Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Chinese investment flows to Hong Kong through the Stock Connect programme have hit a record high as mainland capital drives a revival of the territory’s equities market.

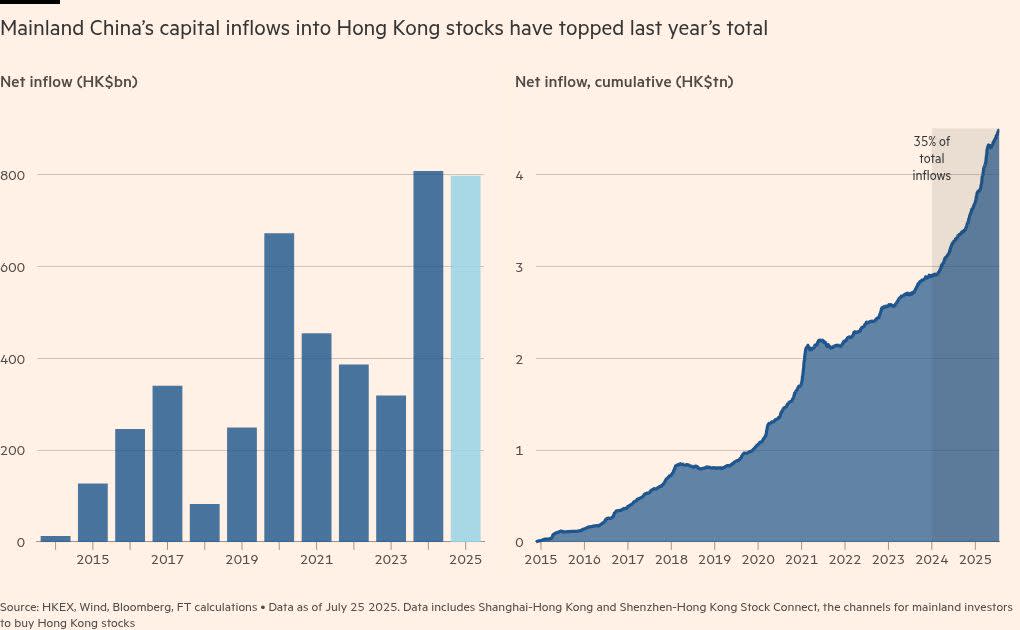

About HK$820bn (US$104bn) of Chinese money has been invested this year through Stock Connect, which links the mainland’s stock exchanges to Hong Kong’s, surpassing 2024’s full-year inflow of HK$807.9bn.

The surge in investment has helped end a post-Covid slump in Hong Kong’s financial markets and underlines how the city’s fortunes have become increasingly dependent on policy in Beijing and on Chinese capital.

It also points to a growing appetite among Chinese investors to put money to work outside the mainland’s tightly controlled financial system, as yields on government bonds have fallen to record lows amid an uncertain economic backdrop.

“Domestic investors are now waking up to the opportunity offshore,” said Jason Lui, head of Asia-Pacific equity and derivative strategy at BNP Paribas. “If you’re [Chinese] institutional investors, you have no choice but to start looking outward. There’s actually limited choices for where you can go.”

“From an allocation perspective it’s a no-brainer to allocate more of your fund into Hong Kong,” said Vincent Che, head of equities at China Ping An Insurance Overseas, citing low bond yields in mainland markets.

The Stock Connect programme, which started in 2014, allows Chinese retail investors with at least Rmb500,000 ($70,000) to access Hong Kong’s financial markets without violating China’s strict capital controls.

