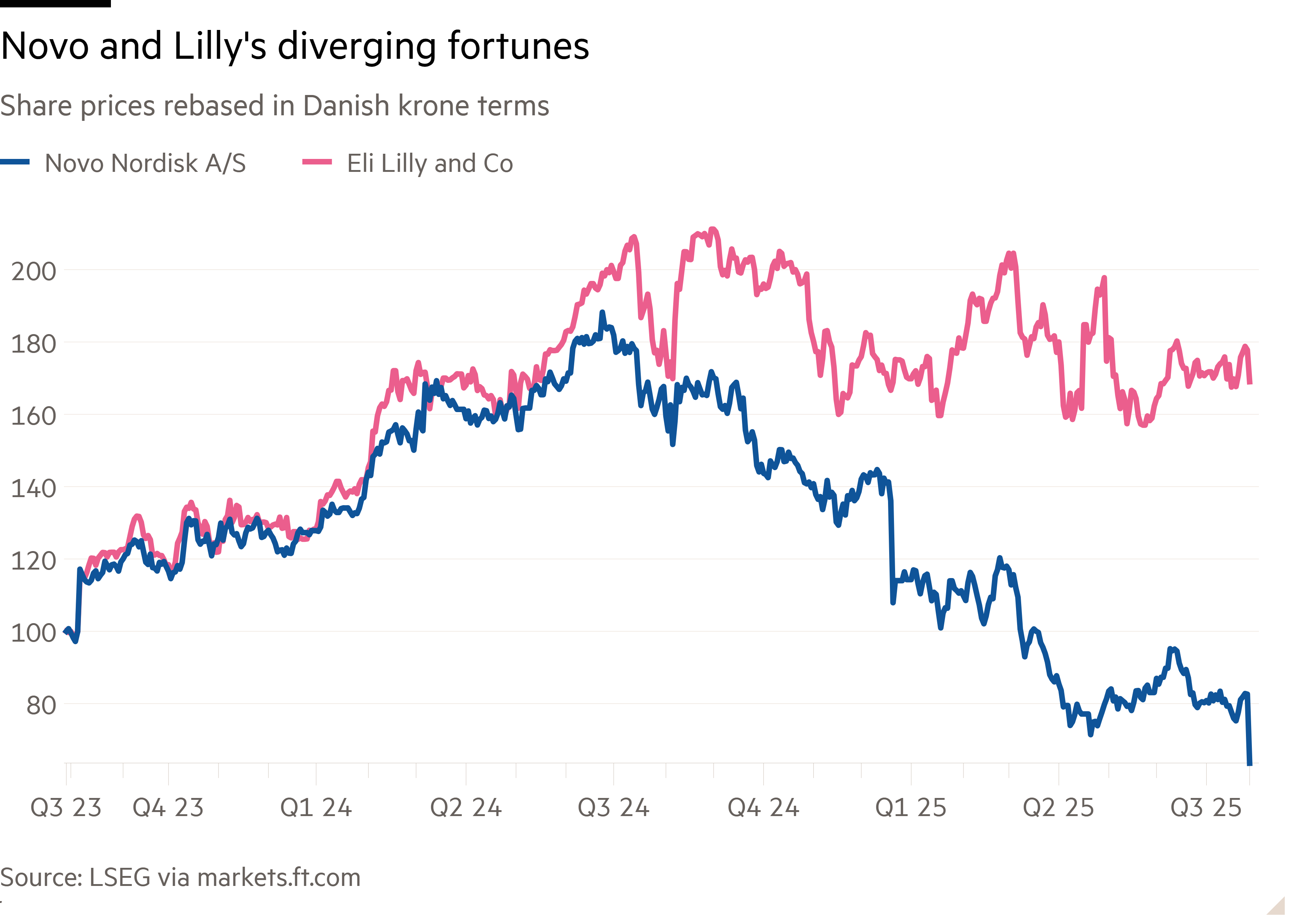

Until a year ago, Novo Nordisk, the maker of Ozempic and Wegovy, was riding high. But competition, a drug trial disappointment and its chief executive departing in May has taken the shine off the Danish company’s shares. Then yesterday a profit warning knocked more than €60bn off its value. What happened?

Take a break from the news . . .

The art world’s age of empires might be over, writes Tim Schneider. As prominent baby-boomer gallerists exit earlier than expected, many of their potential successors are working to completely redefine success in the field.