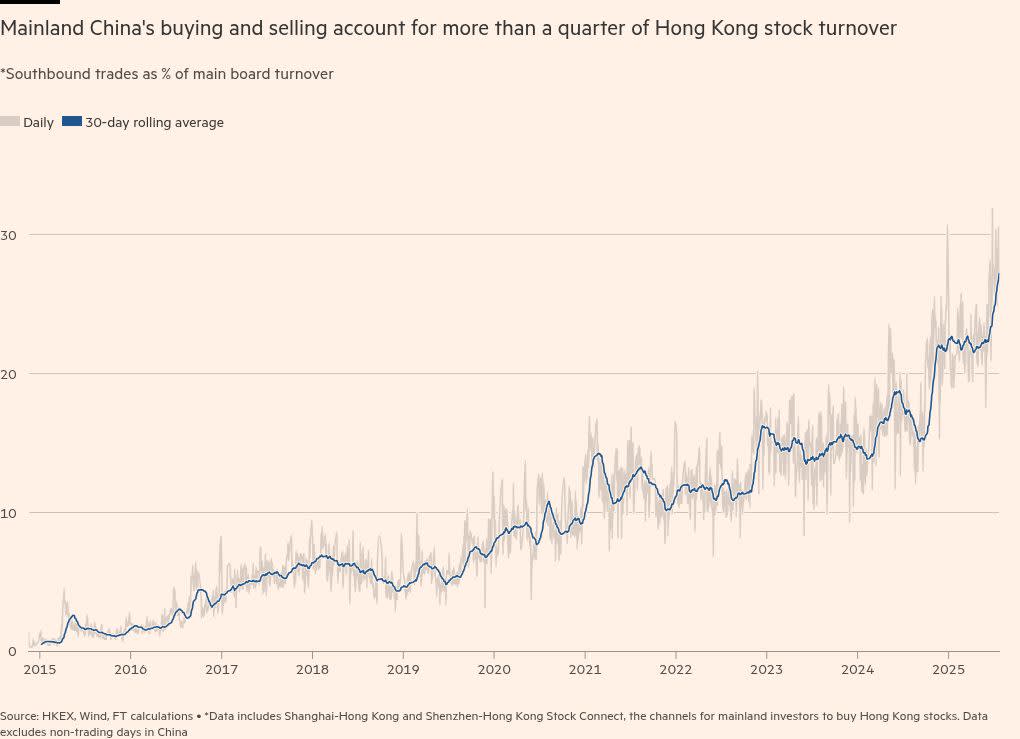

Cumulative investment into Hong Kong through Stock Connect has reached HK$4.5tn, with more than a third of inflows occurring in the past two years. Southbound transactions now make up about a quarter of daily turnover on the Hong Kong exchange’s main board, compared with well below 10 per cent on most days in 2019.

The programme is one of the only ways Chinese investors can buy shares of technology companies such as Alibaba, Baidu and Tencent, which are listed in Hong Kong but not in the mainland. Their shares have rallied sharply this year following the release of a groundbreaking artificial intelligence model by Chinese start-up DeepSeek and signs of easing tensions between China’s tech sector and regulators.

Hong Kong’s market has also been boosted by policy support from Beijing. During a conference in the territory in January, central bank governor Pan Gongsheng said China would “support more high-quality enterprises to list and issue bonds” in the city and “increase the proportion of national foreign exchange reserves allocated in Hong Kong”.

His pledge came after China’s securities regulator last year announced measures to deepen links between mainland and Hong Kong stock markets and to encourage Chinese businesses to list in the territory. Hong Kong’s listings pipeline has hit a record high this year as mainland companies pursue secondary listings in the city.

“The Hong Kong stock exchange has become the main platform for mainland companies to raise offshore capital,” said David Tsai, a partner at law firm Clifford Chance.

Hong Kong’s turnaround has helped rekindle investor interest in Chinese businesses that were hit by a government crackdown on the private sector and a property market slowdown now in its fourth year.

“The longer-term outlook for Hong Kong has improved,” said James Wang, head of China equity strategy at UBS. “You’re not hearing investors saying: ‘Is China investable anymore?’ That kind of rhetoric is well and truly behind us.”

At the same time, the city’s trajectory looks to be increasingly as a hub for Chinese capital, said Drew Thompson, a senior fellow at the S Rajaratnam School of International Studies in Singapore and an expert on US-China relations.

“Hong Kong becoming the undisputed clearinghouse for Chinese companies and renminbi settlement is obviously a very positive thing for the Chinese economy and necessary for the rest of the world doing business with China,” said Thompson.

But its resurgence is from “efforts to integrate Hong Kong into China rather than integrate Hong Kong into the rest of Asia”.